Benzinga - by Avi Kapoor, Benzinga Staff Writer.

The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Paycom Software Inc (NYSE:PAYC)

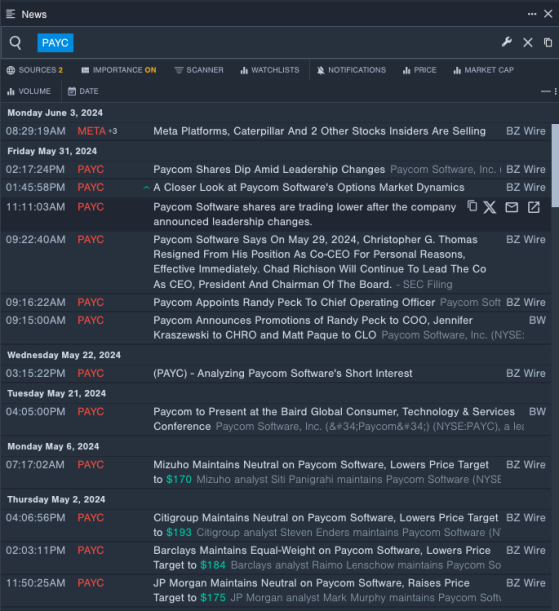

- On May 31, Paycom Software announced significant leadership changes. Randy Peck, a 20-year Paycom veteran, has been appointed as the new Chief Operating Officer (COO). Concurrently, Matt Paque has been promoted to Chief Legal Officer (CLO). The company's stock fell around 11% over the past five days and has a 52-week low of $143.88.

- RSI Value: 25.83

- PAYC Price Action: Shares of Paycom Software fell 1.7% to close at $144.32 on Wednesday.

- Benzinga Pro's real-time newsfeed alerted to latest Paycom Software news.

Titan Machinery Inc (NASDAQ:TITN)

- On May 23, Titan Machinery reported worse-than-expected first-quarter earnings. "Our first quarter results reflected an industry-wide transition to a more challenging market environment, characterized by softening demand and excess supply of inventory in many product categories as OEM delivery timelines returned to normal and as new sales converted to used trade-ins," commented Bryan Knutson, Titan Machinery's President and Chief Executive Officer. The company's stock fell around 24% over the past month. It has a 52-week low of $17.11.

- RSI Value: 26.31

- TITN Price Action: Shares of Titan Machinery fell 0.1% to close at $17.83 on Wednesday.

- Benzinga Pro's signals feature notified of a potential breakout in TITN’s shares.

American Airlines Group Inc (NASDAQ:AAL)

- On May 28, American Airlines announced the departure of its executive vice president and lowered guidance for the second quarter. The company's stock fell around 21% over the past month and has a 52-week low of $10.86.

- RSI Value: 27.05

- AAL Price Action: Shares of American Airlines rose 1% to close at $11.62 on Wednesday.

- Benzinga Pro's earnings calendar was used to track AAL’s upcoming earnings report.

Nordson Corp (NASDAQ:NDSN)

- On May 28, Nordson announced plans to acquire Atrion for $460.00 per share in cash. Sundaram Nagarajan, president and chief executive officer of Nordson Corporation, said, “Over nearly 15 years, Nordson has built a strong medical portfolio through organic and acquisitive growth. This attractive end market has several long-term secular growth drivers, including aging of the population, increasing healthcare spending and procedures, adopting of minimally-invasive surgical techniques, continuing innovation and medical OEM outsourcing. We have long admired Atrion’s technology portfolio, and today’s announcement represents a step forward in expanding our medical offerings for our customers.” The company's shares lost around 16% over the past month. The company's 52-week low is $208.91.

- RSI Value: 25.69

- NDSN Price Action: Shares of Nordson rose 0.2% to close at $228.44 on Wednesday.

- Benzinga Pro's Insiders feature was used to track Insider Trades in Nordson’s shares.

Now Read This: Lululemon Athletica, Smucker And 3 Stocks To Watch Heading Into Thursday

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga