Benzinga - by Avi Kapoor, Benzinga Staff Writer.

The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Toyota Motor Corp (NYSE:TM)

- The U.S. National Highway Traffic Safety Administration said on June 4 that Japanese automaker Toyota Motor is recalling over 100,000 vehicles in the U.S. over concerns that debris in its engines might cause them to stall and cause loss of driving power. The company's stock fell around 8% over the past month and has a 52-week low of $152.78.

- RSI Value: 29.77

- TM Price Action: Shares of Toyota Motor fell 3.1% to close at $199.35 on Thursday.

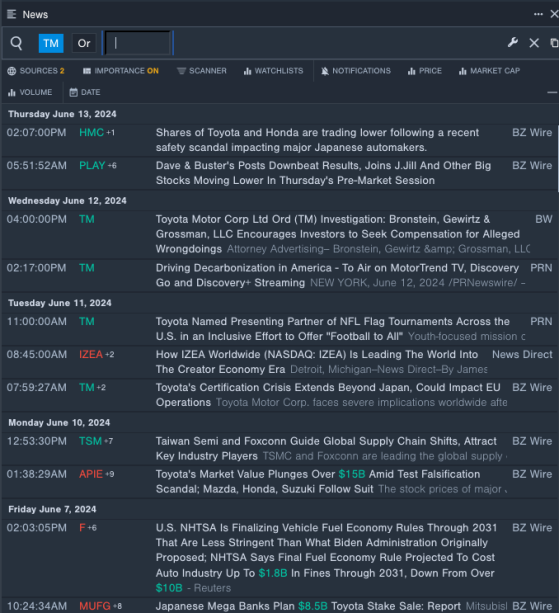

- Benzinga Pro's real-time newsfeed alerted to latest Toyota’s news.

Bloomin’ Brands Inc (NASDAQ:BLMN)

- On May 7, Bloomin' Brands reported first-quarter adjusted earnings per share of 70 cents, missing the analyst consensus of 74 cents. "We have completed all restaurant closures under the 2023 Closure Initiative and incurred severance and closure charges of $13.0 million during Q1 2024," the company said. The company's stock fell around 20% over the past month. It has a 52-week low of $18.81.

- RSI Value: 22.875

- BLMN Price Action: Shares of Bloomin’ Brands fell 0.3% to close at $19.38 on Thursday.

- Benzinga Pro's charting tool helped identify the trend in BLMN’s stock.

Five Below Inc (NASDAQ:FIVE)

- On June 5, Five Below reported worse-than-expected first-quarter earnings and lowered its guidance. “While our first quarter sales were disappointing, disciplined cost management enabled us to deliver adjusted EPS within our earnings outlook. Needs-based items such as those in our Candy, Food and Beauty departments outperformed expectations and drove positive sales results. We also saw positive comparable sales from our higher income customers; however, the macro environment disproportionately impacted our core lower income customers, resulting in overall comparable sales declines,” said Joel Anderson, President and CEO of Five Below. The company's stock fell around 20% over the past month and has a 52-weeklow of $106.21.

- RSI Value: 28.09

- FIVE Price Action: Shares of Five Below fell 2.4% to close at $113.75 on Thursday.

- Benzinga Pro's signals feature notified of a potential breakout in Five Below’s shares.

Now Read This: Over $105M Bet On This Oil Giant? Check Out These 3 Stocks Insiders Are Buying

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga