- Didier Haenecour, Head of Fixed Income, WisdomTree

We have all felt the brunt of higher inflation rates and the European bond market is no exception. The narrative from the European Central Bank (ECB) is getting more hawkish and bond yields have responded to the expectation of higher policy rates. An important question posed by investors is whether the higher yields available across each segment of the euro investment-grade bond markets is attractive?

There is no one answer that makes sense to each investor. The starting point and the objective of investing in investment-grade bonds vary according to bespoke objectives. However, we can provide some elements of the answer that should be considered by all investor types.

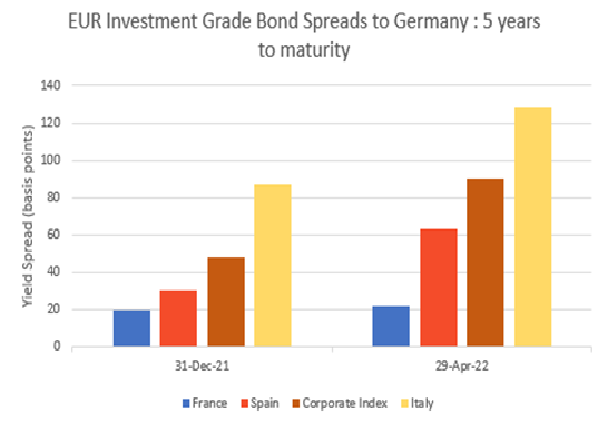

For starters, European Government Bond yields have moved into positive territory across the maturity spectrum (2 years and beyond). It is an event in its own right as yields have been negative for the most part over the last 5 years (using Germany as a case in point as shown in figure 1). In addition, we have observed a widening of the yield differential between other issuers and Germany (i.e. credit spreads) during the first four months of the year as shown in figure 2.

Bloomberg, WisdomTree, Corporate Index: iTraxx 5-year Europe Credit Default Swap. Historical performance is not an indication of future performance and any investments may go down in value.

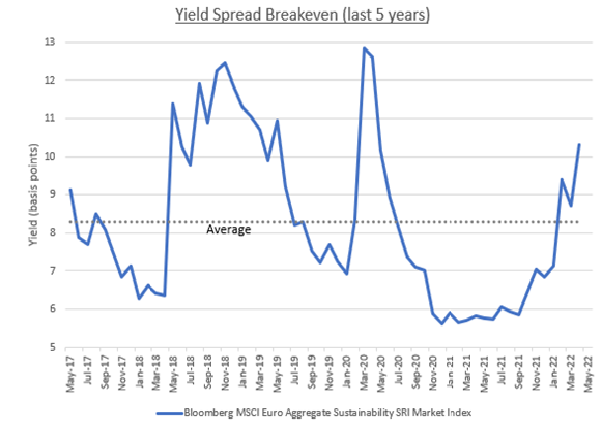

From the perspective of long-only investors who are typically benchmark sensitive, this could be the moment to assess whether government and corporate spreads are attractive enough in the current macro environment. One way to answer this question is to look at the historical valuation of credit spreads within the euro investment-grade bond universe. Yield spread breakeven shows the protection against yield spread widening over the next 12 months. The current level is roughly twice the level compared to a year ago, this makes it look attractive if we are looking at historical performance.

Bloomberg, WisdomTree, series from 31 May 2017 to 29 April 2022, Index Ticker 136661EU. Historical performance is not an indication of future performance and any investments may go down in value

Conclusion

Many institutional investors are investing across multiple segments of the fixed income market. Their assessment is often done on a relative basis. The widening of credit spreads since the beginning of the year is observed across a breadth of issuers, sovereign and corporates alike. In our view, one way to harness the current credit premium is through a broad and diversified implementation of euro investment-grade bonds. An indexing approach such as that deployed by Exchange Traded Funds (ETFs) seems highly appropriate for consideration as it can mitigate issuer-specific risk and delivers the credit premium in a more diversified way.

Disclaimer: This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.