Benzinga - by Shanthi Rexaline, Benzinga Editor. Positive expectations concerning Nvidia Corp. (NASDAQ:NVDA) earnings and the recent pullback will likely cushion the market on Wednesday despite the economic overhangs. After Tuesday's lackluster performance, stock futures are pointing to a higher start.

Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium on Friday is the most-watched catalyst of the week, potentially keeping traders on tenterhooks. Traders may also draw cues from a set of preliminary private sector activity readings and new home sales data, due after the market close, the direction of oil prices, and the bond yields.

Cues From Tuesday's Trading:

Stocks closed on a mixed note on Tuesday, as traders weighed in on S&P's downgrade of a slew of regional bank stocks and the possibility of further Fed rate hikes. The major indices opened higher but saw volatility throughout the session before closing mixed.

The tech-heavy Nasdaq Composite Index closed marginally higher, while the S&P 500 Index, Dow Industrials and Russell 2000 Index experienced modest to moderate losses.

Financial, energy and consumer staple stocks served as drags on the market.

US Index Performance On Tuesday

| Index | Performance (+/-) | Value |

| Nasdaq Composite | +0.06% | 13,505.87 |

| S&P 500 Index | -0.28% | 4,387.55 |

| Dow Industrials | -0.51% | 34,288.83 |

| Russell 2000 | -0.28% | 1,850.84 |

Analyst Color:

The current pullback could be limited in depth and duration, said LPL Financial Chief Technical Strategist Adam Turnquist. The analyst attributed the view to the lack of damage to the market depth amid the pullback and the composition of leadership underneath the surface.

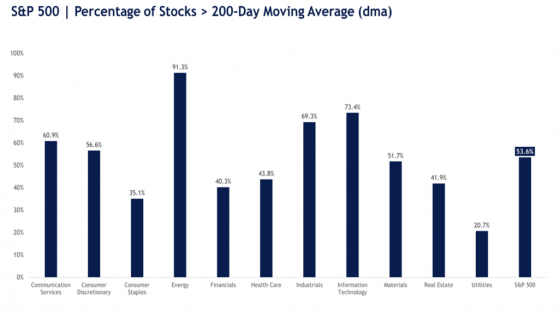

“At a high level, while there has been some technical damage, it has not been severe, and overall breadth is holding up relatively well,” Turnquist said. The measure the analyst used to quantify market depth was the percentage of S&P 500 stocks trading above their longer-term 200-day moving average.

“The higher the percentage of stocks above their 200-dma, the more widespread the buying pressure is—implying the market's advance is likely sustainable,” he said.

The technical strategist noted that over half of the index was still holding up above its 200-DMA, with cyclical or more offensive sectors outperforming.

Chart Courtesy of LPL Financial

Futures Today

Futures Performance On Wednesday

| Futures | Performance (+/-) |

| Nasdaq 100 | +0.40% |

| S&P 500 | +0.28% |

| Dow | +0.16% |

| R2K | -0.05% |

In premarket trading on Wednesday, the SPDR S&P 500 ETF Trust (NYSE:SPY) rose 0.26% to $439.30 and the Invesco QQQ ETF (NASDAQ:QQQ) gained 0.36% to $364.67, according to Benzinga Pro data.

Upcoming Economic Data:

S&P Global is set to release the flash manufacturing and services purchasing managers' indices for August at 9:45 a.m. EDT. Economists, on average, expect the manufacturing PMI to come in at 49.3, up from 49 in July. The services PMI is expected at 52.3, flat with the month-ago levels. The composite PMI, which combines both readings, is likely to remain unchanged at 52.

The Commerce Department will release its new home sales report for July at 10 a.m. EDT. The consensus estimate calls for an increase in new home sales from 697,000 in June to 705,000 in July.

The Labor Department is due to release a preliminary estimate for the annual benchmark revision of employment data at 10 a.m. EDT, with the consensus calling for a 500,000 net downward revision to the already published numbers.

The Energy Information Administration will release its weekly petroleum status report at 10:30 a.m. EDT.

The Treasury will auction 20-year bonds at 1 p.m. EDT.

See also: Futures Vs. Options

Stocks In Focus:

- Urban Outfitters, Inc. (NASDAQ:URBN) surged over 7% in premarket trading following its quarterly results announcement.

- Nvidia added about 1.30% ahead of its quarterly results due after the market close.

- Advance Auto Parts, Inc. (NYSE:AAP), Peloton Interactive, Inc. (NASDAQ:PTON), Williams-Sonoma, Inc. (NYSE:WSM), Foot Locker, Inc. (NYSE:FL), Analog Devices, Inc. (NASDAQ:ADI), and Kohl's Corp. (NYSE:KSS) are among the companies releasing their quarterly results before the market open.

- Those reporting after the close include Autodesk, Inc. (NASDAQ:ADSK), Splunk, Inc. (NASDAQ:SPLK), Nvidia, Guess?, Inc. (NYSE:GES) and Snowflake, Inc. (NYSE:SNOW).

Crude oil futures slipped 1.54% to $78.41 in early European session on Wednesday after pulling back 0.46% on Tuesday.

The benchmark 10-year Treasury note edged down 0.065 percentage points to 4.263%.

Most Asian markets advanced on Wednesday, although Chinese stocks plunged amid concerns about the travails of the country's real-estate sector and the broader economy per se. The South Korean and Malaysian markets also retreated.

European markets rose moderately in late-morning trading.

Read Next: Labor Market’s True Strength Under Microscope: Analyst Expects 500,000 Fewer Payrolls Wednesday

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga