Copper hits a two-year high

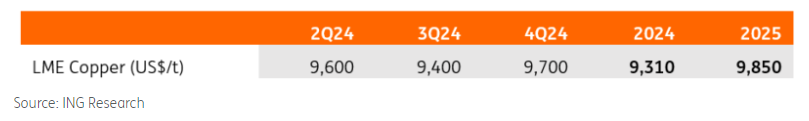

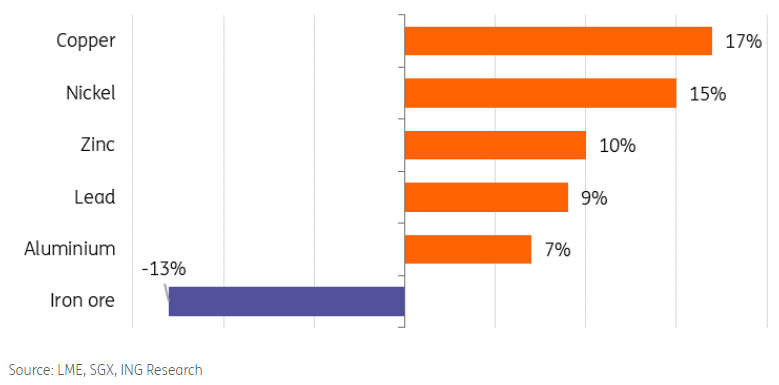

Copper prices have stood out over the last month with LME prices breaking above $10,000/t for the first time in two years. Concerns over tightness in global mine supply and stronger demand from the green energy sector have boosted prices.

While our long-term supportive outlook for copper has not changed, short term, there are indicators which suggest that copper prices are due a downward correction, unless the Chinese government unveils sustained stimulus measures, or we see Chinese smelters cutting output. Here’s why:

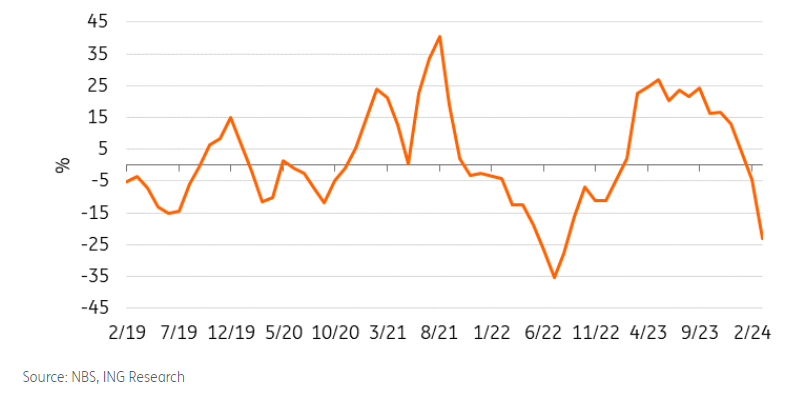

China’s property market remains a drag

While China’s manufacturing activity has been holding up, mainly thanks to overseas demand and the government’s focus on developing advanced technologies, the prolonged crisis in China’s property market doesn’t show signs of bottoming out just yet. In particular, housing completions, which usually act as a good measure of copper demand, have been on a downtrend this year, down more than 20% year-on-year, pointing at slowing demand for the red metal.

The low level of housing starts will also continue to weigh on copper demand looking ahead, given the lag between starts and metals usage.

China copper inventories are elevated

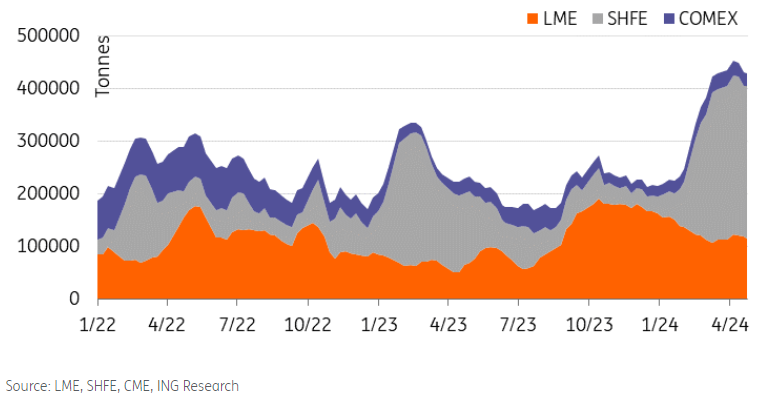

In China, copper inventories are at seasonally elevated levels as peak season for local demand continues to disappoint. Historically, copper stocks at SHFE exchanges start to decline from the second half of March. The second quarter is seasonally the strongest for copper demand. However, stocks in the SHFE warehouses recently jumped above 300,000 tonnes, to a four-year high, a level last seen when demand collapsed during the Covid pandemic. In addition to sluggish domestic demand, high refined copper output is behind the rising stocks in China.

This accumulation in stocks has led smelters to export more refined copper to China-bonded zones and LME warehouses. China is usually a major net importer of refined copper; however, it still exports some volumes when it turns profitable to do so. Some major smelters plan to export a total of 40,000 tonnes and 50,000 tonnes of refined copper in May to LME warehouses in Asia, according to a Bloomberg report citing industry sources. A monthly volume of 50,000 tonnes would be the highest since April 2022, according to Chinese customs data.

China’s refined output is heading for a record

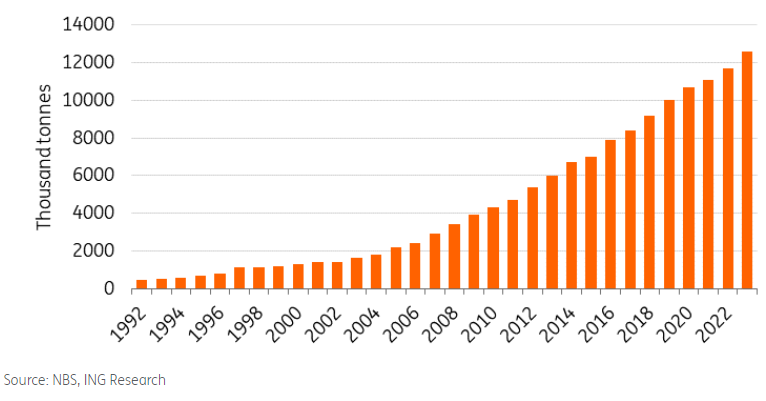

Despite spot treatment charges slumping below zero last month, there are no signs yet of Chinese smelters cutting operating rates. China’s refined output last month was up 7.9% year-on-year to 1.147 million tonnes. Output in March was 37,000 tonnes a day – that is near the all-time high of 38,000 a day in November, according to official data.

This expansion has been driven by China’s strategic need for copper as demand from the green energy sector is set to grow. Last year, China’s production of refined copper surged 13.5% year-on-year to 12.99 million tonnes.

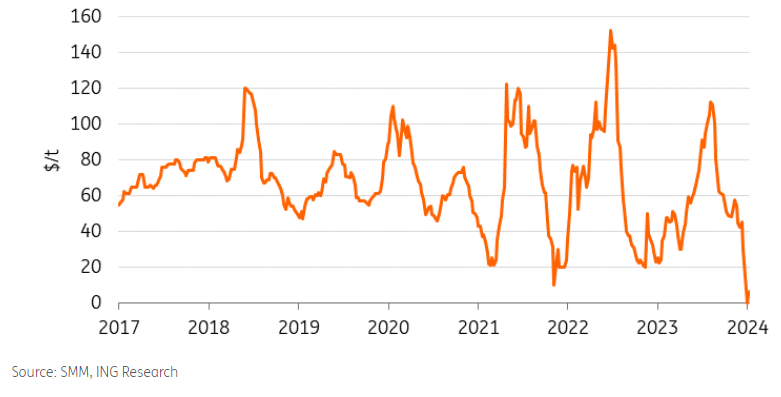

China imports premium slumps to zero

China’s premium on imported copper slumped to zero last month for the first time in Shanghai Metals Market (SMM) data going back to 2017 as international copper prices have continued to rise, deterring buyers. The Yangshan premium is paid on top of global exchange prices and is usually a good measure of Chinese buying appetite. Its peak was just above $150/t.

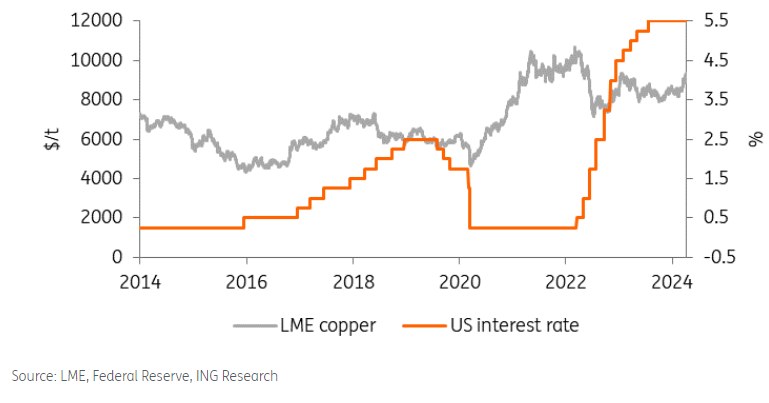

US Fed could provide a headwind

Outside of China, US monetary policy will also be important for the direction of copper prices. Elevated rates and a stronger dollar have been a drag on industrial metals over the past two years. If US Fed rate cut expectations continue to be pushed back, it should provide a further headwind to copper prices. Swaps markets now point to a 54% chance of a Fed rate cut by year-end, up from about 40% at the end of April. Our US economist expects the first rate cut in September, followed by cuts in November and December as well.

If US rates stay higher for longer, this would lead to a stronger US dollar and weaker investor sentiment, which in turn would translate to lower copper prices.