Benzinga - by Surbhi Jain, .

China’s tech landscape is a hotbed of innovation and growth, with companies like JD.com Inc (NASDAQ:JD) and Baidu Inc (NASDAQ:BIDU) leading the charge. Both companies are scheduled to report earnings before the market opens, Thursday.

As two of the country’s most prominent tech giants, JD.com and Baidu Inc offer investors a compelling opportunity to tap into China’s digital revolution.

We compare these two titans, on various metrics and valuation to provide investors with insights into which stock might offer the most promising investment opportunity.

JD.com: China’s Amazon.com

JD.com, known as Jingdong, stands as a stalwart in China’s e-commerce realm. Renowned for its vast product offerings and efficient logistics, JD.com has secured a significant market share, competing head-to-head with Alibaba‘s (NYSE:BABA) (NYSE:BABAF) Tmall. At the global level, it competes with e-commerce behemoth Amazon.com Inc (NASDAQ:AMZN).Despite a recent stock slump, JD.com’s upcoming Q1 2024 earnings announcement could spark a turnaround, making it an intriguing prospect for investors seeking growth in the e-commerce realm.

Also Read: JD.Com’s Cost Management In Focus – Analyst Maintains Core GMV Growth Assumptions

Baidu Inc: Google Of China

Baidu, often dubbed the “Google of China,” reigns supreme in the country’s tech landscape. Its search engine dominance in China is just the tip of the iceberg. Baidu has forayed into AI, cloud services, and autonomous driving, which set it apart as a technological juggernaut.While its stock has faced challenges, Baidu’s imminent Q1 2024 earnings release could unveil hidden potential, making it an enticing opportunity for investors eyeing China’s tech evolution.

Also Read: AI Vs. Cloud: Decoding Baidu And Alibaba’s Battle For Tech Supremacy In China

JD Vs. Baidu – Key Differences

Core Business: JD.com’s focus on e-commerce and logistics pits it directly against Alibaba’s Tmall, showcasing its resilience and growth potential in a fiercely competitive market. Baidu’s tech-centric approach, with its search engine as the cornerstone, sets it apart as a diversified tech giant with a finger in many lucrative pies.Market Position: JD.com’s battle with Alibaba for e-commerce supremacy mirrors the global Amazon-Alibaba rivalry, promising an exciting narrative for investors looking for a compelling growth story. Baidu’s dominance in China’s search engine market, akin to Google’s global presence, positions it as a strategic player in China’s tech revolution.

Innovation: Both companies are at the forefront of innovation, with JD.com’s forays into autonomous delivery drones and Baidu’s advancements in AI and autonomous driving showcasing their commitment to shaping the future of technology.

Revenue Streams: JD.com’s revenue diversity, stemming from retail and logistics, provides a stable foundation for growth, while Baidu’s reliance on online advertising and cloud services highlights its adaptability and revenue potential in the ever-evolving tech landscape.

Valuation and Analyst Ratings

JD stock is up 15.68% YTD. However, over the past year, it is down 11.28%. On the other hand, Baidu stock has been declining 13.60% over the past year, and is down 7.41% YTD.Data Source: Yahoo Finance, Compiled by Benzinga

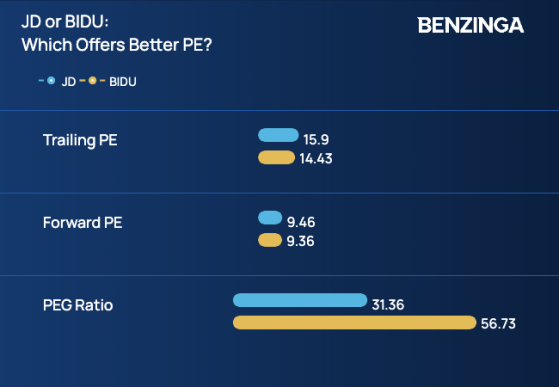

Evidently, JD stock is more expensive at a trailing PE of 15.9 and a forward PE of 9.46, while Baidu stock’s figures stands at 14.43 and 9.36, respectively.

Data Source: Yahoo Finance, Compiled by Benzinga

In terms of valuation, JD and Baidu present competitive figures. Analysts favor both companies, with a consensus buy rating for JD and Baidu, offering potential upsides of 16.1% and 40.0%, respectively.

JD and Baidu exemplify China’s technological prowess, each with its unique strengths and market positions.

Investors eyeing China’s tech sector should closely monitor these titans, as they continue to innovate and shape the country’s digital landscape.

Read Next: Alibaba’s Investment Challenges Vs. Tencent’s Revenue Growth: Which Stock Has Higher Upside?

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga