(This Feb. 23 story has been corrected to say Ballinger Group, not Bellinger Group, in paragraph 4)

By Stefano Rebaudo

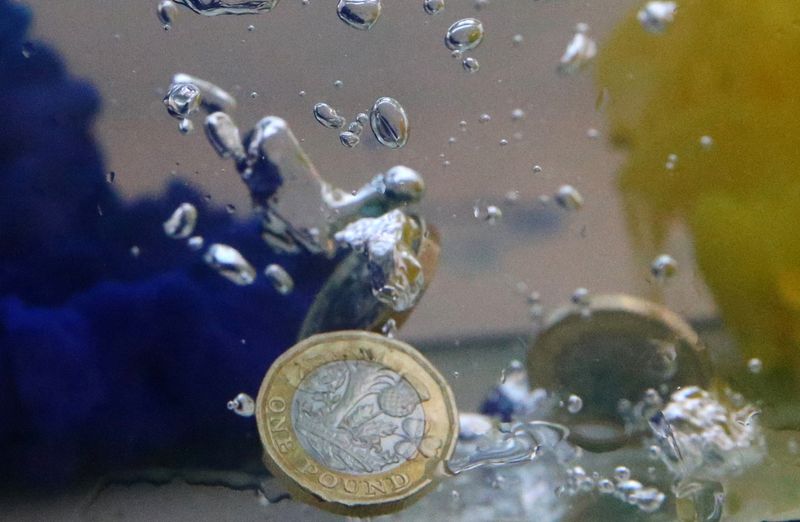

(Reuters) - Sterling was on track for its first weekly rise versus the dollar since mid-January on increasing risk appetite and some solid British economic data.

Traders see the pound as a "risk currency" that moves in line with similar assets, most typically equities, and global shares capped a record-breaking week after U.S. chipmaker Nvidia (NASDAQ:NVDA)'s blockbuster earnings energised tech stocks.

A survey showed strong growth for services firms and business optimism at a two-year high. But British consumer sentiment fell for the first time in four months in February.

"The pound has consolidated at a higher level this morning, undeterred by an unexpected fall in GfK consumer confidence," said Kyle Chapman, forex analyst at Ballinger Group.

"A global risk asset inflow keeps sterling buoyed despite a widening US yield advantage. FX has detached somewhat from rate spreads over the past few days," he added.

Sterling was 0.1% higher versus the dollar but set to end the week up 0.54%, in its first rise since the week ending on Jan. 12.

"The pound correlation with global equities has started to weaken but remains stronger than the U.S. dollar risk correlation and may prompt some pound strengthening if this risk appetite persists," said Derek Halpenny, head of research, global markets EMEA and international securities, at MUFG Bank.

However, investors remained focused on the Bank of England policy path as higher rates would support the British currency.

Analysts said recent data showed inflation pressures were likely to keep the BoE wary about cutting borrowing costs.

While money markets are pricing a 25 basis points rate cut by the European Central Bank and the Federal Reserve, according to the CME FedWatch Tool, by June, they are discounting less than a 50% chance of such a move from the BoE.

Analysts also flagged that BoE policymaker Megan Greene said on Thursday she wanted more evidence that inflation pressures were easing before voting to cut rates.

Sterling rose 0.13% to 85.37 pence per euro and was on track to end the week up 0.15%.