Investing with the ability to predict the future is a tantalising notion, one that has almost become a Hollywood trope. How many movies or TV shows feature characters who amass wealth using future information for investments? Who would not want to return to the 1970s and buy a few Apple (NASDAQ:AAPL) shares? Yet, the truth for any investor is far from this fantasy. There is no crystal ball, time machine, or certainty.

However, investors still have a wealth of information and tools at their disposal to make informed decisions. One such tool is pattern recognition. Consider factor investing, which involves identifying which stocks have performed well or poorly in the past and using that knowledge to build successful portfolios. But what if there was a pattern that could have guided investors to exponential growth stocks, like Apple or Amazon (NASDAQ:AMZN), before their exceptional run and became household names? Surprisingly, there is. It's called thematic investing.

Is thematic the new crystal ball for growth stocks?

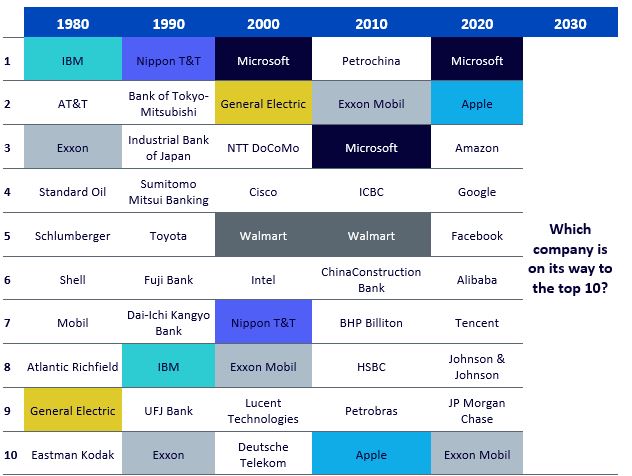

Reflecting on the past, we can discern a pattern between leading megatrends, or structural shifts in the world, and the rise of megacaps. One of the most significant trends in the 1970s and 1980s was the economic miracle of the rise of Japan. It is no coincidence that the biggest companies in the world in the 1990s were Japanese stocks, with Nippon T&T, Bank of Tokyo Mitsubishi and Industrial Bank of Japan as the three biggest. Similarly, from the end of the 1990s, a driving source of disruption has been the internet and the subsequent digitalisation of our world. Again, it is not a coincidence that Amazon, Alphabet (NASDAQ:GOOGL) and Meta are among the biggest companies in the world 20 years later.

In other words, history teaches us that to invest early in the biggest companies of the 2030s and 2040s, investors need to look at what trend or technology is structurally changing the world now. While finding the next Apple is hard, finding those structural drivers is not as hard. There is already quite a large consensus around the following five: Artificial Intelligence, Digitalisation, Energy Transition, Health Tech, and Blockchain. In many ways, it sounds obvious that the next exponential growth companies will be strongly linked to one or more of those. We don’t even need to wait to validate this thesis, two companies have already unlocked some of the growth from those nascent trends: Tesla and Nvidia (NASDAQ:NVDA).

Figure 1: The world mega caps over the last few decades

Source: WisdomTree.

How not to invest in thematic

While extremely useful, we still don’t have a “thematic crystal ball” as much as we have a “thematic lens.” We are not able to extract a single ticker by applying this technique. Therefore, there are two important mistakes to avoid.

- The first is for an investor or a portfolio manager to become arrogant and overestimate their abilities. Applying this thematic lens in the late 1990s would have easily led investors to look at and invest in Internet stocks. However, this would have pointed us toward Amazon and eBay (NASDAQ:EBAY), as well as Yahoo, Lycos, and InfoSpace. Without a real crystal ball or time machine, there would have been no way to differentiate between the future winners and losers that early. So, the mistake would be to overplay our hand and try to guess things we can't guess to select between them. At the end of the day, an investor who would have bought the 10 biggest internet stocks in 1998 would have beaten the markets easily over the following two decades (even if seven out of those 10 stocks disappeared and lost money), while an investor who would have picked the biggest one, Yahoo, would have not.

- The second important lesson investors need to remember is that while megacaps have probably benefited from exponential growth at one point in the past, it cannot continue indefinitely. If Nvidia, with its 3 trillion market cap, were to increase 10x in price, which is something that an investor would be looking for in an exponential growth stock, it would get close to the size of the full US equity market, which seems improbable. So, exponential growth stocks are overwhelmingly smaller cap but still have the runway to deliver outsized returns.

