By Arathy S Nair and Justin George Varghese

(Reuters) - UDG Healthcare Plc (L:UDG) could spend up to $600 million (£462.7 million) for acquisitions, its chief executive said, after the company raised its full-year earnings estimate as a recent acquisition helped prop up profit in the first half.

The healthcare services provider on Tuesday reported a 19 percent jump in pretax profit for the first six months ended March 31, sending its shares up 6 percent to a record high of 812.50 pence.

"We've looked at acquisitions - small $20 million ones right up to $200-$300 million - and in total, the consideration we could use is $500-$600 million," Chief Executive Brendan McAtamney told Reuters.

The Dublin-based company said strong performance at its recent acquisition, STEM Marketing - a provider of commercial, marketing and medical audits to pharmaceutical companies - helped boost profit in the first half.

The company now expects a 15-18 percent increase in diluted earnings per share, on a constant currency basis, for the year ending September 2017.

The group had earlier forecast a 13-16 percent growth in full-year EPS.

"With a much stronger-than-expected first half, tailwinds across its U.S. businesses building ... we think even this raised guidance looks quite conservative, and would expect consensus forecasts to increase by at least 2 percent," Liberum analyst Graham Doyle said.

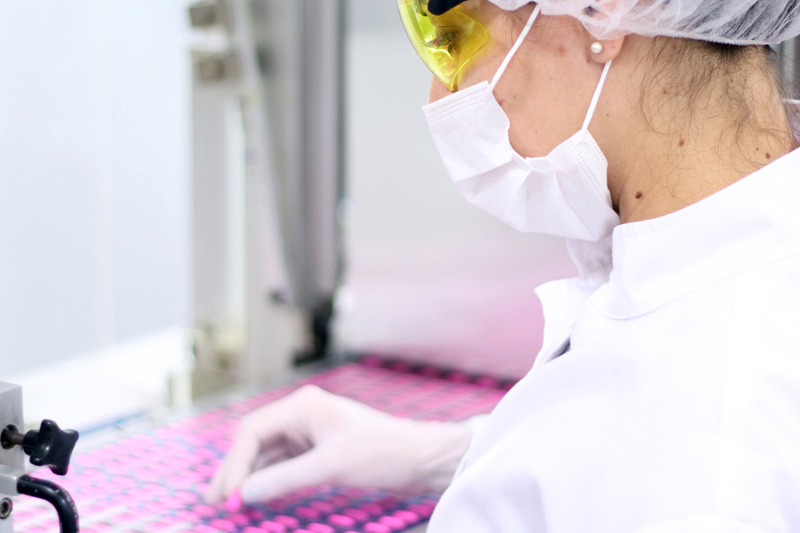

CEO McAtamney said UDG would look to acquire U.S.-focused businesses to strengthen its Sharp Packaging Services unit, which is engaged in contract packaging and clinical trial packaging services for the pharmaceutical and biotechnology industries.

UDG, which traces its roots to a co-operative called the United Drug Chemical Co in Ireland, is also keen on bolstering its Ashfield operations in Japan through acquisitions, he said.

UDG's first-half profit stood at $52.9 million. Revenue for the period rose 8 percent to $578.9 million.