By Atul Prakash

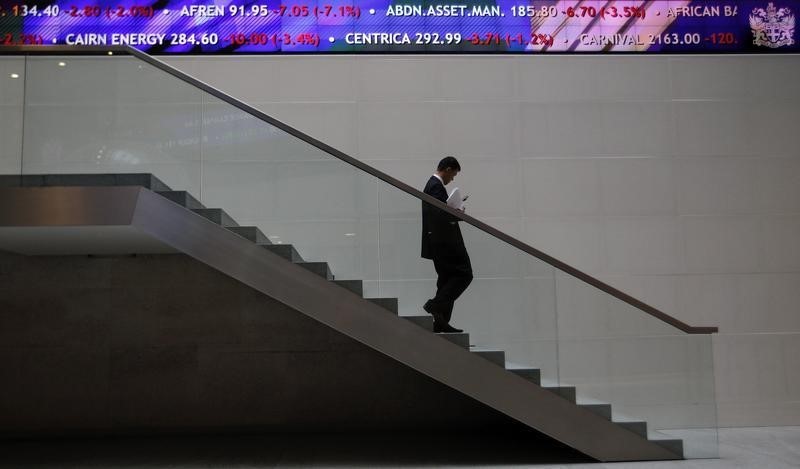

LONDON (Reuters) - The FTSE 100 index edged higher in afternoon trading on Thursday, with encouraging updates from companies such as 3i Group supporting the broader stock market.

Private-equity group 3i rose 3 percent, the top gainer in the blue-chip FTSE 100 index, after it reached the end of a three-year restructuring with strong earnings growth at its portfolio companies.

"The group remains cautious about the current environment given high financial market valuations and increased currency volatility. However it looks forward with confidence, with a focus on enhancing the value of the existing investment portfolio," said Nicolas Ziegelasch, head of equity research at Killik & Co.

Merlin Entertainments rose 1 percent after the British operator of attractions including Madame Tussauds waxworks and London Eye posted a rise in first quarter revenue, helped by good weather in Europe and continued strong trade at its U.S. Legoland Parks.

The benchmark FTSE 100 index was up 0.16 percent at 6,960.55 points by 1426 London time after falling earlier in the session following weaker commodity stocks.

Commodities stocks remained week, but slightly recovered. The UK mining index was down 0.3 percent, while the oil and gas index slipped 0.8 percent.

Investors remained cautious and avoided strong bets, in line with European shares which were recently hit by a bond-market sell-off. While Britain has not been immune to spreading jitters from the sell-off, it has been supported so far by dovish statements from the Bank of England.

"U.S. and UK stocks appear to be preferred versus German stocks for now, mainly because any increases in interest rates in the U.S. and the UK aren't imminent and on hold for now," Peregrine & Black senior sales trader Markus Huber said. "Economic growth worries (are) hampering exporters."

BoE Governor Mark Carney said on Thursday it was possible British interest rates would be higher in a year's time, although the central bank would not raise them too soon and risk slowing the economy.

Several stocks went ex-dividend, including Sainsbury, down 2.1 percent, and drugmaker GlaxoSmithKline, down 1.9 percent. UBS analysts also downgraded Glaxo to "neutral" from "buy", saying company updates on cost structure had led them to cut earnings estimates.