What about performance?

In the first blog of this two-part series, we analysed the real difference between active ETFs and, let’s say, ‘classic’ ETFs in Europe. We noted two main differences: 1. active ETFs allow active stock picking, and 2. their holdings can be less transparent. We also highlighted that ETFs do not mean passive investments and that ETFs that differ from the market and aim to outperform have been around for over two decades. Those ETFs, from an investment point of view, are active.

In this second blog, we aim to explore what made ETFs successful historically and how active ETFs compare to existing ETFs.

What drove ETFs’ success?

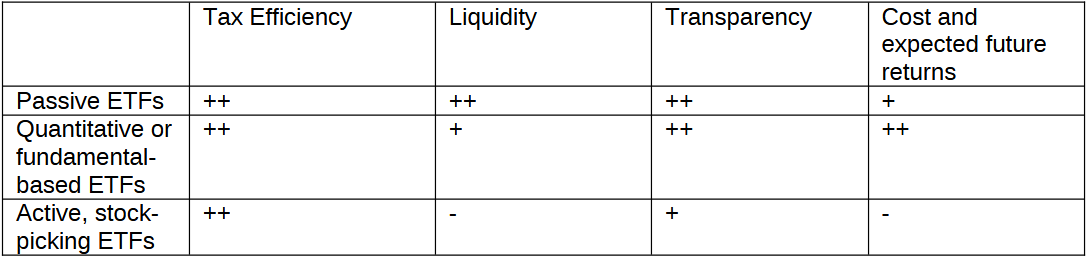

ETFs’ success mainly relied on three critical technical or operational characteristics and one investment characteristic:

-

Tax efficiency

-

Intraday liquidity and greater trading flexibility

-

Greater transparency

-

Lower costs and its more relevant corollary: Higher expected future returns.

So, let’s look at how active ETFs stack up against those characteristics:

-

Tax Efficiency

All ETFs gain the same tax efficiency from using the wrapper. There are no notable differences between active ETFs and ‘classic’ ETFs

-

Intraday liquidity and greater trading flexibility

ETFs can always be traded intraday if the exchange on which they are listed is open (even if the underlying market is closed). This is a big advantage versus active mutual funds, which can only be traded at the end of the day.

The depth of this intraday liquidity and the cost of trading intraday (the bid-offer spread) can vary depending on the ETF's strategy. This liquidity is a factor in the liquidity of the underlying assets wrapped in the ETF. ETFs, with significant assets under management, can also benefit from higher liquidity than the underlying, thanks to their secondary liquidity (SPY (NYSE:SPY) is more liquid than S&P 500 stocks, for example). Still, the ETF is always at least as liquid as its underlying portfolio.

-

ETFs that track cap-weighted market benchmarks tend to be the most liquid because they invest in very diversified baskets where the biggest stocks have the biggest weight (market cap weighting), and they also tend to be the biggest ETFs leading to a strong secondary market

-

Quantitative or fundamental-based ETFs are usually less liquid than passive ETFs but, in most cases, well-constructed ETFs are very diversified with many liquidity rules in place, leading to very strong liquidity

-

Active ETFs could be the least liquid of all ETFs depending on what strategy is run inside the ETF because active strategies tend to be concentrated in a small number of stocks and tend to take active bets on smaller stocks

-

Transparency

While ETFs that track an index must make their holdings publicly available daily, this is not always true for active ETFs. The French finance regulator (AMF), for example, recommends relaxing portfolio transparency rules for Active ETFs1.

-

Costs and expected future returns

Low fees are usually considered to be one of the key reasons for the success of ETFs. However, this is somewhat of a reduction. The reality is that by the early 90s, most investors were fed up with the inability of most active funds to create alpha higher than their fees consistently. In other words, investors were unhappy with the expected future returns being significantly lower than the market returns. With passive ETFs, the expected future return is basically the market minus the ETF fees (usually in the single to low double-digit bps) which ends up being higher than the expected future returns of active funds. So, investors, being rational, started to invest in those products.

So, the question is not directly whether Active ETFs are cheaper (they are not) but whether they have higher expected future returns than ETFs.

I won’t maintain the suspense too long. They do not. As discussed earlier, active ETFs that rely on active stock picking as their main driver of outperformance, follow the same strategies as active mutual funds (at the end of the day, for most of them, it is the same strategy; it is the same portfolio manager). So, while there is not a lot of academic research available on active ETFs themselves, it is only fair to look at the performance of active mutual funds as a proxy. The SPIVA report is always a good resource for that. The report shows things have not improved since the 90s for active strategies:

-

Over the last 10- or 15-year period, only 13% of US active strategies have outperformed the S&P 500

-

Over the last 10-year period, only 8% of European active strategies have outperformed the S&P Europe 350

-

Over the last 10-year period, only 15% of Japanese active strategies have outperformed the S&P /TOPIX 150

As a counterpoint, looking at the research around quantitative or fundamental-based ETFs (sometimes called smart-beta ETFs) is interesting. While academic research is thin on the ground, a few research teams still tried to assess the capacity of factor ETFs to outperform. Overall, the results are quite positive:

-

In “Do smart beta ETFs deliver persistent performance?” by Soggiu M., Mateus C., and Mateus I., the authors state, “We found that as per the risk-adjusted performance, about 40% of Smart Beta ETFs outperformed their related traditional ETFs after expenses. The analysis of performance persistence conducted based on the relative performance of Smart Beta ETFs showed that the performance of winners and losers does persists in the year ahead. The persistence in performance was documented in 7 out of 9 peer categories”.

-

In “Do Smart Beta ETFs Outperform the World Market?” Foreland F. and Solheim Kreutz P. (Dec 2022) state, “We find that all the US smart beta ETFs categories in our sample, except low volatility, earn excess returns above the world market. The European portfolios do not perform as well with only three categories earning abnormal returns: momentum, fundamentals weighted, and equal-weighted”.

This is no surprise. Quantitative or fundamental-based ETFs rely on decades of academic research showing that investing in high-quality or high-momentum stocks tends to outperform in the long term. They also do not suffer from the weaknesses of a stock-picking approach, such as style drifts, emotion-driven decisions, or cognitive biases.

Taking a step back from the noise, it is clear that active ETFs do not bring anything new from an investment perspective. After years of consecutive ETF growth and years of consistent outflows in active mutual funds, it is no wonder that active houses are trying everything to stop the bleeding. But stock picking in any wrapper is still stock picking. Everything that exasperated investors (secrecy, higher fees and, more importantly, an incapacity to beat the market after fees) is still there. So, let’s not get distracted by the newest marketing fads and let’s continue to benefit from the real value add and the real innovation that fundamentally-based and factor ETFs have delivered to investors.

__________________________________________________

1 https://www.amf-france.org/en/news-publications/news/active-etfs-amf-publishes-recommendation-transparency-portfolios

__________________________________________________

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

The application of regulations and tax laws can often lead to a number of different interpretations. Any views or opinions expressed in this communication represent the views of WisdomTree and should not be construed as regulatory, tax or legal advice. WisdomTree makes no warranty or representation as to the accuracy of any of the views or opinions expressed in this communication. Any decision to invest should be based on the information contained in the appropriate prospectus and after seeking independent investment, tax and legal advice.