A thoughtful strategy design is necessary to leverage the potential of thematic investment

The WisdomTree Megatrends UCITS ETF (WMGT) provides exposure to 16 high-conviction themes and leverages the “thematic crystal ball” while trying to avoid both issues. To do so, the thematic stock selection in the strategy follows three guiding principles:

- It is expert-driven

- It focuses on pure players

- It differentiates itself from the market

This means that we leverage the theme knowledge of industry experts with which we have a partnership (a different expert for a different theme) to answer the key question for thematic investing: “Is this company highly relevant to this theme or not?”.

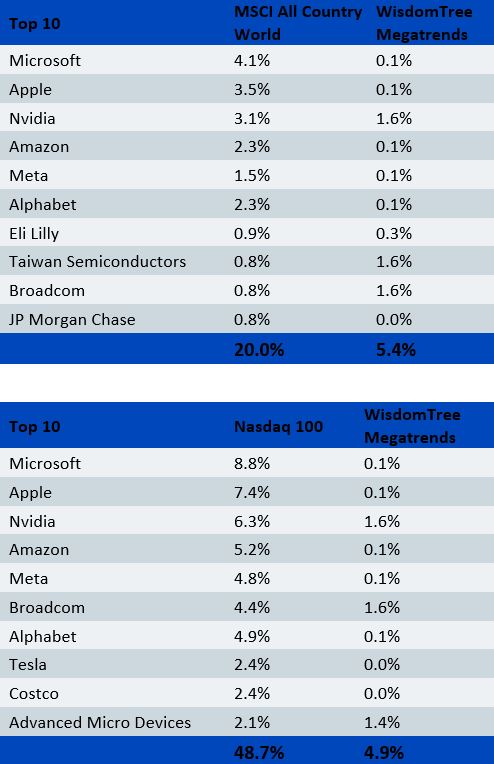

The portfolio for each theme is then built in a diversified way to invest in the relevant companies without trying to predict which one will win the theme, ensuring that the portfolio includes future winners. By focusing on highly relevant companies, in other words, pure players, the portfolio tends to include smaller cap, earlier-stage companies instead of diversified megacaps that are involved in many themes but at the margin. As illustrated in figures 2 and 3, this creates a portfolio that is, almost by definition, less similar to the market or core investment and includes companies with higher growth potential (as they are smaller).

Source: WisdomTree. As of 19 April 2024. You cannot invest directly in an index. Historical performance is not an indication of future results and any investments may go down in value.

Figure 3: Weight of MSCI All Country World and Nasdaq 100 top 10 holdings vs WisdomTree Megatrends

Source: WisdomTree. As of 19 April 2024. WisdomTree Megatrends = WisdomTree Global Megatrends Equity Index. You cannot invest directly in an index. Historical performance is not an indication of future results and any investments may go down in value.

Conclusion

A thematic lens applied to stock selection helps investors see the future and isolate companies with the potential to grow exponentially. However, it is easy for investors to miss out on that opportunity through execution. First, a thematic strategy should focus on pure play, smaller companies that have not yet realised the potential that their underlying megatrends lend them. Second, a thematic strategy should lean into the uncertainty at the heart of disruption and innovation. It is impossible to predict the final form of an exponential growth company. Amazon started as a bookshop and look what it has become! So, diversification and humility must be at the heart of the process.

---------------------------------------------------------------------

IMPORTANT INFORMATION

Marketing communications issued in the European Economic Area (“EEA”): This document has been issued and approved by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Marketing communications issued in jurisdictions outside of the EEA: This document has been issued and approved by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

WisdomTree Ireland Limited and WisdomTree UK Limited are each referred to as “WisdomTree” (as applicable). Our Conflicts of Interest Policy and Inventory are available on request.

For professional clients only. Past performance is not a reliable indicator of future performance. Any historical performance included in this document may be based on back testing. Back testing is the process of evaluating an investment strategy by applying it to historical data to simulate what the performance of such strategy would have been. Back tested performance is purely hypothetical and is provided in this document solely for informational purposes. Back tested data does not represent actual performance and should not be interpreted as an indication of actual or future performance. The value of any investment may be affected by exchange rate movements. Any decision to invest should be based on the information contained in the appropriate prospectus and after seeking independent investment, tax and legal advice. These products may not be available in your market or suitable for you. The content of this document does not constitute investment advice nor an offer for sale nor a solicitation of an offer to buy any product or make any investment.

An investment in exchange-traded products (“ETPs”) is dependent on the performance of the underlying index, less costs, but it is not expected to match that performance precisely. ETPs involve numerous risks including among others, general market risks relating to the relevant underlying index, credit risks on the provider of index swaps utilised in the ETP, exchange rate risks, interest rate risks, inflationary risks, liquidity risks and legal and regulatory risks.

The information contained in this document is not, and under no circumstances is to be construed as, an advertisement or any other step in furtherance of a public offering of shares in the United States or any province or territory thereof, where none of the issuers or their products are authorised or registered for distribution and where no prospectus of any of the issuers has been filed with any securities commission or regulatory authority. No document or information in this document should be taken, transmitted or distributed (directly or indirectly) into the United States. None of the issuers, nor any securities issued by them, have been or will be registered under the United States Securities Act of 1933 or the Investment Company Act of 1940 or qualified under any applicable state securities statutes.

This document may contain independent market commentary prepared by WisdomTree based on publicly available information. Although WisdomTree endeavours to ensure the accuracy of the content in this document, WisdomTree does not warrant or guarantee its accuracy or correctness. Any third party data providers used to source the information in this document make no warranties or representation of any kind relating to such data. Where WisdomTree has expressed its own opinions related to product or market activity, these views may change. Neither WisdomTree, nor any affiliate, nor any of their respective officers, directors, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this document or its contents.

This document may contain forward looking statements including statements regarding our belief or current expectations with regards to the performance of certain assets classes and/or sectors. Forward looking statements are subject to certain risks, uncertainties and assumptions. There can be no assurance that such statements will be accurate and actual results could differ materially from those anticipated in such statements. WisdomTree strongly recommends that you do not place undue reliance on these forward-looking statements.

WisdomTree Issuer ICAV

The products discussed in this document are issued by WisdomTree Issuer ICAV (“WT Issuer”). WT Issuer is an umbrella investment company with variable capital having segregated liability between its funds organised under the laws of Ireland as an Irish Collective Asset-management Vehicle and authorised by the Central Bank of Ireland (“CBI”). WT Issuer is organised as an Undertaking for Collective Investment in Transferable Securities (“UCITS”) under the laws of Ireland and shall issue a separate class of shares ("Shares”) representing each fund. Investors should read the prospectus of WT Issuer (“WT Prospectus”) before investing and should refer to the section of the WT Prospectus entitled ‘Risk Factors’ for further details of risks associated with an investment in the Shares.

Notice to Investors in Switzerland – Qualified Investors

This document constitutes an advertisement of the financial product(s) mentioned herein.

The prospectus and the key investor information documents (KIID) are available from WisdomTree’s website: https://www.wisdomtree.eu/en-ch/resource-library/prospectus-and-regulatory-reports

Some of the sub-funds referred to in this document may not have been registered with the Swiss Financial Market Supervisory Authority (“FINMA”). In Switzerland, such sub-funds that have not been registered with FINMA shall be distributed exclusively to qualified investors, as defined in the Swiss Federal Act on Collective Investment Schemes or its implementing ordinance (each, as amended from time to time). The representative and paying agent of the sub-funds in Switzerland is Société Générale Paris, Zurich Branch, Talacker 50, PO Box 5070, 8021 Zurich, Switzerland. The prospectus, the key investor information documents (KIID), the articles of association and the annual and semi-annual reports of the sub-funds are available free of charge from the representative and paying agent. As regards distribution in Switzerland, the place of jurisdiction and performance is at the registered seat of the representative and paying agent.

For Investors in France

The information in this document is intended exclusively for professional investors (as defined under the MiFID) investing for their own account and this material may not in any way be distributed to the public. The distribution of the Prospectus and the offering, sale and delivery of Shares in other jurisdictions may be restricted by law. WT Issuer is a UCITS governed by Irish legislation, and approved by the Financial Regulatory as UCITS compliant with European regulations although may not have to comply with the same rules as those applicable to a similar product approved in France. The Fund has been registered for marketing in France by the Financial Markets Authority (Autorité des Marchés Financiers) and may be distributed to investors in France. Copies of all documents (i.e. the Prospectus, the Key Investor Information Document, any supplements or addenda thereto, the latest annual reports and the memorandum of incorporation and articles of association) are available in France, free of charge at the French centralizing agent, Societe Generale (EPA:SOGN) at 29, Boulevard Haussmann, 75009, Paris, France. Any subscription for Shares of the Fund will be made on the basis of the terms of the prospectus and any supplements or addenda thereto.

For Investors in Malta: This document does not constitute or form part of any offer or invitation to the public to subscribe for or purchase shares in the Fund and shall not be construed as such and no person other than the person to whom this document has been addressed or delivered shall be eligible to subscribe for or purchase shares in the Fund. Shares in the Fund will not in any event be marketed to the public in Malta without the prior authorisation of the Maltese Financial Services Authority.

For Investors in Monaco: This communication is only intended for duly registered banks and/or licensed portfolio management companies in Monaco. This communication must not be sent to the public in Monaco.