Benzinga - by Piero Cingari, Benzinga Staff Writer.

The West Texas Intermediate (WTI) crude spot price, as tracked by the United States Oil Fund (NYSE:USO), hovered below $80 a barrel on Monday, remaining relatively stable despite significant geopolitical developments in the Middle East.

Indeed, natural gas prices have experienced a substantial increase, although for different reasons. Henry Hub front-month futures for June delivery, as closely followed by the United States Natural Gas Fund (NYSE:UNG), surged by over 4% to $2.64/MMBTu, marking the highest level since Jan. 19, 2024.

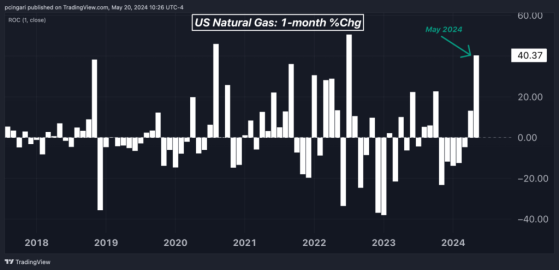

The price has escalated by 40% since the beginning of May, making it the strongest monthly performance for natural gas since July 2022.

Chart: US Natural Gas Eyes Best Monthly Performance In Nearly Two Years

Latest Geopolitical Events In Middle East The International Criminal Court (ICC) has requested arrest warrants for top Israeli officials, including President Benjamin Netanyahu and Defense Minister Yoav Gallant, as well as three senior Hamas leaders, a move that could potentially escalate tensions in the already volatile region.

Iran’s President Ebrahim Raisi and Foreign Minister Hossein Amirabdollahian died in a helicopter crash near the Iran-Azerbaijan border on Sunday. In response, Iran's Supreme Leader Ayatollah Ali Khamenei has appointed First Vice President Mohammad Mokhber as acting president and Ali Bagheri as acting foreign minister. Bagheri is known for his close ties to Iran's ultraconservatives, which could influence the country’s foreign policy direction.

Independent aviation analyst Alex Macheras told Al Jazeera that decades-long sanctions on Iran might have contributed to the helicopter crash, given the age and condition of Iran’s aviation fleet. The helicopter, a Bell 212, was manufactured in the U.S. decades ago and had a capacity of 15 people.

"The helicopter involved was acquired over 40 years ago… Iran is home to the world's oldest commercial aviation fleet. It is a similar scenario to those aircraft that are owned privately," Macheras noted.

Adding to the Middle Eastern geopolitical complexity, Saudi Arabia’s Crown Prince Mohammed bin Salman has postponed a planned visit to Japan due to King Salman's health issues. The 88-year-old king is receiving treatment for lung inflammation, as reported by the Saudi state news agency. The Crown Prince's trip, originally scheduled for May 20-23, included planned meetings with Japanese Emperor Naruhito and Prime Minister Fumio Kishida.

Natural Gas Market Dynamics The surge in natural gas prices can be attributed to several factors.

- Rising demand: Warmer weather forecasts have led to increased electricity consumption as power generators ramp up to meet the heightened demand for air conditioning. Weather predictions indicate that these higher temperatures will continue until May 31, further driving gas consumption.

- Tighter production despite elevated inventories: U.S. gas production has declined by 10% in 2024. Major energy companies such as EQT Corp. (NYSE:EQT) and Chesapeake Energy Corp. (NASDAQ:CHK) have postponed well completions and scaled back drilling operations, leading to a tighter supply. Still, according to the latest Energy Information Administration (EIA) estimates, current gas storage levels are approximately 30% higher than the seasonal average.

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga