Predicting market direction based on previous performance isn't new. Investors and traders are always looking for an edge—any insight to help generate outsized returns.

Earlier this year we fact checked whether a generally accepted principle, selling in May and going away, was actually supported by the data. While the period from May to November did underperform, we discovered that the best strategy, given transaction costs and taxes, was to buy and hold.

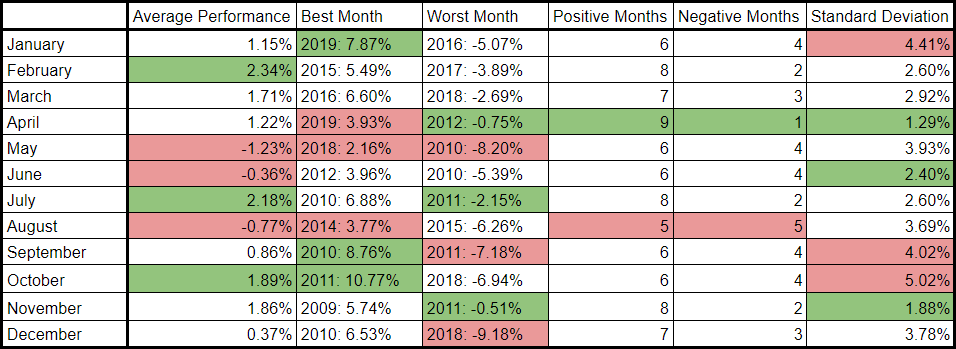

This time, we’re taking a wider look at the monthly performance of the stock market over the past ten years. Our goal: to test generally accepted hypotheses regarding month-by-month outcomes. As well, we were wondering what the best or worst months for investors really are. In addition we looked to see if there's a month where markets are consistently more or less volatile.

Best and Worst Months

First, over the past 10 years, the average monthly performance of the S&P 500 has been +0.94%. At that rate, it would take 74 months, or a little over six years, to double an initial investment. However, the market tends to be much more volatile and far less predictable, thus rarely providing a steady 0.94% each month.

So which months are optimal for increased profits? Surprisingly, on average, over the past 10 years, February has been the month during which the market performed best. Average returns were +2.34%, or 2.5 times mean monthly returns. The second best month, and the only other one to frequently show gains of more than 2%, was July, with a 2.18% average return.

On the other hand, for the same period, there are three months where negative returns were more common. May, it seems, has been the worst performing month, with a -1.23% return, followed by August at -0.77%, and June at -0.36%.

If limiting downside results is what you’re after, April should be your go-to month. Nine out of the past ten Aprils ended with markets in positive territory.

April 2012 was the sole exception with a -0.75% return. February, July, and November all closed with positive returns eight times out the past 10 occurrences.

On those terms, with a mixed record of five positives and five negatives, August was the worst month for downside returns. January, May, June, September, and October all show six positives and four negatives for monthly performance.

Most Volatility

Over the past decade, the least predictable of all months has been October. While the median monthly return for all months is 1.19%, October’s returns have all been over 2% in positive months, and around -2% for the negative months.

Indeed, volatility has been so prevelant in October, the standard deviation for returns is 5.02%, meaning October returns vary widely from the average. This is reflected in the fact that two out of the three best months over the last decade have been Octobers (2011, +10.77% and 2015, +8.30%). Conversely, October 2018 was the fourth worst month over the past 10 years, at -6.94%.

January tends to be the second most volatile period, with a 4.41% standard deviation, followed by September, at 4.02%.

If you're looking for calm, April has been the most predictable and stable month, with a standard deviation of 1.29% in monthly returns. The best April performance, during 2019, returned 3.93%, while the worst April returned -0.75%, in 2012.

In truth, it seems there's not a lot of action in April. The months highlighted above were the 19th best and #31 worst months respectively. Other relatively tranquil months after April are November with a standard deviation of 1.88% and June with a standard deviation of 2.4%.

Additional Insight

Over the past decade, there have been 12 months out of 120 (10%) during which returns exceeding 5%, and 10 months (8%) when returns were worse than -5%. Average performance during these abnormal months was surprisingly balanced—positive months over 5% averaged +6.96%; negative months averaged -6.68%.

From a performance perspective, three out of the five worst months occurred during the past year. December 2018 leads all negative months with a -9.18% return; October 2018 comes in fourth with a -6.94% return; May 2019 closes out the top 5 with a -6.58% return.

Conversely, only two months this past year ranked in the top 20. January 2019 puts it in fourth position, with a 7.87% return, and April 2019 squeeked in at 19, with a 3.93% return.

But the year isn't over yet. Right now we're only 3.5% away from the S&P 500's all-time high. Which would mean, of course, there could be new monthly leaders ahead.

One key insight to keep in focus. Over the past decade, there were three different times when the best performance of a certain month followed immediately after the worst performance during the previous month.

Of all June performances, June 2010 was the worst -5.39%. The S&P rebounded immediately in July of that year for providing the best July of the decade with a 6.88% return.

This happened again in 2011. The worst September, -7.18%, was followed by the best October, +10.77%. And in 2018-2019, the worst December, -9.18%, was followed by the best January (7.87%).