-

The LERI shows corporate uncertainty increasing to its highest level since the pandemic

-

Fewer buyback and dividend increase announcements highlight other ways companies are holding back

-

Banks on deck this week: expectations are for increased credit losses and lower IB fees

-

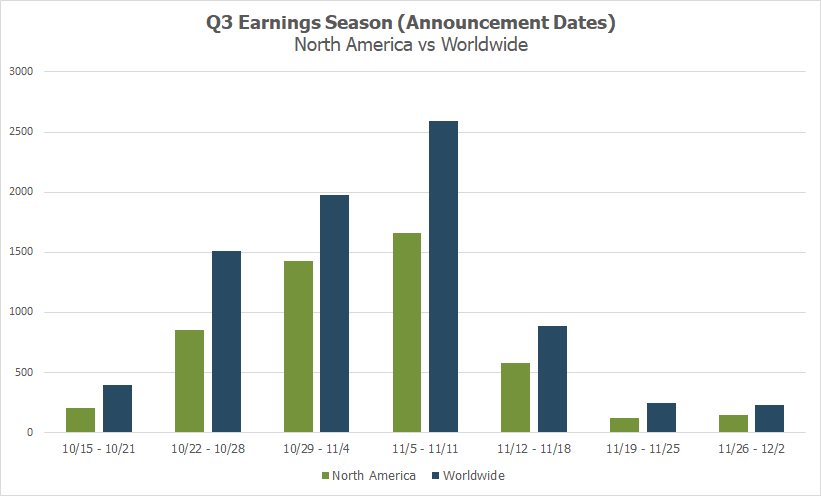

Peak weeks for Q3 season run from October 23 - November 10

The third quarter 2023 earnings season kicks off this Friday, October 13 and a Friday the 13th kickoff date could be a very apropos foreshadowing for the season to come.

Currently, S&P 500 earnings growth for the third quarter is set to come in at -0.3%, which would be the fourth consecutive drop in YoY earnings-per-share (EPS) growth. However, this is still a marked improvement from prior quarters and will likely tip into positive territory once companies start to report. With that said, the massive headwinds seen throughout the year have not disappeared. High interest rates, a waning consumer, and now with the addition of the Israel-Hamas war, it’s clear US companies still have a lot to contend with.

On the sector front, Communication Services and Consumer Discretionary are set to lead the charge on both the top and bottom line, driven by growth from Meta Platforms (NASDAQ:META) and Amazon (NASDAQ:AMZN), respectively. Lagging sectors continue to be Materials and Energy.

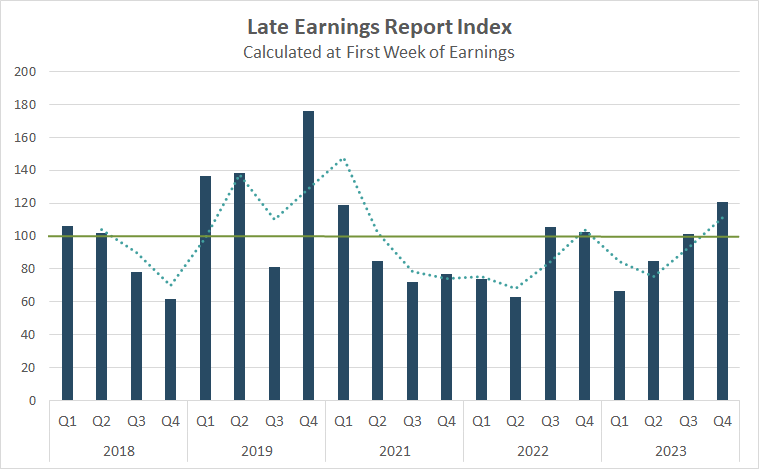

LERI Update: CEOs the Most Uncertain They’ve Been Since the COVID-19 Pandemic

One early hint that CEOs might not be feeling so confident can be seen in the Late Earnings Report Index (LERI) reading for the upcoming earnings season.

The Late Earnings Report Index tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250M and higher. The LERI has a baseline reading of 100, anything above that indicates companies are feeling uncertain about their current and short-term prospects. A LERI reading under 100 suggests companies feel they have a pretty good crystal ball for the near term.

While we won’t officially calculate the Q3 2023 earnings season (reporting in Q4 2023) LERI until the big banks report Friday, October 13, the current pre-peak season LERI reading stands at 121, the highest reading since the COVID-19 pandemic.

As of October 10, there were 51 late outliers and 38 early outliers. Typically, the number of late outliers trends upwards as earnings season continues, indicating that the LERI is poised to get even worse from here as corporations are increasingly more worried heading into the new year.

Source: Wall Street Horizon

The recent Measure of CEO Confidence published by the Conference Board confirms this ongoing pessimism from corporate America. The August 3 report showed that while the measure improved to 48 in Q3 2023, from 42 in Q2 2023, it still fell below 50, suggesting CEOs remained “cautious about what’s ahead in the economy.” Most CEOs still anticipate an economic downturn, with 84% preparing for a US recession in the coming 12 - 18 months.

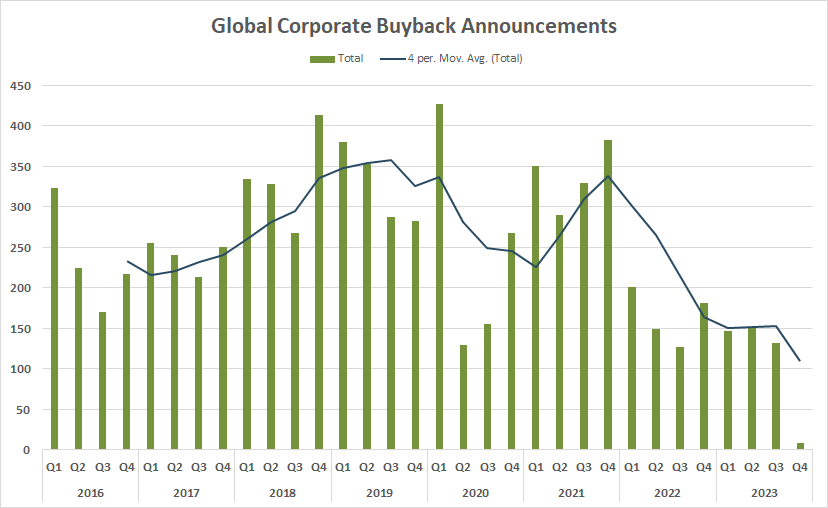

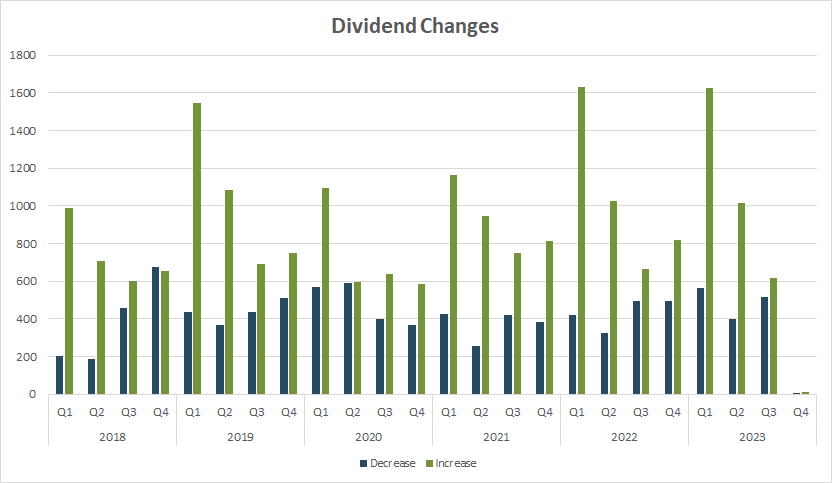

A Pullback in Buybacks (and Dividends)

It’s not just estimates and earnings dates that look less than stellar this quarter, but dividends and share repurchases as well. These are the two primary vehicles that companies use to return value to shareholders, and both are seeing meaningful decreases.

In another sign that US companies are still acting with caution, the degree to which they return excess profits to investors is cooling. The third quarter of 2023 had the fewest number of buyback announcements in a year, 132 vs. 127 in Q3 2022, and the second lowest amount since COVID-19-related lockdowns occurred in Q2 2020 (130).

Source: Wall Street Horizon

In a similar vein, dividend increases have also dampened. In Q3 2023, the number of companies increasing dividends (617) vs. decreasing dividends (516) were nearly on par with each other, we tend to see a far higher count for increases when compared to decreases.

So far for Q4, of the 23 dividend change announcements that we’ve tracked, 9 are decreases, and 14 are increases.

Source: Wall Street Horizon

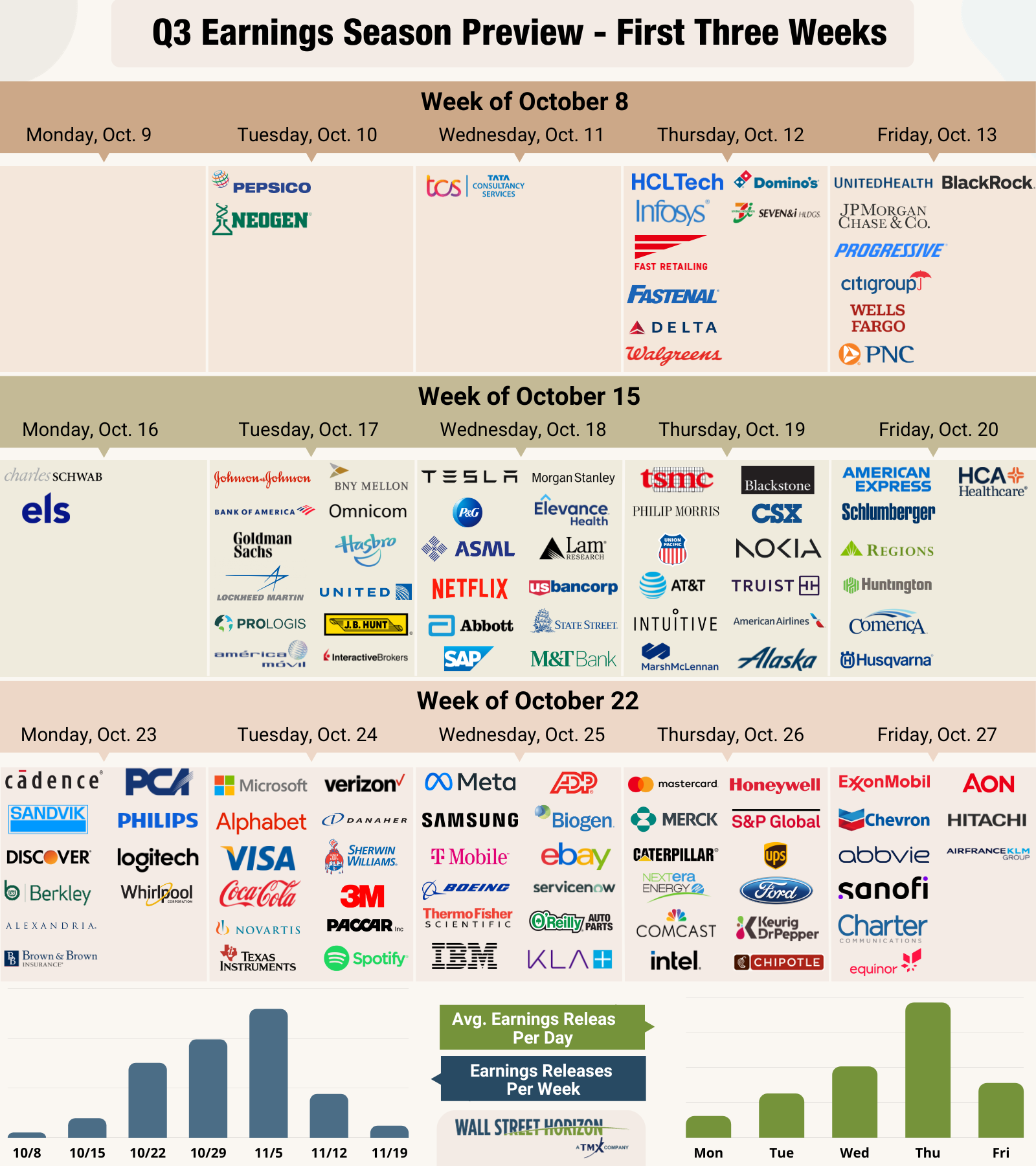

Up This Week: Big Banks

In its usual fashion, Q3 earnings season will begin with the big banks, with JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C) and Wells Fargo & Company (NYSE:WFC) reporting on Friday. Headwinds persist in a few main areas, starting with credit losses.

According to a recent note from Goldman Sachs (NYSE:GS), credit card losses are rising at the fastest pace in almost 30 years excluding the Great Recession. Both JPM and WFC have reported increases in their 30+ day delinquency rate for card services as compared to last year. As such, expect to see increases in loan loss provisions again in Q3.

Another focus will be the continued drought in deal activity at the investment banks. Despite a brief uptick in M&A deals and some exciting IPOs announced in the tech space recently, in September Bank of America (NYSE:BAC) estimated that Q3 investment banking fees would be down 30 - 35% for the sector vs. the year earlier.

The bottom line is, despite a better-than-expected jobs report last week, banks are likely to reveal that headwinds still remain.

Source: Wall Street Horizon

Q3 Earnings Wave

This season's peak weeks will fall between October 23 - November 10, with each week expected to see nearly 2,000 reports or more. Currently, November 9 is predicted to be the most active day with 1,173 companies anticipated to report. Thus far only 44% of companies have confirmed their earnings date (out of our universe of 9,500+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

Source: Wall Street Horizon