Investing.com - Artificial Intelligence (AI) is perhaps the most transformative technology cycle since the birth of the internet. Yet we are only in the early stages of testing and experimenting with commercial applications. And it is easy to lose sight of the breadth of the technology sector when the focus is on a small group of large-cap stocks.

- How to invest by taking advantage of AI, try InvestingPro, sign up HERE and NOW for less than 8 pounds a month and get almost 40% off for a limited time on your 1-year plan!

Since late 2022, when ChatGPT launched, the Magnificent Seven have dominated market returns due to their prominent role in developing the hardware and building the infrastructure for generative AI.

Is there a way to incorporate AI-driven stocks into low volatility funds? Kent Hargis, Co-Chief Investment Officer-Strategic Core Equities, and James Russo, Senior Research Analyst-Strategic Core Equitie at AllianceBernstein, think so.

The key is to look for companies with high-quality business models, a degree of stability and relatively attractive valuations for the sector, even if they may be somewhat more expensive than the general market average. The dotcom bubble taught us that investors should not be blinded by the promises of unproven new markets and should always ensure that a pioneering product is backed by a credible business model.

How to identify quality AI companies

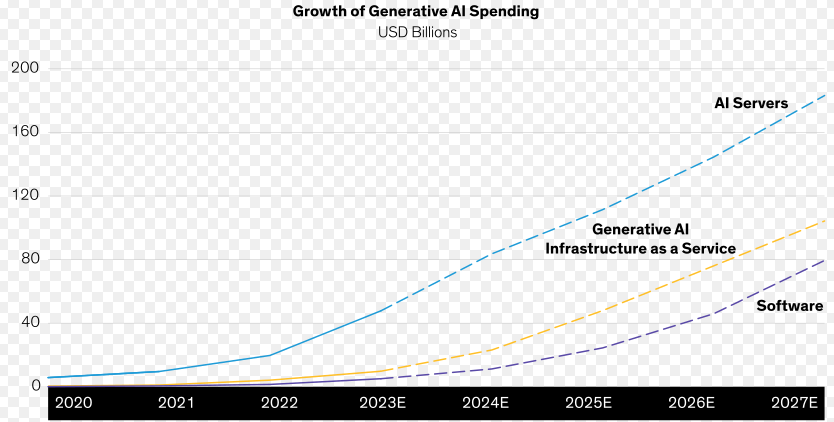

- Distinguish between technology industries: Hargis and Russo believe that current investments in semiconductors and cloud infrastructure will provide a boost to revenue growth for the software industry if they are able to monetise them (see chart). This would cause the values of these companies to catch up with their semiconductor counterparts.

- Be selective within the Magnificent Seven and subject them to the same scrutiny as any other stock in a low-volatility portfolio: investors should focus on high-quality business models that offer the flexibility to weather short-term market stresses and longer-term challenges. That said, portfolio positions should be calibrated to help ensure that the strategy is not overly exposed to a potential downturn in the Magnificent Seven.

ProPicks strategies

Investors are slowly incorporating investment strategies that use AI. Here, the professional tool InvestingPro can help. ProPicks strategies use a combination of Artificial Intelligence (AI) and expert human analysis to highlight stocks with the potential to outperform market benchmarks.

InvestingPro's proprietary AI model analyses historical financial data, to categorise and rate different stocks and their historical performance. The AI model learns to identify different financial parameters and their correlation to overall stock performance over the years and assigns relative weights to the different financial parameters.

Based on the results of the analysis, the AI model ranks each stock by assigning it one of the following labels: Underperform, Neutral Performer, or Outperformer, and thus attempts to identify stocks that may have historically outperformed market benchmarks over certain periods.

InvestingPro's historical dataset includes over 25 years of financial data and over 50 financial metrics for thousands of companies across a variety of industries. This extensive dataset is necessary to increase the accuracy of the weighting assigned to each financial metric, which contributes to a more rigorous analysis of stock performance.

How do you continue to take advantage of market opportunities with the help of AI? Take the opportunity HERE & NOW to get InvestingPro's annual plan for less than £8 per month. Use the code INVESTINGPRO1 and get 40% off your 1-year subscription - less than a Netflix (NASDAQ:NFLX) subscription costs you! (And you get more out of your investments too). With it you get:

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So fundamental analysis professionals can drill down into all the details themselves.

- And many other services, not to mention those we plan to add shortly.

Act fast and join the investment revolution - get your OFFER HERE!