Stocks finished the day lower after the Fed held rates steady and signaled a more patient approach. If you listen to Powell’s talk, the takeaway is that the Fed is in a good place, and it sounds like they are in no rush to cut rates. No surprise there.

Based on Fed Fund Futures, the market didn’t seem to think the Fed would step up the pace of rate cuts. The contracts for December traded higher by three bps to 3.89%; at this point, the futures have been pretty range-bound since November.

As for nominal rates, the 10-year managed to finish the day flat.

The dollar also changed a little on the day.

To this point, at least we haven’t seen the 10-year or the dollar index break key support levels, and as long as support holds despite the news, we need favor both continuing to move higher over the longer term. If support breaks, that is another story.

The 10-year period is probably holding on because oil continues to maintain support at $73 and the retracement is at 61.8%.

Technically, oil still looks like it could head higher, and if oil heads higher, I would think rates and inflation expectations head higher.

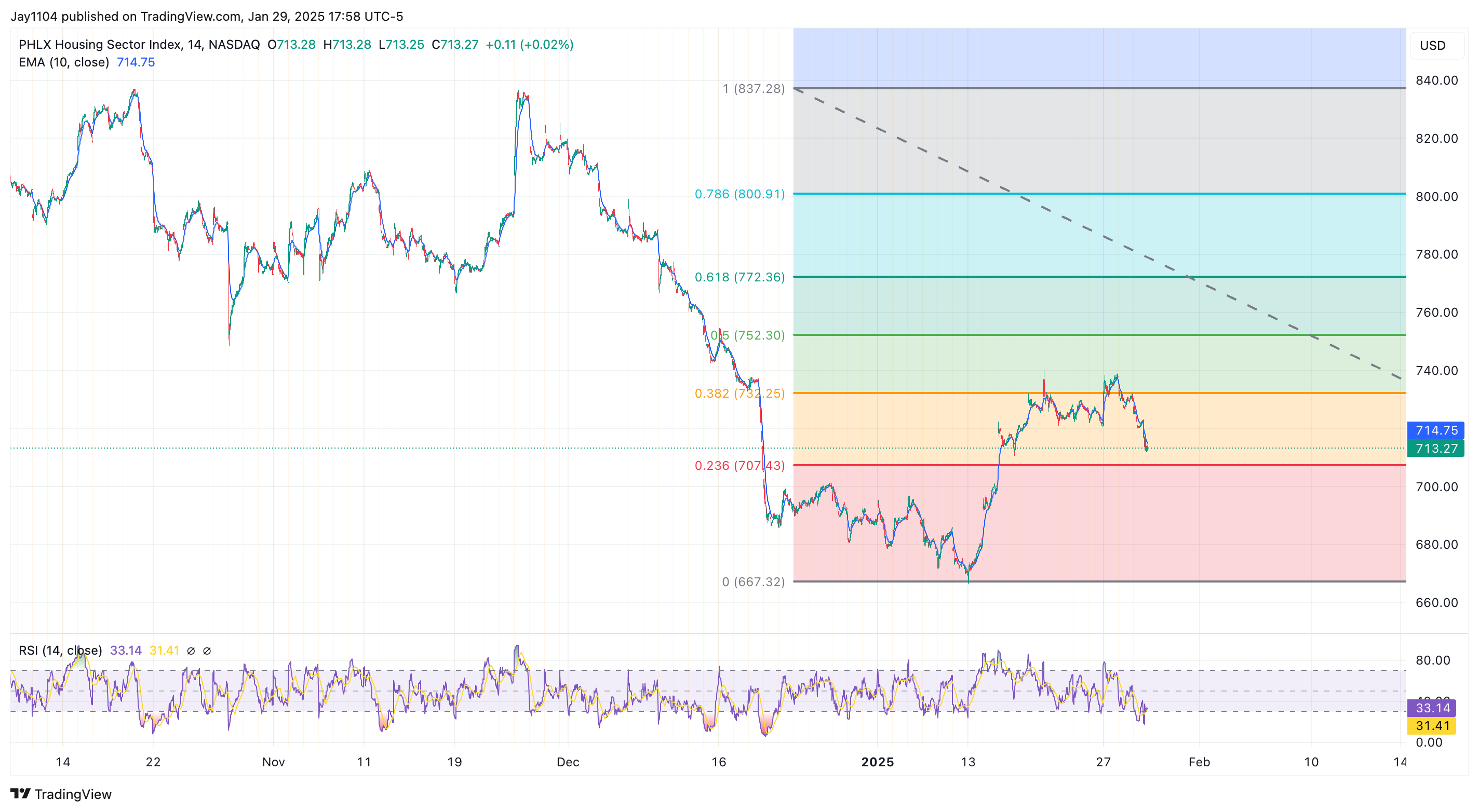

The HGX housing ETF was hit pretty hard on the day, dropping by more than 2%. This is an interest rate-sensitive group, so it’s probably a good indicator of what the market thinks about the direction of interest rates.

It was weak all day but took another turn lower after 2 PM. At this point, this looks like a group that rebounded to the 38.2% retracement level, and that is about all it could get. If that is true, the HGX could undercut the lows at 667.

In the past, the housing sector has been a good leading indicator to the broader S&P 500 over time and bears watching.

The broader S&P 500 index looks pretty directionless at this point, and I think with tough resistance at 6,100, we see a revisit to 5,875 in the not-too-distant future

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.