Benzinga - by Shanthi Rexaline, Benzinga Editor.

Earnings optimism has kept sentiment buoyant, with the stock futures pointing to a higher opening on Monday. The third-quarter earnings season starts in earnest this week, with some blue chip companies, including Tesla, Inc. (NASDAQ:TSLA), Netflix, Inc. (NASDAQ:NFLX), Procter & Gamble Co. (NYSE:PG) and Johnson & Johnson (NYSE:JNJ) scheduled to release their earnings.

S&P 500 earnings could edge up 0.4% in the third quarter, potentially marking an inflection following four straight quarters of negative earnings growth, said data analytics company FactSet.

Traders may look to a regional manufacturing activity reading and the Fed speeches scheduled for the day for trading cues. Oil has begun ticking higher, and so have bond yields.

Tech stocks appear to be on the back foot in premarket trading, given their looming earnings and fears concerning the sustainability of their stretched valuation. In the eventuality of the economic picture worsening, the earnings of these companies are at risk.

Cues From Past Week's Trading:

U.S. stocks closed the week ended Oct. 13 on a mixed note as traders digested inflation readings that came in above expectations and the spike in oil prices on the Israel-Hamas conflict in the Middle East. Optimism concerning a positive third-quarter earnings season, dovish comments from some Fed officials, and the pullback in bond yields helped mitigate the weakness.

The S&P 500 indices settled higher for a second straight week.

US Index Performance In Week Ended Oct. 13

| Index | Performance (+/-) | Value |

| Nasdaq Composite | -0.18% | 13,407.23 |

| S&P 500 Index | +0.45% | 4,327.78 |

| Dow Industrials | +0.79% | 33,670.29 |

| Russell 2000 | -1.48% | 1,719.71 |

Analyst Color:

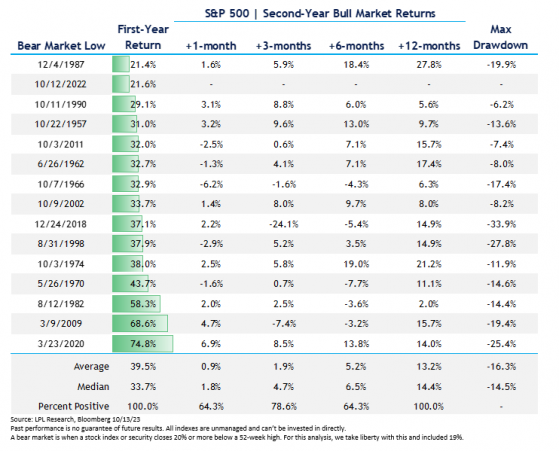

“The S&P 500 has wrapped up the first year of the bull market with a gain of 21.6%, underwhelming from a historical context but respectable given the challenging macro backdrop over the last 12 months,” said LPL Financial Chief Technical Strategist Adam Turnquist.

The analyst expects some of the headwinds to recede as the bull market progresses into its second year. The likelihood of the Federal Reserve ending its rate-hiking cycle amid a cool-off of inflationary pressure will likely take some upside pressure off interest rates. This, in turn, could prove positive for stocks, he suggested.

“History also suggests this bull market may have more room to run. Average and median 12-month returns for the S&P 500 have averaged around 13% to 14% during the second year of a bull market,” he said.

Chart Courtesy of LPL Financial

Futures Today

Futures Performance On Monday

| Futures | Performance (+/-) |

| Nasdaq 100 | +0.05% |

| S&P 500 | +0.28% |

| Dow | +0.40% |

| R2K | +0.70% |

In premarket trading on Monday, the SPDR S&P 500 ETF Trust (NYSE:SPY) rose 0.26% to $432.63 and the Invesco QQQ ETF (NASDAQ:QQQ) edged up 0.01% to $365.32, according to Benzinga Pro data.

Upcoming Economic Data:

A slew of Fed speeches dominate the economic calendar of the unfolding week before the central bank officials go silent ahead of the Oct. 30-Nov.1 Federal Open Market Committee meeting.

Two regional manufacturing activity surveys for October, the September retail sales report, the Federal Reserve’s industrial production report for September, and a handful of housing market readings will also be on investors’ radar.

The New York Fed’s Empire Manufacturing survey results are due at 8:30 a.m. EDT. Economists, on average, expect the business conditions index to slip back from 1.9 in September to -7 in October. A reading below ‘0’ indicates a contraction of the manufacturing sector.

Philadelphia Fed President Patrick Harker, a member of the FOMC, is due to speak at 10:30 a.m. EDT and again at 4:30 p.m. EDT.

The Treasury is set to auction three- and six-month Treasury notes at 11:30 a.m. EDT.

- Novavax, Inc. (NASDAQ:NVAX) stock fell about 3.70% in premarket trading after the EU delayed approval of its revised COVID-19 vaccine.

- Tesla retreated over 1% ahead of the company’s quarterly report due on Wednesday.

- Nvidia, Inc. (NASDAQ:NVDA) also decreased more than 1% after a report said the company’s AI chip exports to China could face further restrictions.

- Charles Schwab Corp. (NYSE:SCHW) is scheduled to report its quarterly results ahead of the market open.

Crude oil futures edged up 0.03% to $86.38 in early European session on Monday following a nearly 6% spike in the week ended Oct. 13. The past week’s rally was due to geopolitical tensions in the Middle East following Hamas’ strikes against Israel.

The benchmark 10-year Treasury note rose 0.06 percentage points to 4.689% on Monday.

The Asian markets were down across the board on Monday, with Japan’s Nikkei 225 average leading the slide with a 2% pullback. By late-morning trading on Monday, European stocks were nearly flat with a slight negative bias. The simmering tensions in the Middle East and the start of the second-quarter reporting season kept traders on the sidelines.

Photo by Jirapong Manustrong on Shutterstock

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.