Benzinga - by Piero Cingari, Benzinga Staff Writer.

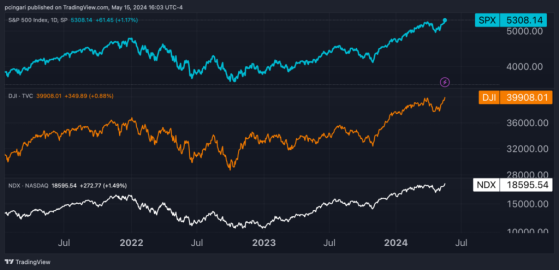

The S&P 500, Nasdaq 100 and Dow Jones Industrial Average indices all shattered fresh all-time highs Wednesday, driven by a benign inflation report that boosted risk sentiment among bullish investors.

The three major indices, tracked by the SPDR S&P 500 ETF Trust (NYSE:SPY), the Invesco QQQ Trust (NASDAQ:QQQ) and the SPDR Dow Jones Industrial Average ETF (NYSE:DIA), have recorded nine positive sessions in the last 10.

Since April’s lows, the Nasdaq 100 has rallied 9.7%, while the S&P 500 has gained 7.2%.

The S&P 500 closed Wednesday’s session at 5,308 points and the Nasdaq 100 ended at 18,595. Blue-chip stocks in the Dow Jones Industrial Average also closed at all-time highs, reaching 38,908.

Chart of The Day: Wall Street’s Major Equity Indices Close At Record Highs

Top Movers Among Sectors, Stocks Top-performing S&P 500 sectors include technology and real estate, with the Technology Select Sector SPDR Fund (NYSE:XLK) and the Real Estate Select Sector SPDR Fund (NYSE:XLRE) rising 2.2% and 1.7%, respectively.

Utilities, tracked by the Utilities Select Sector SPDR Fund (NYSE:XLU), were also strong, up 1.4%, marking their 18th positive session in the last 21.

Top-performing S&P 500 stocks Wednesday include Super Micro Computer, Inc. (NASDAQ:SMCI), up 15.8%, D.R. Horton, Inc. (NYSE:DHI), up 6.5% and Vistra Corp. (NYSE:VST), up 6%. Super Micro Computer benefited from a robust daily rally in Bitcoin (CRYPTO: BTC), which rose over 7%.

In the Nasdaq 100 Index, the top performers were IDEXX Laboratories, Inc. (NASDAQ:IDXX), up 5.2%, MongoDB, Inc. (NASDAQ:MDB), up 4.8%, and The Trade Desk, Inc. (NASDAQ:TTD), up 4.7%.

Among blue-chip stocks, top performers include Salesforce, Inc. (NASDAQ:CRM), Amgen Inc. (NASDAQ:AMGN) and The Home Depot, Inc. (NYSE:HD), with gains of 3.9%, 2.5% and 2.4%, respectively.

Read now: GameStop, AMC Surge Burns Short Sellers: This Hedge Fund May Have Been On The Right Side Of The Trade

Illustration generated using artificial intelligence via MidJourney.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga