The US housing market is red-hot thanks to record-low interest rates as well as the successful COVID-19 vaccine rollout. As a result, Real Estate Investment Trusts (REITs) have been getting significant investor attention. Despite variations in definitions across countries, REITs, in general, own, operate or finance income-generating real estate.

Recent joint numbers from the US Census Bureau and the US Department of Housing and Urban Development show:

"...sales of new single-family houses in March 2021 were at a seasonally adjusted annual rate of 1,021,000... This is 20.7% (±23.7%) above the revised February rate of 846,000 and is 66.8% (±36.7%) above the March 2020 estimate of 612,000."

The US housing market, in part, reflects the optimism about a return to pre-pandemic days and lifestyles. Meanwhile, investors are taking a closer look at REITs, which can cover different property sectors (like housing, retail, office, leisure, health care, data centers, student housing and even billboards) as well as domestic or international regions.

A large number of retail investors tend to allocate some capital to exchange-traded funds (ETFs) that focus on REITs as their holdings are typically liquid, diversified and professionally managed.

We recently covered several ETFs (here and here) that could appeal to readers who regard Q2 as a good time to enter the REIT market. Today's article extends that discussion to two other funds.

1. The Real Estate Select Sector SPDR Fund

Current Price: $42.33

52-Week Range: $30.03 - $42.57

Dividend Yield: 3.62%

Expense Ratio: 0.12% per year

The The Real Estate Select Sector SPDR Fund (NYSE:XLRE) provides exposure to the real estate sector of the S&P 500 Index. The fund started trading in October 2015, and assets under management stand at $ 2.86 billion.

XLRE, which follows the Real Estate Select Sector Index, currently has 29 holdings. The index includes real estate management and development companies as well as equity real estate investment trusts (REITs). But it excludes mortgage REITs.

Around 61% of the assets are in the top 10 stocks. Leading names in the roster include the communications real estate group American Tower (NYSE:AMT), whose clients include wireless service providers, radio and television broadcast companies; Prologis (NYSE:PLD), which invests in logistics facilities; provider of communications infrastructure Crown Castle International (NYSE:CCI); digital infrastructure group Equinix (NASDAQ:EQIX); and Public Storage (NYSE:PSA).

Readers who have been watching this fund might notice that it has been allocating more weighting to specialty (such as digital infrastructure) and industrial REITs. Retail REITs, which used to have a higher weighing before the pandemic, are not as important any more.

Year-to-date, it is up about 16% and hit a record high in recent days. Potential investors could consider investing at around $40 or below, a level that would improve the risk/return profile.

2. Invesco Real Assets ESG ETF

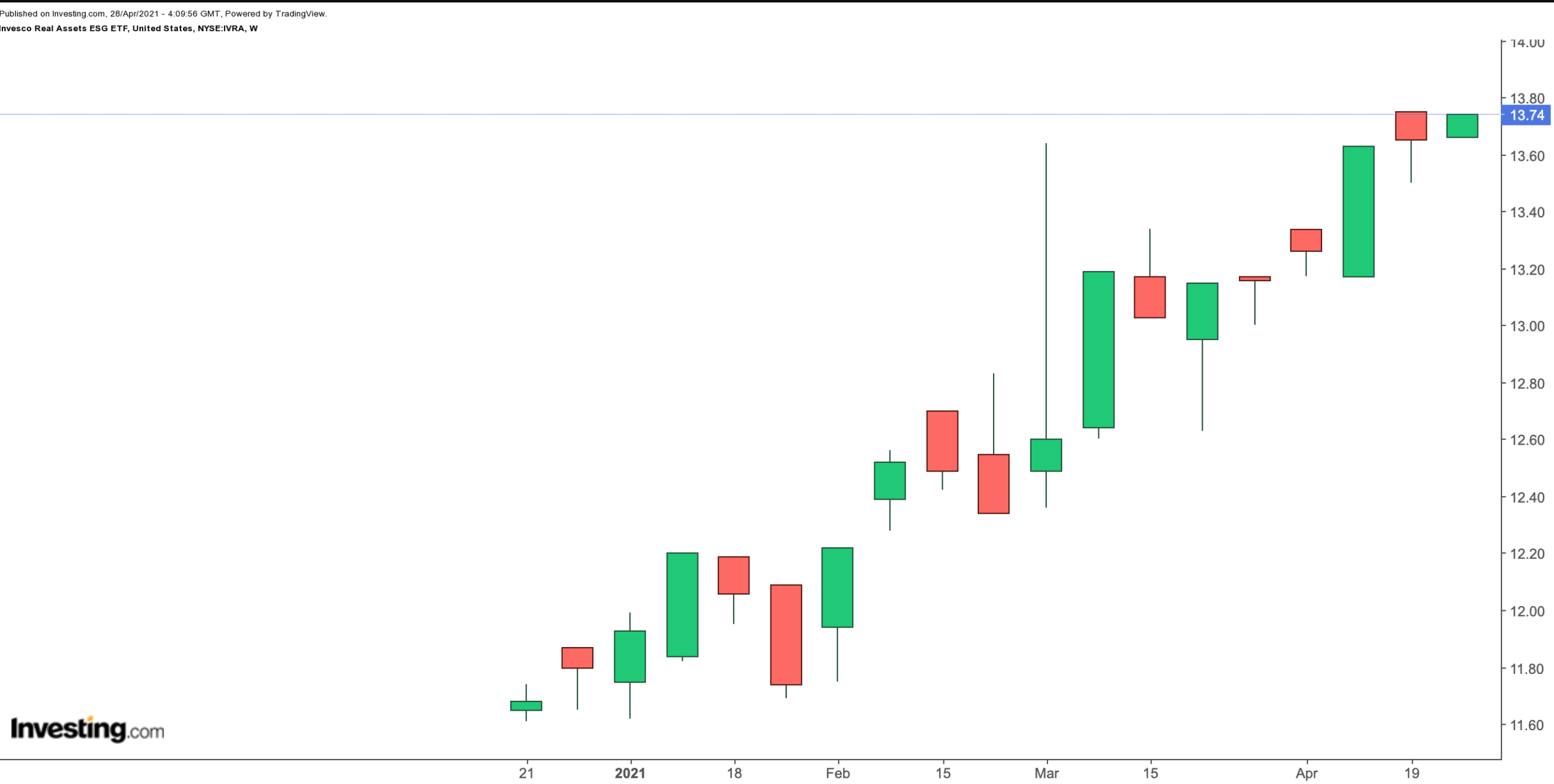

Current Price: $13.74

52-Week Range: $11.61 - $13.75

Dividend Yield: 2.16%

Expense Ratio: 0.59% per year

The Invesco Real Assets ESG ETF (NYSE:IVRA) is an active non-transparent (ANT) ETF, an asset class we have covered previously. Unlike the majority of funds, ANTs do not publish their holdings daily.

Instead, they announce their holdings every quarter, typically with a 30-day lag. The US Securities and Exchange Commission gave the legal approval for ANTs in November 2019.

IVRA, which started trading in December 2020, only has $1.4 million under management. In other words, it is a young and small fund without much trading history. As the ANT space continues to resonate further with investors, the ETF is likely to grow in size.

The objective of the fund is both capital appreciation and providing current income. Fund managers currently focus on North American "real assets" companies that meet a set of environmental, social and governance (ESG) standards.

Therefore, it is not only REITs that IVRA invests in. According to the current sectoral breakdown, real estate has a 51.45% slice. Next in line are energy (18.32%) and materials (16.13%) firms. According to the most recent numbers, the leading 10 businesses comprise around 40% of the fund.

Prologis; American Tower; United Dominion Realty Trust (NYSE:UDR), which focuses on multi-family apartment communities; Canada-based energy infrastructure group Enbridge (NYSE:ENB); and fertilizer company Nutrien (NYSE:NTR) are among the top names in the fund as of the last quarter.

So far this year, the ETF is up close to 16% and hit an all-time high in April. We like that the fund gives access to real assets, which might be appropriate in inflationary environments. We'd consider buying the dips in the fund. The fact that it is a small ANT fund, however, would not necessarily suit all investment objectives.