This article was written exclusively for Investing.com

- Rising grain prices increase cost of meat production

- A bullish trend in live and feeder cattle futures

- Lean hogs break to the upside

- Grilling season on the horizon

- Meats could play catchup with the rest of the commodities asset class

COVID-19 made 2020 a rough year for the animal protein sector of the commodities market. Producers and consumers received the short end of the pricing stick.

Cattle, hog, and other animal producers could not deliver their animals to processing plants because of shutdowns and slowdowns caused by the pandemic's spread. Cattle and hog futures dropped to multi-year lows as ranchers could not find buyers. Live cattle futures fell to 81.45 cents per pound in April 2020, the lowest level since October 2009. Feeder cattle futures reached a low of $1.0395 in April, the lowest since 2010, and lean hog futures prices plunged to 37 cents, an eighteen-year low.

Meanwhile, consumers did not benefit from producers' woes. Supply shortages caused prices at the butcher counter in supermarkets to soar. Moreover, retail markets limited purchases because of the lack of meat to satisfy requirements.

In the world of commodities, the cure for low prices tends to be those low prices. In 2021, cattle and hog futures have been trending higher. The iPath® Series B Bloomberg Livestock Subindex Total Return ETN (NYSE:COW) tracks the price of animal protein futures.

Rising grain prices increase cost of meat production

In 2020, the primary issue facing the animal protein sector was the divergence created by COVID-19. In 2021, it will be the cost of feeding animals.

Grain prices are the input in raising cattle and hogs. In August 2020, soybean, corn, and wheat prices took off on the upside, reaching over six-year highs in the oilseed and grain futures markets.

Weather conditions, a falling dollar, rising inflationary pressures, and increasing demand for the commodities that feed the world pushed prices to multi-year peaks. Soybeans rose to a high of $14.3825 per bushel in January. The oilseed futures were trading at the $13.80 level at the end of last week, not far below the recent high. Corn reached $5.7425 per bushel in February. At over $5.40 on Feb. 19, they were just below the peak. Wheat rose to $6.93 per bushel in mid-January. The primary ingredient in many food products was at over the $6.50 level late last week.

Rising grain prices increased the cost of raising animals to weights for processing, putting upward pressure on meat prices.

Bullish trend in live and feeder cattle futures

After hitting a low of 81.45 cents last April, live cattle futures have been trending higher.

Source, all charts: CQG

The weekly chart highlights the price appreciation in the live cattle futures market, lifting prices to over $1.15 per pound late last week. Live cattle for April 2021 delivery were trading higher at over $1.23625 per pound.

While feeder cattle futures have been consolidating between just below $1.3200 and $1.4640 per pound since early July, the price is far higher than the $1.0395 low from early April 2020.

Beef prices have rebounded from the 2020 lows.

Lean hogs break to the upside

Lean hogs dropped to 37 cents per pound in mid-April 2020.

The weekly chart shows the pattern of higher lows and higher highs over the past ten months. At around 84.6 cents per pound on the continuous futures contract, the pork price more than doubled since the eighteen-year low last year. Lean hogs for April delivery traded to a high of 87.25 cents on Feb. 12.

Meat prices are bound to go into the 2021 peak season for demand at far higher prices than last year’s lows. Higher feed prices are the primary reason.

Grilling season on the horizon

The 2021 grilling season begins on Memorial Day weekend at the end of May. It runs through the Labor Day weekend in early September each year.

The peak season for demand looks set to be a lot better this year than last as vaccines create herd immunity to COVID-19. Slowdowns at processing plants will likely end, but consumer demand will rise dramatically on a year-on-year basis as social distancing guidelines will not prevent barbecues and summer gatherings.

The demand for beef and pork should be far greater in 2021 than in 2020. Higher input costs, a weak dollar, increased export demand as trade with China returns, and inflationary pressures are all bullish factors for the meats as we head into the spring and summer months.

Meats could play catchup with rest of the commodities asset class

Commodities have been roaring over the past months. Just recently, copper, oil, lumber, cotton, sugar, grains, platinum, and a host of other commodities rose to multi-year highs. Meats are likely to follow in the footsteps of the other asset class members.

The most direct route for a risk position in cattle or hogs is through the futures market. For those who do not venture into the futures arena, the COW ETN product provides an alternative. COW’s fund summary states:

Source: Yahoo Finance

COW has $26.82 million in net assets and trades an average of 23,888 shares each day. The ETN charges a 0.45% expense ratio.

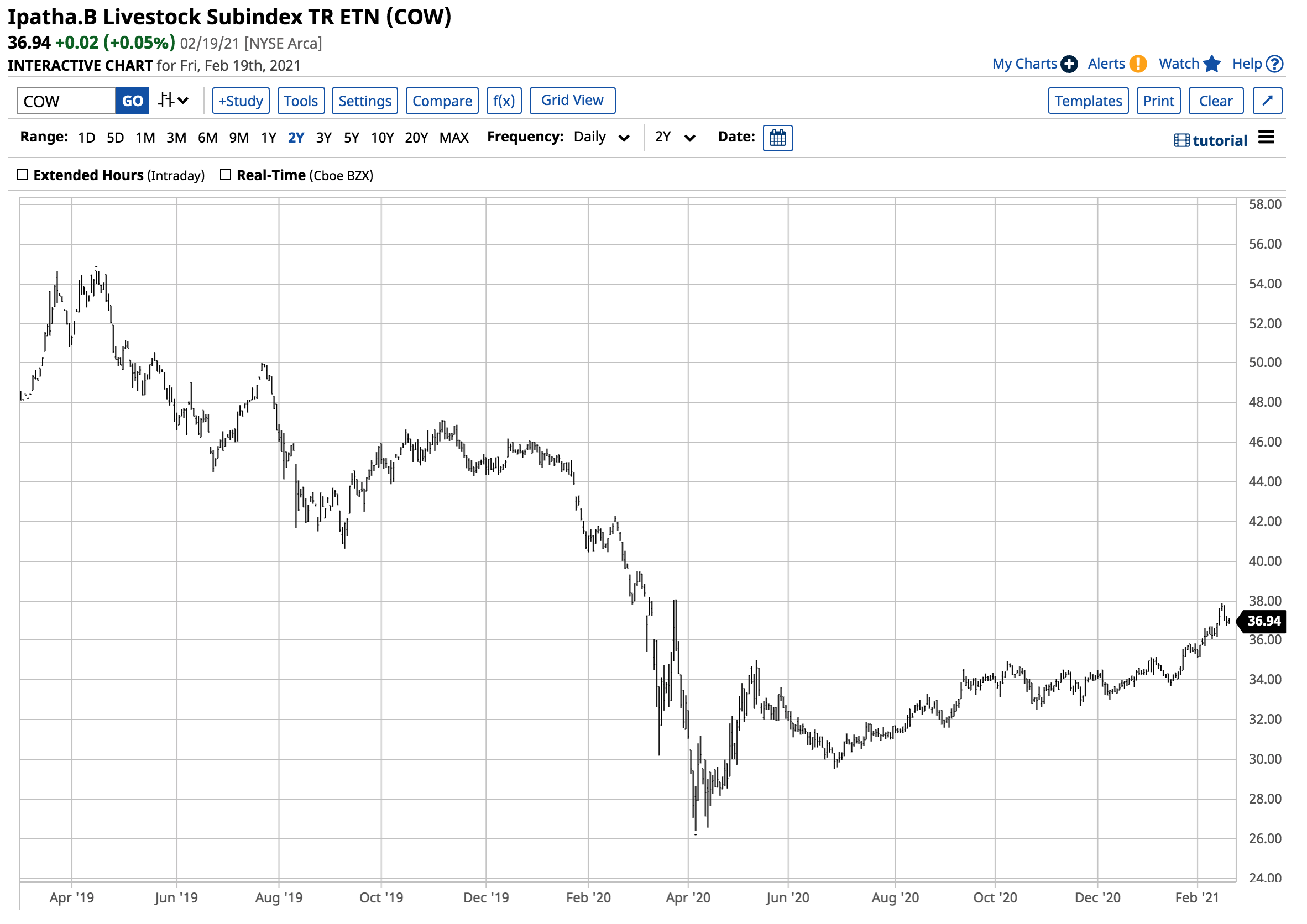

Source: Yahoo Finance

COW rose from $26.40 per share in April when cattle and hog prices were on their respective lows to $36.94 at the end of last week. The ETN kept pace with the meat futures markets as it rose by nearly 40% over the past ten months.

The trend is always your best friend in markets, and in the animal protein sector, it is higher going into the 2021 peak season. Higher grain prices are screaming that meats will be more expensive over the coming months.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.