Benzinga - by Anusuya Lahiri, Benzinga Editor.

Intel Corp (NASDAQ:INTC) is gearing up for increased demand for AI-capable consumer products. It anticipates that businesses will increasingly rely on private environments for AI computing needs.

Intel aims to integrate AI capabilities across various products, from computers to edge computing to software, the Wall Street Journal cited Alexis Crowell, Intel’s VP and CTO for Asia-Pacific and Japan.

Crowell noted that demand for traditional data centers might slow as companies seek a balance between public cloud infrastructure and private data storage for privacy and cost reasons.

This shift aligns with IDC’s prediction that by next year, 75% of enterprise-generated data will be processed outside traditional data centers or the cloud.

Intel, traditionally strong in CPUs for personal computers and servers, faces challenges in the data center market dominated by Nvidia Corp’s (NASDAQ:NVDA) AI chips.

Despite this, Intel’s data center and AI division saw a 5% revenue increase to $3 billion in Q1.

The company plans to bolster its AI chip offerings with the Gaudi 3 chip, which will likely outperform Nvidia’s H100 and generate $500 million in revenue in the latter half of 2024, WSJ writes.

Chip company CEOs, including Intel and Nvidia, have gathered at Taiwan’s Computex event to discuss AI’s prospects.

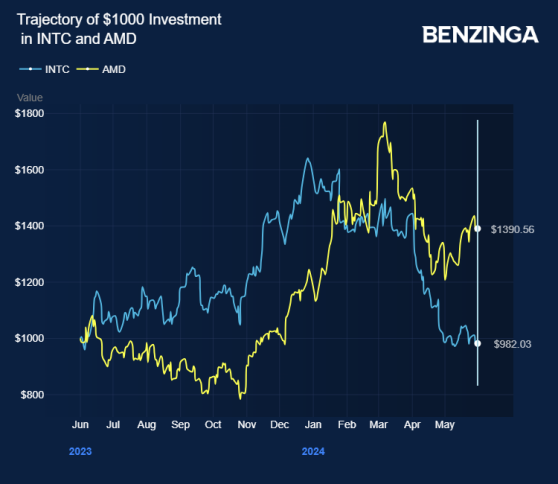

Currently, Intel and Advanced Micro Devices Inc (NASDAQ:AMD) are battling for the AI PC market’s dominance, while Nvidia sealed its numero uno position with its latest quarterly earnings beat.

Intel has earmarked shipping chips for over 100 million AI PCs by 2025, including over 40 million in 2024.

Intel stock lost over 4% in the last 12 months. Investors can gain exposure to the stock via ProShares Nanotechnology ETF (NYSE:TINY)

and First Trust S-Network Streaming And Gaming ETF (NYSE:BNGE).

Price Action: INTC shares traded lower by 0.63% at $30.00 at the last check on Friday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga