Showing both the power and the limitations of central bankers, Fed Chairman Powell was able to postpone yesterday’s selloff in risk assets…but only for 24 hours.

US indices were trading sharply lower on Thursday, with previously high-flying technology stocks leading the way lower, while yields on the benchmark US treasury bond briefly spiked to 1.60% following a disappointing debt auction, and risk-sensitive currencies like the Australian dollar are leading the way lower.

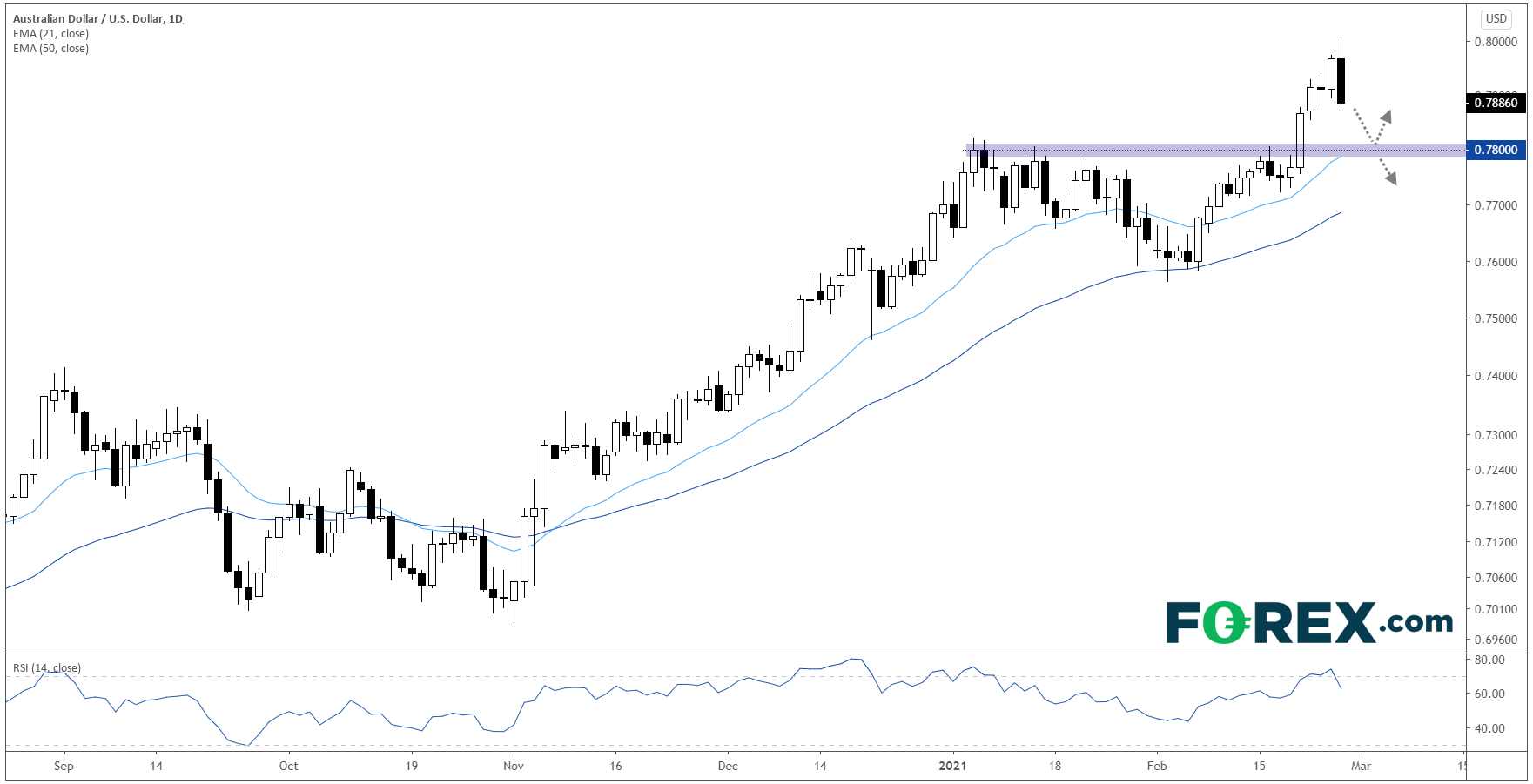

One pair that’s having a particularly rough day is AUD/USD. After breaking out to a 3-year high above 0.7800 to close last week, the pair extended its gains to briefly test 0.8000 earlier today before seeing a sharp reversal on the back of surging US yields and risk aversion throughout the broader market.

As we go to press, the pair is showing a big key reversal or bearish engulfing candle on the daily chart. For the uninitiated, this candlestick pattern shows a shift from buying to selling pressure and hints at more downside to come. The fact that the RSI indicator has turned lower from overbought territory and is showing a bearish divergence with its previous highs reinforces the potential for a pullback from here:

To the downside, AUD/USD bears could look to push the pair down to previous-resistance-turned-support at 0.7800 as an initial target; the rising 21-day EMA also comes in around that area. Below there, a deeper retracement toward the 50-day EMA near 0.7700 could be in the cards. On the other hand, bulls would need to see AUD/USD stabilize and close above today’s high around 0.8000 to shift the short-term bias back in favor of the buyers.

Finally, traders should be aware of the RBA meeting during Tuesday’s Asian session as a major source of potential volatility to watch in the coming days.