By Chris Gannatti and Pierre DEBRU

In 2024, we have seen Meta Platforms, Salesforce.com (NYSE:CRM), Booking (NASDAQ:BKNG) Holdings and Alphabet (NASDAQ:GOOGL) initiating dividend payments. Many technology companies have accumulated significant amounts of cash, with more calls to return this cash to shareholders by initiating dividends.

The psychology with which the investment world treats dividends feels more like an ongoing arrangement between the shareholders and the company. Once declared, expectations are to continue and even moderately increase over time, offering a promising outlook for investors. True, no dividend payment is ever ‘guaranteed’, but if a dividend is reduced or curtailed, it can be headline news amongst certain large companies – news these companies would prefer to avoid.

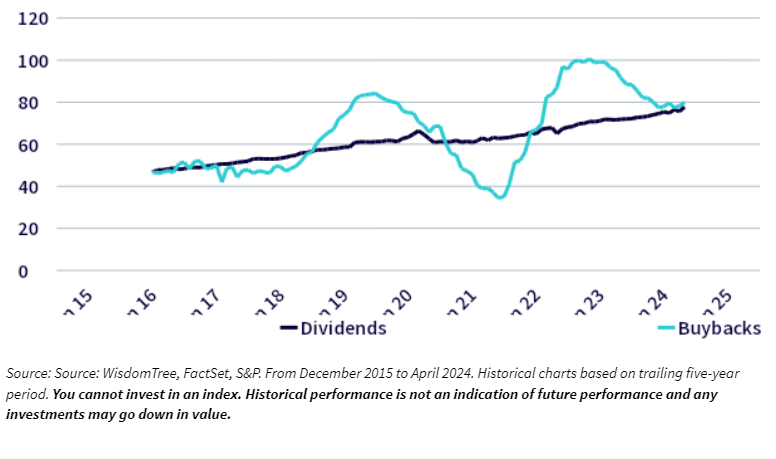

Buybacks are another way for companies to transfer cash back to shareholders, but they are less transparent and, more importantly, they are more transient and less stable in time. Boards of directors can announce buybacks that could occur over specific time frames, but they are not known about as they are happening and are only visible in hindsight where one can confirm them on the quarterly statement of cash flows.

This chart on dividends versus buybacks shows the stability versus cyclicality and volatility of buyback streams – the two are hardly comparable if one wants a predictable stream of cash flows from stocks.

This stability of dividend cash flow explains why ‘dividend investing’ is such a big category and why dividend-growth ETFs are so well-maintained. Investors love the idea of a company raising its dividend over time and of a stream of income that has the potential to grow over time.

Here are three of the largest such, dividend growth ETFs in the ecosystem:

-

WisdomTree US Quality Dividend Growth UCITS ETF (DGRW): The ETF is designed to track, before fees and expenses, the total return performance of the WisdomTree US Quality Dividend Growth UCITS Index. The index focuses on companies with strong growth and quality metrics, as defined by 1) estimated earnings growth over the next three–five years, 2) three-year average return on equity and 3) three-year average return on assets. The Index is weighted by cash dividends1.

-

SPDR S&P US Dividend Aristocrats UCITS ETF: The ETF is designed to track, before fees and expenses, the total return performance of the S&P High Yield Dividend Aristocrats Index. The Index measures the performance of companies within the S&P Composite 1500 Index universe that have followed a managed-dividends policy of consistently increasing dividends every year for at least 20 years. Weighting is focused on dividend yield2.

-

iShares Dow Jones US Select Dividend UCITS ETF: The ETF is designed to track, before fees and expenses, the total return performance of the Dow Jones US Select Dividend Index. The Index screens on numerous criteria, which include, but are not limited to 1) nonnegative historical five-year dividend-per-share growth, 2) a five-year average dividend-to-earnings-per-share ratio of less than or equal to 60% and 3) payments of dividends in each of the prior five years. Weighting is based on indicated annual dividends3.

To summarise one critical point involving historical dividend-growth requirements for each of the indexes tracked by these ETFs:

-

WisdomTree US Quality Dividend Growth UCITS ETF (DGRW) – no historical dividend-growth requirement.

-

SPDR S&P US Dividend Aristocrats UCITS ETF – 20 consecutive years of historical dividend growth.

-

iShares Dow Jones US Select Dividend UCITS ETF – nonnegative dividend per share growth for five years.

We underline that point because Meta Platforms initiated a regular cash dividend on 1 February 2024. WisdomTree undertook a special rebalance to immediately add this substantial dividend payer to the appropriate indexes, including the one tracked by DGRW. The other approaches will have to wait a varying number of years before Meta Platforms become eligible.

Of course, these dividend-growth requirements don’t mean much in a vacuum. We believe that what investors really care about are results. If waiting 20 years to include companies that grow their dividends has been a route to strong performance and strong dividend growth in the portfolio, that’s great. If not, it’s a very stringent criterion for which investors aren’t being compensated.

Where the rubber meets the road: Historical dividend growth and total returns

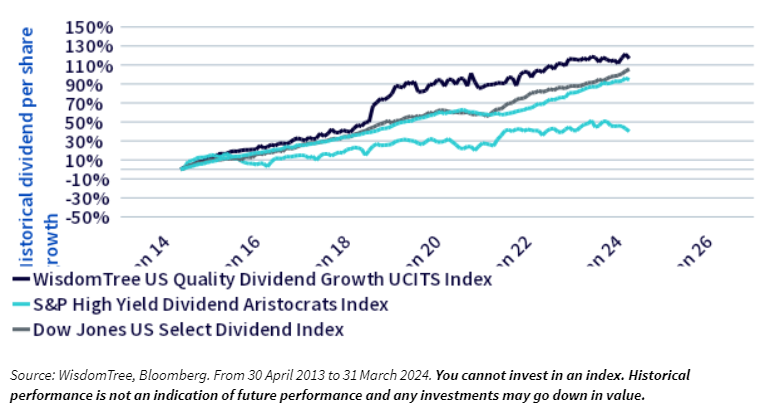

Focusing first on the explicit target of those ETFs, Figure 2 shows the historical evolution of the dividend per share of their underlying indices. We observe that the S&P grew its dividend per share by 94% over the 10-year period. In comparison, the Dow Jones index grew by a bit more, 105.6%, but the Aristocrats, despite (or because of) their very stringent constraints, grew by only half that at 40%.

WisdomTree’s strategy grew its dividend the most – 116.8% over the period – despite having no explicit dividend growth constraints but by focusing instead on what makes a dividend-growing stock: its capacity to grow dividends in the future. The WisdomTree strategy focuses on companies that are growing and that are very profitable, in other words, high-quality companies. Those high-quality companies have not just the will but the capacity to grow dividends over time.

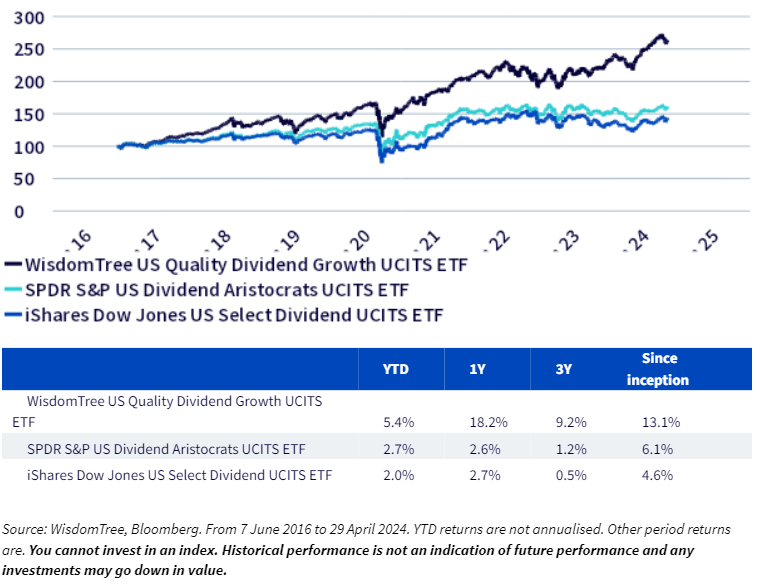

Figure 3 shows the performance of those different ETFs net of fees since common inception date. WisdomTree US Quality Dividend Growth exhibits the strongest returns since inception. It also shows the strongest performance over the rest of the time periods: year-to-date (YTD), one-year (1Y), or three-year (3Y).

Clearly, despite having a strategy without explicit dividend growth criteria, WisdomTree US Quality Dividend Growth exhibits the best dividend growth over time and the best performance over long and short time periods.

Sector exposure: The foundation of understanding dividend-oriented ETFs

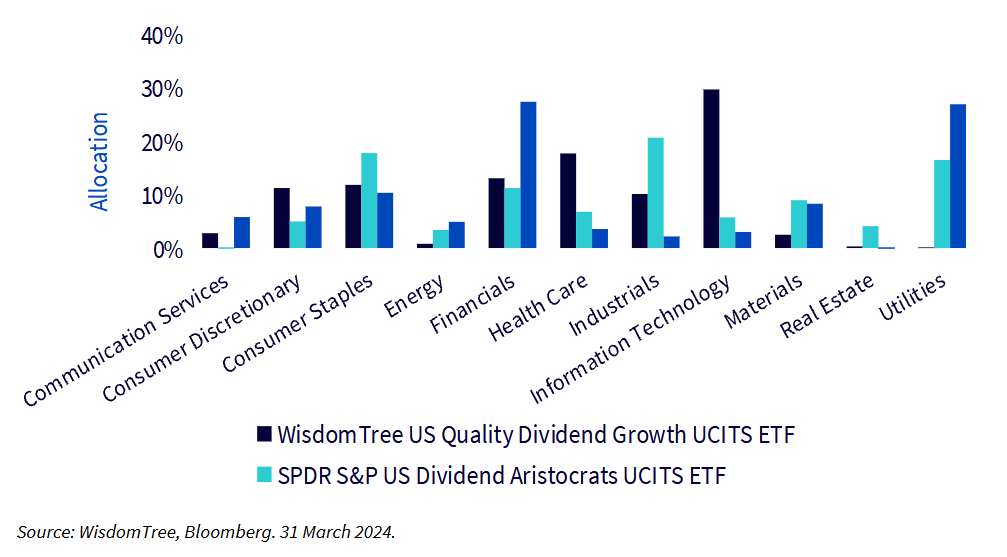

Different sectors have different relationships to dividend payments. Typically, one of the starkest comparisons involves looking at Utilities versus Tech-orientated sectors such as Information Technology or some part of Consumer Discretionary, for example:

-

Utilities tend to have a high current dividend yield, but utility companies do not grow their earnings very quickly and, therefore, do not grow their dividends very quickly

-

Tech companies have been the engine of growth for the US equity market since the global financial crisis of 2008/9. Many of the largest companies in this sector are paying extremely large dividends, buying back lots of their own stock and still accumulating massive amounts of cash on their balance sheets. However, many of these firms may not have been paying dividends for 10 or 20 years, and we believe waiting for 10 or 20 years is an arbitrary requirement that, for example, would have disqualified Apple (NASDAQ:AAPL) from 2012 (dividend initiation) to 2022, if one was looking for 10 years

When we look at figure 4:

-

The Aristocrats strategy and the Dow Jones strategy emphasised the weight of Utilities ahead of the other strategies. Similarly, they tilted away from the Information Technology and Consumer Discretionary sectors

-

WisdomTree placed more weight in the Information Technology sector and de-emphasised weight to the Utilities sector

We think that contrast ultimately says a lot in terms of how different strategies generate different performances.

Conclusion

Dividend investing allows investors to create a steady stream of cash flow while investing in dividend-paying and dividend-growing stocks that have historically outperformed the market. Of course, the difficulty is figuring out which companies are dividend-growing. While it makes sense intuitively to look back and search for companies that have grown their dividends historically, like with everything in investing, what has already happened is already priced in. By focusing on high-quality fundamentals and on what makes the growth of dividends possible, the WisdomTree US Quality Dividend Growth UCITS ETF has delivered very strong performance and dividend growth historically.

1 Source: WisdomTree US Quality Dividend Growth Index, WisdomTree.

2 Source: S&P Dividend Aristocrats Indexes Methodology, S&P Dow Jones Indexes, updated as of January 2024

3 Source: Dow Jones US Select Dividend Index. S&P Dow Jones Indexes.

________________________

IMPORTANT INFORMATION

Marketing communications issued in the European Economic Area (“EEA”): This document has been issued and approved by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Marketing communications issued in jurisdictions outside of the EEA: This document has been issued and approved by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

WisdomTree Ireland Limited and WisdomTree UK Limited are each referred to as “WisdomTree” (as applicable). Our Conflicts of Interest Policy and Inventory are available on request.

For professional clients only. Past performance is not a reliable indicator of future performance. Any historical performance included in this document may be based on back testing. Back testing is the process of evaluating an investment strategy by applying it to historical data to simulate what the performance of such strategy would have been. Back tested performance is purely hypothetical and is provided in this document solely for informational purposes. Back tested data does not represent actual performance and should not be interpreted as an indication of actual or future performance. The value of any investment may be affected by exchange rate movements. Any decision to invest should be based on the information contained in the appropriate prospectus and after seeking independent investment, tax and legal advice. These products may not be available in your market or suitable for you. The content of this document does not constitute investment advice nor an offer for sale nor a solicitation of an offer to buy any product or make any investment.

An investment in exchange-traded products (“ETPs”) is dependent on the performance of the underlying index, less costs, but it is not expected to match that performance precisely. ETPs involve numerous risks including among others, general market risks relating to the relevant underlying index, credit risks on the provider of index swaps utilised in the ETP, exchange rate risks, interest rate risks, inflationary risks, liquidity risks and legal and regulatory risks.

The information contained in this document is not, and under no circumstances is to be construed as, an advertisement or any other step in furtherance of a public offering of shares in the United States or any province or territory thereof, where none of the issuers or their products are authorised or registered for distribution and where no prospectus of any of the issuers has been filed with any securities commission or regulatory authority. No document or information in this document should be taken, transmitted or distributed (directly or indirectly) into the United States. None of the issuers, nor any securities issued by them, have been or will be registered under the United States Securities Act of 1933 or the Investment Company Act of 1940 or qualified under any applicable state securities statutes.

This document may contain independent market commentary prepared by WisdomTree based on publicly available information. Although WisdomTree endeavours to ensure the accuracy of the content in this document, WisdomTree does not warrant or guarantee its accuracy or correctness. Any third party data providers used to source the information in this document make no warranties or representation of any kind relating to such data. Where WisdomTree has expressed its own opinions related to product or market activity, these views may change. Neither WisdomTree, nor any affiliate, nor any of their respective officers, directors, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this document or its contents.

This document may contain forward looking statements including statements regarding our belief or current expectations with regards to the performance of certain assets classes and/or sectors. Forward looking statements are subject to certain risks, uncertainties and assumptions. There can be no assurance that such statements will be accurate and actual results could differ materially from those anticipated in such statements. WisdomTree strongly recommends that you do not place undue reliance on these forward-looking statements.

WisdomTree Issuer ICAV

The products discussed in this document are issued by WisdomTree Issuer ICAV (“WT Issuer”). WT Issuer is an umbrella investment company with variable capital having segregated liability between its funds organised under the laws of Ireland as an Irish Collective Asset-management Vehicle and authorised by the Central Bank of Ireland (“CBI”). WT Issuer is organised as an Undertaking for Collective Investment in Transferable Securities (“UCITS”) under the laws of Ireland and shall issue a separate class of shares ("Shares”) representing each fund. Investors should read the prospectus of WT Issuer (“WT Prospectus”) before investing and should refer to the section of the WT Prospectus entitled ‘Risk Factors’ for further details of risks associated with an investment in the Shares.

Notice to Investors in Switzerland – Qualified Investors

This document constitutes an advertisement of the financial product(s) mentioned herein.

The prospectus and the key investor information documents (KIID) are available from WisdomTree’s website: https://www.wisdomtree.eu/en-ch/resource-library/prospectus-and-regulatory-reports

Some of the sub-funds referred to in this document may not have been registered with the Swiss Financial Market Supervisory Authority (“FINMA”). In Switzerland, such sub-funds that have not been registered with FINMA shall be distributed exclusively to qualified investors, as defined in the Swiss Federal Act on Collective Investment Schemes or its implementing ordinance (each, as amended from time to time). The representative and paying agent of the sub-funds in Switzerland is Société Générale (EPA:SOGN) Paris, Zurich Branch, Talacker 50, PO Box 5070, 8021 Zurich, Switzerland. The prospectus, the key investor information documents (KIID), the articles of association and the annual and semi-annual reports of the sub-funds are available free of charge from the representative and paying agent. As regards distribution in Switzerland, the place of jurisdiction and performance is at the registered seat of the representative and paying agent.

For Investors in France

The information in this document is intended exclusively for professional investors (as defined under the MiFID) investing for their own account and this material may not in any way be distributed to the public. The distribution of the Prospectus and the offering, sale and delivery of Shares in other jurisdictions may be restricted by law. WT Issuer is a UCITS governed by Irish legislation, and approved by the Financial Regulatory as UCITS compliant with European regulations although may not have to comply with the same rules as those applicable to a similar product approved in France. The Fund has been registered for marketing in France by the Financial Markets Authority (Autorité des Marchés Financiers) and may be distributed to investors in France. Copies of all documents (i.e. the Prospectus, the Key Investor Information Document, any supplements or addenda thereto, the latest annual reports and the memorandum of incorporation and articles of association) are available in France, free of charge at the French centralizing agent, Societe Generale at 29, Boulevard Haussmann, 75009, Paris, France. Any subscription for Shares of the Fund will be made on the basis of the terms of the prospectus and any supplements or addenda thereto.

For Investors in Malta

This document does not constitute or form part of any offer or invitation to the public to subscribe for or purchase shares in the Fund and shall not be construed as such and no person other than the person to whom this document has been addressed or delivered shall be eligible to subscribe for or purchase shares in the Fund. Shares in the Fund will not in any event be marketed to the public in Malta without the prior authorisation of the Maltese Financial Services Authority.

For Investors in Monaco

This communication is only intended for duly registered banks and/or licensed portfolio management companies in Monaco. This communication must not be sent to the public in Monaco.