Benzinga - by Shanthi Rexaline, Benzinga Editor.

Inflation jitters are weighing on the index futures on Wednesday, which point to a modestly lower open. A weaker-than-expected inflation print could reverse the sentiment and lead to a strong gain and an in-line report could also trigger a relief rally. On the contrary, if the numbers exceed expectations, near-term weakness cannot be ruled out as the Fed continues to swear by its resolve to fight inflation until it falls below its 2% target.

Cues From Tuesday’s Trading

In the absence of any major Main Street cues and amid a negative reaction to Apple, Inc.’s (NASDAQ:AAPL) iPhone launch event, the major averages retreated on Tuesday. After a negative start, the tech-heavy Nasdaq Composite and the S&P 500 indices stayed below the unchanged line throughout the session.

The 30-stock Dow Industrial Averages recovered from a weak start and remained mostly in the green during the mid-session. Pulling back below the unchanged line in late trading, the index closed marginally lower, snapping a three-session winning streak.

US Index Performance On Tuesday

| Index | Performance (+/-) | Value |

| Nasdaq Composite | -1.04% | 13,773.61 |

| S&P 500 Index | -0.57% | 4,461.90 |

| Dow Industrials | -0.05% | 34,645.99 |

| Russell 2000 | +0.01% | 1,855.32 |

Analyst Color:

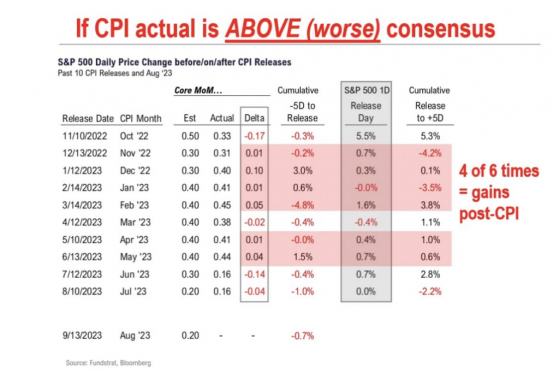

Hotter-than-expected inflation has not been negative for the market in the recent past, Fund Strat’s Tom Lee said. Data shared by the firm showed that six out of the past 10 inflation prints showed a hotter-than-expected monthly core inflation rate.

Four out of the six times, the monthly rate of the core inflation exceeded expectations, stocks gained in the following week, and five of the six times, the market gained on that day.

Futures Today

Futures Performance On Wednesday

| Futures | Performance (+/-) |

| Nasdaq 100 | -0.23% |

| S&P 500 | -0.15% |

| Dow | -0.15% |

| R2K | -0.15% |

In premarket trading on Wednesday, the SPDR S&P 500 ETF Trust (NYSE:SPY) fell 0.16% to $445.29 and the Invesco QQQ ETF (NASDAQ:QQQ) receded 0.20% to $372.05, according to Benzinga Pro data.

Upcoming Economic Data:

The Mortgage Bankers Association is scheduled to release the weekly mortgage application volume data at 7 a.m. EDT. Data for the week ended Sept. 1 released last Wednesday showed a seasonally adjusted 2.9% week-over-week, with mortgage applications declining to the lowest level since Dec. 19.

The Bureau of Labor Statistics is due to release the consumer price inflation report for August at 8:30 a.m. EDT. The monthly consumer price inflation rate is expected to spike from 0.2% in July to 0.6% in August. The monthly rate of the core consumer price inflation, which excludes food and energy, is expected to remain unchanged at 0.2%.

The annual rate of consumer price inflation is expected at 3.6% in August, up from the 3.2% rate in July. The core annual rate is expected to slip from 4.7% to 4.3%.

The Energy Information Administration will release its customary weekly petroleum status report at 10:30 a.m. EDT.

The Treasury is expected to auction 30-year bonds at 1 p.m. EDT.

See also: How To Trade Futures

Stocks In Focus:

Ford Motor Co. (NYSE:F) and General Motors Corp. (NYSE:GM) rose over 2% and 1%, respectively, in premarket trading on hopes of a resolution to the standoff with the UAW. The company may also be gathering momentum in the wake of the Detroit Auto Show that is currently underway.

Cracker Barrel Old Country Store, Inc. (NASDAQ:CBRL) is due to report its quarterly results ahead of the market open, while Semtech Corp. (NASDAQ:SMTC) will report after the market close.

Commodities, Bonds, Other Global Equity Markets:

Crude oil futures rose 0.60% to $89.37 a barrel in early European session on Wednesday following Tuesday’s 1.78% jump. The commodity is now trading at its highest level since mid-November amid supply concerns.

The benchmark 10-year Treasury note rose 0.042 percentage points to 4.306% on Tuesday.

Most Asian markets retreated on Tuesday, while European stocks traded lower in late-morning trading, as traders bid time to see off the U.S. inflation report.

Read Next: Peter Schiff Says Fed May Have ‘Secretly Given Up’ 2% Inflation Target: ‘New Unspoken Mandate Will Be …’

Image created with artificial intelligence on MidJourney

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga