China’s Economy Key Takeaways

- Chinese consumer confidence is weak, domestic consumption remains muted, and unemployment among youth has surged, raising concerns about unrest and long-term stagnation.

- Unsold housing inventory in China exceeds two years’ worth of demand, and property values could fall another 20-25% without sustained government intervention.

- USD/CNH could see a bullish breakout to 18-year highs above 7.37, potentially even rallying toward 7.50 or higher in the coming year.

China’s economy, the world’s second-largest, faces a convergence of critical challenges that could culminate in a long-awaited-but-nonetheless-surprising economic slowdown in 2025.

Following the end of Beijing’s stringent “zero-COVID” policy in late 2022, analysts initially predicted a strong economic recovery, but the reality has been a stagnating growth. The reasons are deeply structural, compounded by a sluggish property market, overcapacity in key industries, and an aging population. If the much-ballyhooed stimulus out of Beijing fails to comprehensively address these challenges in the coming year, “the world’s growth engine” may sputter in 2025, with major cross-market implications for traders.

A Faltering Growth Engine?

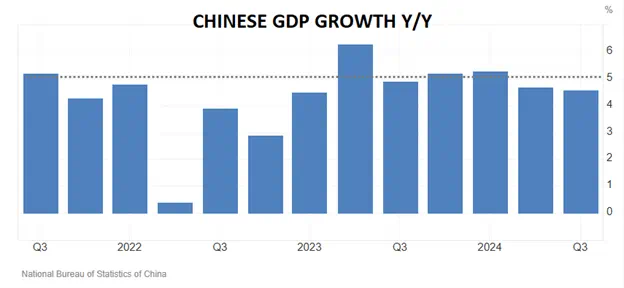

Many in the west are skeptical about the validity of official Chinese data, and even by that potentially generous measure, China’s GDP growth is already falling short of the government’s 5% target.

Source: TradingEconomics, National Bureau of Economic Statistics

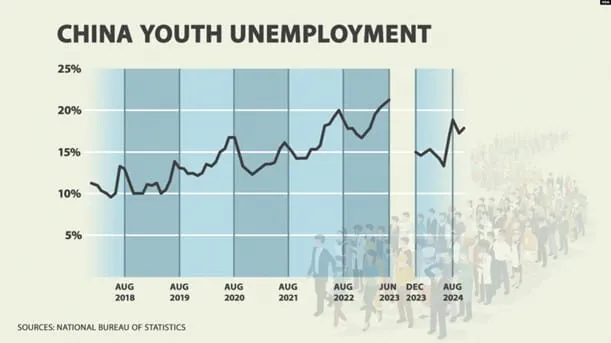

More broadly, consumer confidence is weak, domestic consumption remains muted, and unemployment among youth has surged, raising concerns about unrest and long-term stagnation, as the chart below shows:

Source: VOA, National Bureau of Economic Statistics

Structural Overcapacity and Debt

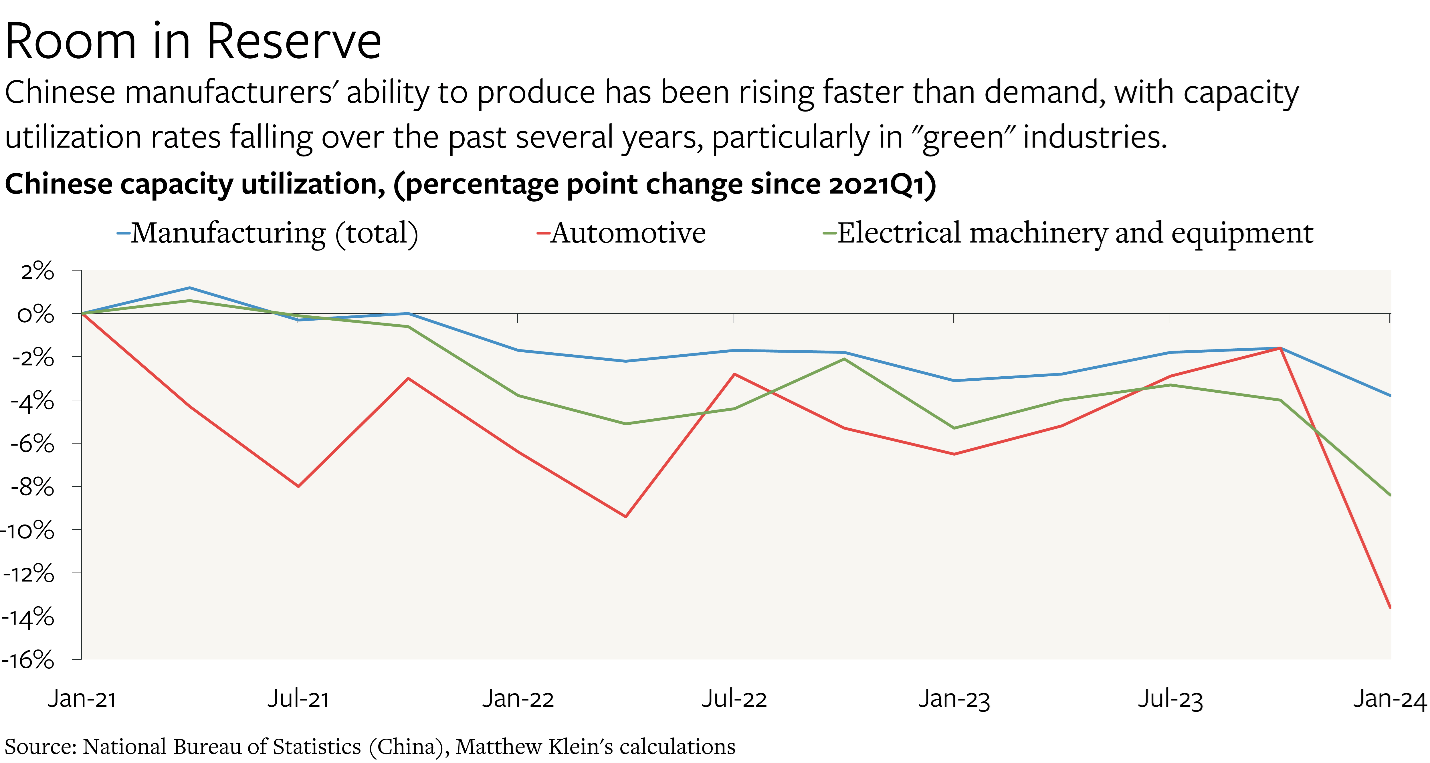

China’s economic model, long reliant on industrial production, has created a chronic overcapacity problem. Key sectors such as steel, electric vehicles, and solar panels produce far more than domestic and global markets can absorb.

As just one example, Chinese factories produce twice as many solar panels annually as the world can install. This rampant oversupply has depressed prices, eroded profits, and caused many firms to rely heavily on government subsidies to stay afloat.

Source: The Overshoot, National Bureau of Economic Statistics

The overcapacity issue is intertwined with the massive debt burdens shouldered by local governments, which are responsible for implementing Beijing’s industrial policies. Estimates suggest that off-the-book local government debt ranges from $7 trillion to $11 trillion, with hundreds of billions at risk of default. This reliance on debt-fueled growth is not sustainable, and the risk of widespread insolvency looms large, though of course it’s always hard to pinpoint exactly when those issues may rear their heads.

China’s Property Sector: A Pivotal Risk

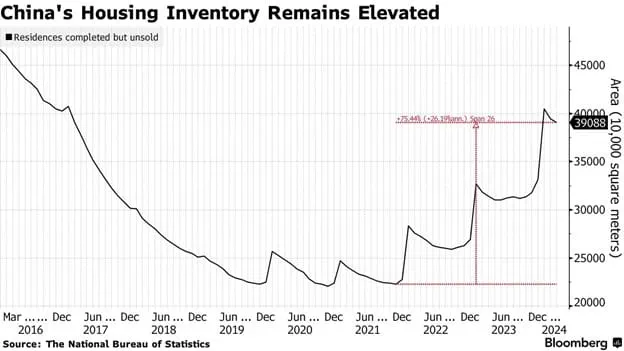

China’s property market downturn is particularly worrying.

The property sector accounts for a significant share of China’s GDP, and its downturn has led to defaults by major developers and has shaken the financial stability of local governments, which are uniquely reliant on the property sector.

According to Goldman Sachs (NYSE:GS) Research, unsold housing inventory exceeds two years’ worth of demand, and property values could fall another 20-25% without sustained government intervention. While recent stimulus measures seek to address these concerns, the scale of the problem is daunting, with trillions needed to stabilize the market fully.

If housing prices continue to drop, the wealth of millions of Chinese households—largely tied to real estate—will erode, further depressing consumption and economic growth.

Source: Bloomberg, National Bureau of Statistics

Global Repercussions

Of course, in the ever-connected global economy, China’s slowdown would not occur in isolation.

The country’s overproduction has already disrupted global markets, leading to trade imbalances and geopolitical tensions. Industries in Europe and the United States face fierce competition from Chinese exports priced below production costs, creating pressure for tariffs and trade restrictions that could accelerate under Donald Trump’s second Presidential term. If China’s economic woes deepen, it could trigger deflationary pressures globally and exacerbate supply chain vulnerabilities.

A Difficult Path Forward

For China to escape this cycle of overcapacity and debt, it needs a fundamental shift in its economic strategy, something that policymakers in Beijing have steadfastly refused to consider. Structural shifts like prioritizing domestic consumption over industrial output, reducing reliance on debt-fueled growth, and fostering innovation in emerging industries would undermine the Communist Party’s control over the economy, making them politically challenging.

For retail traders, a slowdown in China could have significant implications. Commodities reliant on Chinese demand, such as iron ore and copper, may see price declines. Meanwhile, geopolitical tensions could affect currency markets, particularly the yuan and its trading partners.

China’s growth story may have reached an inflection point, and the coming year could reveal whether Beijing can successfully address its economic challenges—or whether the world’s second-largest economy is headed for a prolonged slowdown.

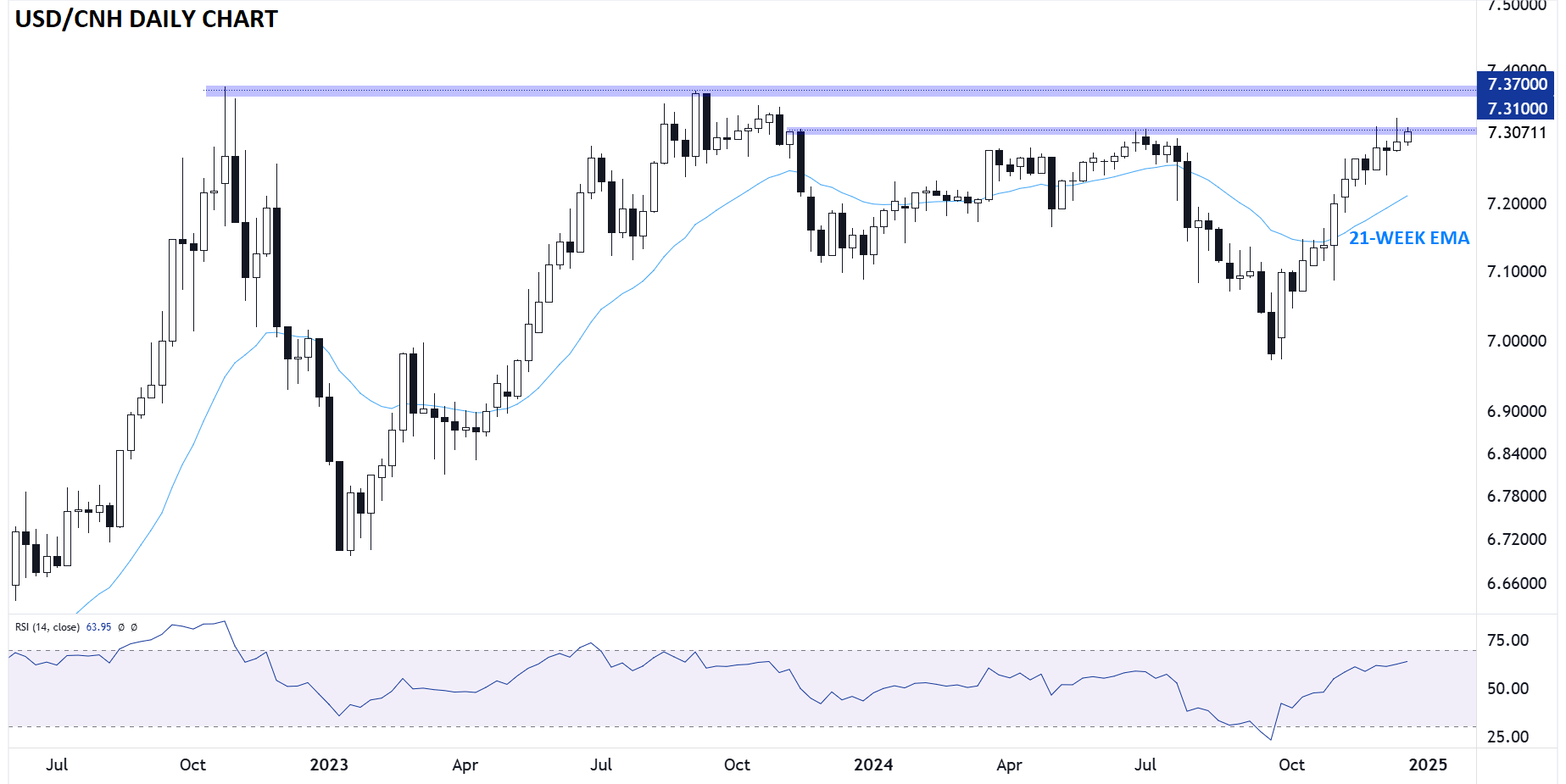

Chinese Yuan Technical Analysis – USD/CNH Daily Chart

Source: TradingView, StoneX.

As the chart above shows, the US Dollar has been remarkably steady relative to the (off-shore) Chinese yuan for the past couple of years, spending most of that time trading between about 7.00 and 7.37. If the concerns highlighted above do indeed come to a head in 2025, Chinese authorities may seek to weaken the yuan to stimulate China’s economy. In that scenario, USD/CNH could see a bullish breakout to 18-year highs above 7.37, potentially even rallying toward 7.50 or higher in the coming year.