By Huw Jones

LONDON (Reuters) - Complaints about payday lenders in Britain have rocketed as concerns about the solvency of firms and lax lending practices in the sector persist, a UK financial watchdog said on Tuesday.

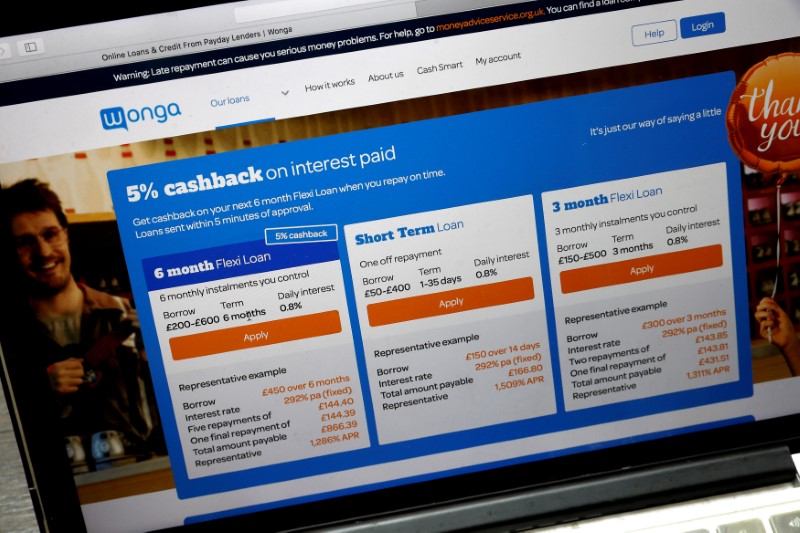

Payday lending, where often vulnerable people borrow small amounts for just days or weeks, has been criticised for charging very high interest rates and trapping borrowers for months.

Caroline Wayman, chief executive of the Financial Ombudsman Service (FOS) said the state watchdog typically deals annually with around 100,000 complaints that financial firms have not been able to resolve on their own with customers.

"We have seen quite significant increases in demand for our services. Short term lending has been particularly acute," Wayman told parliament's Treasury Select Committee.

FOS had forecast around 20,000 short term lending complaint cases in its current financial year, but now expects at least 50,000, compared with about 2,000 annually in recent years.

It would be even higher had payday sector leader Wonga not gone into administration last year, Wayman said.

There were examples of multiple borrowings by the same customers, raising concerns about how the money was lent and affordability, Wayman added.

Britain's Financial Conduct Authority, which oversees FOS, has capped the amount of interest payday lenders can charge, leading to shrinkage in the sector. It has also asked payday lenders to take heed of how FOS has been handling complaints so that fewer reach the watchdog in future.

Wayman said it was unclear how long the surge in short-term lending complaints would last.

"Some of the payday lenders are having difficulties in terms of their own solvency," Wayman said.

Once Wonga went into administration, with a loss of 66.5 million pounds in its most recent accounts, FOS could not take on new complaints about the company.

Wonga collapsed last August after scrutiny of its practices led to a cap on interest on payday loans.

The surge comes just weeks before FOS is due to expand its remit to take on complaints from potentially 210,000 more small companies on April 1.

A "whistleblower" told the committee there was already a backlog of 8,000 complaints to be dealt by FOS, committee member Rushanara Ali said.

Lawmakers questioned whether FOS has enough resources, but Wayman said it was "very ready" for its expanded remit.

Much of FOS' work in recent years has focused on payment protection insurance or PPI, forcing banks to pay out over 30 billion pounds in compensation and making it Britain's costliest retail financial scandal.

The FCA has set an August deadline for PPI complaints, meaning they are expected to become a smaller part of FOS' workload after then.