Proactive Investors -

- FTSE leaps over 1.6% and pound weakens

- National Grid (LON:NG) sells down gas network stake

- UK gives cash to get EV battery gigafactory

Proft warnings on the rise

Profit warnings among UK-listed companies reached their highest reported quarter in three years with interest rates wreaking havoc.

Public companies issued 66 profit warnings between April and June this year, according to an EY-Parthenon report.

The report also found that warnings have risen year-on-year for the seventh consecutive quarter, the longest run since 2008.

Last quarter’s warnings are the highest since the second quarter of 2020 when 166 profit warnings were issued.

Nearly a fifth of UK-listed companies have issued a profit warning in the last 12 months, with persistent inflation and rising interest rates playing a significant role in the second quarter.

The number of companies issuing multiple warnings was also on the rise, with 29% of companies that issued a profit warning last quarter having done so for at least the third time in the last year.

“The sustained rise in profit warnings over the last two years reflects the extraordinary mix of challenges faced by UK businesses over that timeframe,” said Jo Robinson, EY-Parthenon partner and UK&I turnaround and restructuring strategy leader.

“It’s now clear that the effects of these low-growth conditions are spreading to nearly all corners of the UK economy, and this quarter we’ve seen earnings pressure extend up the value chain into the mid-market,” Robinson added.

Credit Suisse job cuts on the horizon

The culling at Credit Suisse shows no signs of abating, with investment bankers in London told 80 jobs will be cut by the end of July.

Credit Suisse (SIX:CSGN) , which is in the process of integrating its business with UBS, plans to cut roughly a third of its London investment banking staff.

Sources familiar with the matter, cited in website Financial News, said around 17 of those sackings will be managing directors.

House prices not falling fast enough

Myron Jobson, senior personal finance analyst at interactive investor, believes house values aren’t falling quick enough in the wake of the latest ONS data.

“House prices are not falling fast enough to offset the heightened cost burden from the uptick in mortgage rates. At present, pesky high mortgage rates are winning the tug of war with falling property prices, to the detriment of housing affordability,” he said.

On rental prices, he believes higher mortgage costs has sparked a chain reaction in the property market which has led to renters paying record high prices.

“When rents start climbing, aspiring homeowners face a double-edged sword. On one hand, the increasing cost of renting can make it even more challenging for them to save up for a deposit,” Jobson said.

“With the cost of borrowing on the rise, the dream of homeownership may start slipping away and those who were once keen on purchasing a home suddenly shift their sights toward the rental market, fuelling demand. Landlords may seize the opportunity to raise rents. They may also foresee higher costs when they remortgage stemming from higher mortgage rates.”

House price growth eases as rents soar

UK house prices for May were around £7,000 lower than last September’s peak, according to fresh data from the Office of National Statistics (ONS).

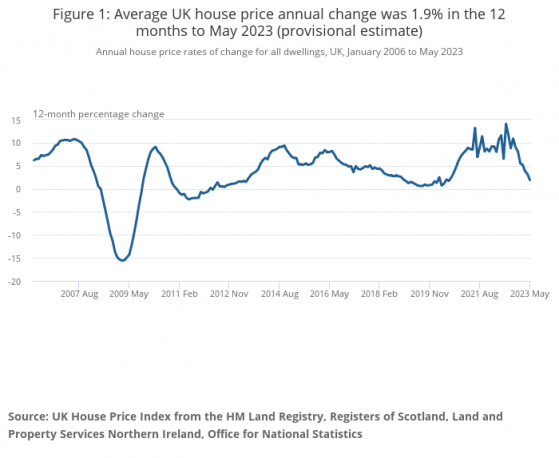

The average UK house prices increased by 1.9% in the 12 months to May, down from a revised 3.2% in April 2023, with the northeast seeing the highest annual percentage change among all English regions at 4%.

House prices were however £6,000 higher than May 2022.

Private rental prices paid by tenants in the UK rose by 5.1% in the year to June, up from 5% in the 12 months to May.

London prices continued to outpace the national average, with the annual percentage change in private rental prices 5.3% in the 12 months to June 2023 and at its highest annual rate since September 2012.

Shares in Barratt Developments (LON:BDEV) were up 6.2% to 450p, while Persimmon (LON:PSN) jumped 7.6% to 1,175p.

Best day for mid-caps since Feb

The rally for the FTSE 250 has topped 520 points, a 2.9% gain to 16,162 - the biggest gain in five months.

“Boom! We’ve just seen the strongest daily movement in UK mid cap stocks since February, with the FTSE 250 index initially jumping 3% on news of inflation cooling more than expected in June,” says Danni Hewson, head of financial analysis at AJ Bell.

She points out that the FTSE 100's positive move is less pronounced than its less heralded sibling because the blue-chip index has less exposure to the UK economy.

“The inflation reading has dampened the outlook for interest rate hikes in the UK, much to the excitement of investors. Two-year gilts fell from 5.079% to 4.842%, sterling fell 0.7% to $1.2937 in the space of 20 minutes and interest rate-sensitive stocks soared on the news."

However, she had some dampening words to add, observing that there have been “plenty of false dawns over the past year regarding the ‘pivot’ and analysing trends means looking at multiple data points over many months.

“Yes, inflation is now much lower than at the start of the year, but June’s 7.9% reading is still considerably higher than the Bank of England’s 2% target. That means further rate hikes cannot be ruled out.

“Nevertheless, stock markets are all about anticipating what will happen next. A further decline in inflation for July could really get the ball rolling for UK equities and lift them out of the mud. While the FTSE 250 is in party mode today, the rally only puts the index back to levels last seen in June."

The FTSE 100 meanwhile has also had a second wind, now having jumped 119 points or 1.6% to 7,573.

FTSE back in positive territory for 2023

Markets bullishness is persisting this morning, led by sectors that are seen as benefitting from inflation easing and interest rate rises coming to a halt soon.

A weaker pound, currently down 0.74% against the US dollar at 1.2938, is provided the FTSE 100 with an early boost given its majority exposure to overseas earnings.

The Footsie is "clawing its way back" into positive territory for the year, notes Richard Hunter, head of markets at Interactive Investor.

At 7,552, up 98.5 points or 1.32% so far today, the blue-chip index is up 1.3% from the 7,451.74 it started the year.

The more domestically focused FTSE 250 is up 490 points today or 2.64% to 19,108.83, leaving the index ahead by 1.7% in the year to date.

Helping things, the housebuilding sector is trading at a one-month high, points out market analyst Neil Wilson at Finalto, "as yields come back down and the market reprices more sensibly for how high the Bank of England goes with rates".

He says the sector "was too oversold as market was too bearish on high the BoE would need to go.

"Anything with any rate sensitivity is in play today – utilities +2%, real estate +7%."