Benzinga - by Zacks, Benzinga Contributor.

PPG Industries Inc. (NYSE: PPG) recently announced a partnership with RightShip, a digital marine sustainability platform, as part of Rightship's Zero Harm Innovation Partners Program. The initiative's goal is to encourage the development and implementation of innovative ideas to create a more sustainable future in the maritime industry.

PPG's breakthrough PPG SIGMAGLIDE 2390 biocide-free silicone fouling release is the only hull coating to be approved by RightShip's stringent product assessment procedure for the Zero Harm Innovation Partners Program. This clearance recognizes its contribution to a zero-harm maritime industry and emphasizes its good environmental impact.

This agreement recognizes PPG's biocide-free PPG Sigmaglide 2390 coating's long-term advantages, as well as its increased efficiency and durability. It enables vessels to realize quick power savings of up to 20% with a speed loss performance of less than 1%, resulting in a 35% decrease in greenhouse gas emissions compared to traditional antifoulings.

PPG Sigmaglide 2390's performance gains are derived from PPG HydroReset technology. When immersed in water, this technology transforms the coating into a nearly friction-free, nonstick surface that marine organisms cannot recognize or adhere to. This produces industry-leading low friction qualities and excellent fouling control, with up to 150 days of idle performance.

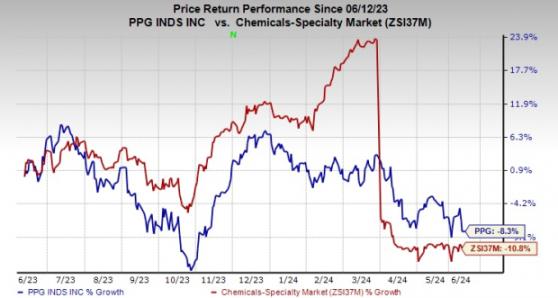

Shares of PPG have lost 8.3% over the past year compared with a 10.8% decline of its industry.

Image Source: Zacks Investment Research

For the second quarter of 2024, the company projects an adjusted EPS in the band of $2.42-$2.52. For full-year 2024, it sees adjusted EPS to be in the range of $8.34-$8.59.

PPG envisions strong organic growth in demand for its products in China. Demand is projected to stabilize in Europe. While economic conditions remain subdued in several end-use markets in the United States, PPG expects overall improvement as the year progresses.

PPG Industries, Inc. Price and Consensus PPG Industries, Inc. price-consensus-chart | PPG Industries, Inc. Quote

Zacks Rank & Key Picks PPG currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include ATI Inc. (NYSE: ATI), Carpenter Technology Corporation (NYSE: CRS) and Ecolab Inc. (NYSE: ECL).

ATI carries a Zacks Rank #2 (Buy). ATI beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 8.3%. The company's shares have soared 46.3% in the past year.

Carpenter Technology currently carries a Zacks Rank #1. CRS beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 15.1%. The company's shares have soared 102% in the past year.

The Zacks Consensus Estimate for Ecolab's current-year earnings is pegged at $6.56 per share, indicating a year-over-year rise of 25.9%. ECL, a Zacks Rank #2 stock, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.3%. The company's shares have rallied roughly 33.4% in the past year.

To read this article on Zacks.com click here.

Read the original article on Benzinga