Benzinga - by Zacks, Benzinga Contributor.

McKesson Corporation's (NYSE: MCK) Biologics by McKesson, its independent specialty pharmacy specializing in oncology and rare disease areas, has been selected by Accord BioPharma, Inc. as an exclusive specialty pharmacy provider for CAMCEVI (leuprolide) 42mg injection emulsion for subcutaneous use. CAMCEVI is a gonadotropin-releasing hormone (GnRH) agonist indicated for the treatment of adult patients with advanced prostate cancer.

CAMCEVI was approved by the FDA on May 25, 2021.

The availability of the FDA-approved drug is expected to significantly solidify McKesson's foothold in the global prostate cancer treatment space.

Significance of the Availability Per McKesson, CAMCEVI is an important advancement in oncology, which is expected to improve patients' long-term outcomes. McKesson's management believes that the availability of the convenient therapy will likely provide an option to treat patients with advanced prostate cancer.

Industry Prospects Per a report by Grand View Research, the global prostate cancer therapeutics market size was estimated at $12.12 billion in 2022 and is anticipated to expand at a CAGR of 8.4% between 2023 and 2030. Factors like the increasing prevalence of prostate cancer and the adoption of novel screening and diagnostic technologies are expected to drive the market.

Given the market potential, the recent drug availability is expected to strengthen McKesson's position in the global prostate cancer care space.

Notable Developments in Specialty Pharmacy Solutions In April, McKesson announced that Biologics by McKesson was selected by Day One Biopharmaceuticals as a limited network specialty pharmacy for OJEMDATM (tovorafenib) for the treatment of pediatric low-grade glioma (pLGG).

In December 2023, McKesson announced that Biologics by McKesson was selected by Novartis as a specialty pharmacy provider for FABHALTA (iptacopan).

The same month, McKesson announced that Biologics by McKesson was selected by SpringWorks Therapeutics as a limited distribution specialty pharmacy for OGSIVEO (nirogacestat).

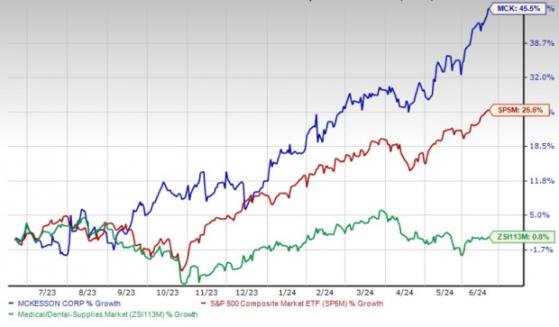

Price Performance Shares of the company have gained 45.5% in the past year compared with the industry's 0.8% rise and the S&P 500's 25.6% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks Currently, McKesson carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. (NYSE: DVA), Boston Scientific Corporation (NYSE: BSX) and Ecolab Inc. (NYSE: ECL).

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 13.6%. DVA's earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 29.4%.

DaVita's shares have gained 45.6% compared with the industry's 16.2% rise in the past year.

Boston Scientific, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 12.5%. BSX's earnings surpassed estimates in each of the trailing four quarters, with the average being 7.5%.

Boston Scientific has gained 41.4% against the industry's 1.7% decline in the past year.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 14.3%. ECL's earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 1.3%.

Ecolab's shares have rallied 34.6% against the industry's 11% decline in the past year.

To read this article on Zacks.com click here.

Read the original article on Benzinga