By Sneha Banerjee

(Reuters) - Health insurer UnitedHealth Group Inc (N:UNH) agreed to buy Catamaran Corp (O:CTRX) (TO:CCT) in a deal worth about $12.8 billion (8.65 billion pounds) to boost its pharmacy benefit business as it competes with bigger rivals such as Express Scripts Holdings Co (O:ESRX).

Pharmacy benefit managers (PBM) administer drug benefits for employers and health plans and run large mail order pharmacies, helping them get better prices from drugmakers.

As employers look to cut prescription costs on expensive drugs, the deal with Catamaran will give UnitedHealth's pharmacy benefits unit, OptumRx, the scale to negotiate favourable prices from pharmacy companies.

U.S. drug prices rose 12 percent in 2014 due to a new treatment for hepatitis C that cost more than $80,000 but cured almost all recipients with few side effects. Another new class of drugs, to treat high cholesterol, is expected to hit the market in 2015 and has insurers worried about drug costs this year as well.

The purchase of Catamaran will increase UnitedHealth's market share to 15 percent to 20 percent of the people who receive their drug benefits through pharmacy benefit managers, BMO Capital Markets analyst Jennifer Lynch said in a research note.

With a combined 1 billion scripts annually, UnitedHealth will be about the same size as current industry number two, CVS Health Corp (N:CVS), she added.

Catamaran was formed after SXC Health Solutions and PBM Catalyst Health Solutions merged in 2012.

UnitedHealth's offer of $61.50 per share represents a premium of 27 percent to Catamaran's Friday close on the Nasdaq.

Catamaran's stock was trading at $60.01 premarket on Monday, while UnitedHealth was up nearly 4 percent.

The deal "makes sense to us, but admittedly came much earlier than we expected," Jefferies analyst Brian Tanquilut said in a research note.

"We had always viewed Catamaran as a compelling asset for companies looking for scale in the PBM sector such as Optum or Walgreens but expected Catamaran to grow the business much further before pursuing a sale."

He added that the offer seemed adequate and he did not expect competing bids at this point.

The deal value is based on Illinois-based Catamaran's total diluted shares outstanding as of Dec. 31.

The transaction is expected to close in the fourth quarter of 2015 and add about 30 cents per share to UnitedHealth's profit in 2016, the companies said.

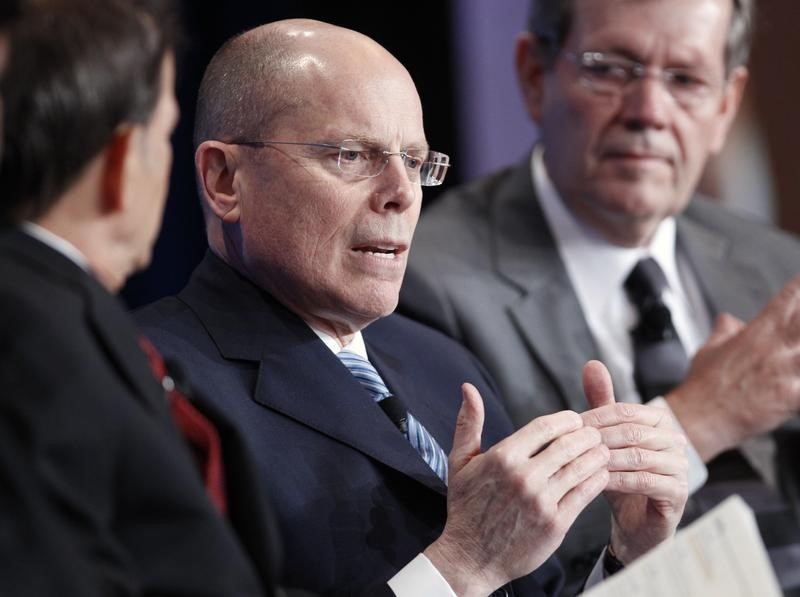

Catamaran Chief Executive Officer Mark Thierer will be CEO of OptumRx and OptumRx CEO Timothy Wicks will become president.