Proactive Investors -

- FTSE 100 lower, down 69 points, after heavy falls in the US

- Bank of England set to reveal interest rate decision

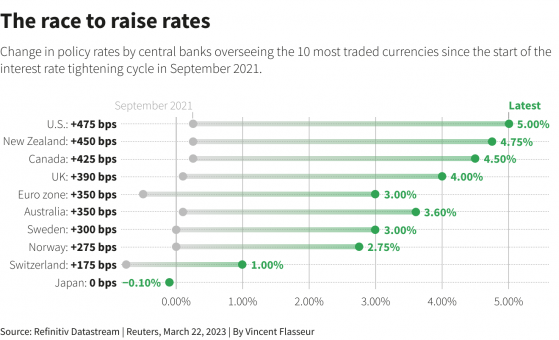

- Federal Reserve lifts US interest rates by 25 basis points

Could commercial property be next?

British Land continued to wallow following yesterday’s downgrade by Goldman Sachs (NYSE:GS) to sell. Shares have fallen a further 2.3%.

Commercial real estate (CRE) is seen by some as another potential sector to come under pressure following the volatility in financial markets.

Analysts at the US investment bank reckon given the current macro volatility and tightening financial conditions that transaction markets will remain mostly subdued and forecasts 9% additional value decline over 2023.

“We believe private CRE markets may be more exposed to refinancing issues than listed landlords, which could lead to pressure (and opportunities) gradually building up in the overall space.”

It forecasts a “growing divide between the City, where vacancy is building, new supply increasing and demand decreasing, vs better trends in the West End, negatively impacting rent growth, property valuations and LTVs.”

As a result it downgraded British Land to sell from neutral. It views it as being most exposed to the City with around 50% office portfolio exposure. Goldman also has a sell rating on Hammerson.

Separately, a report in the Financial Times highlighted that the turmoil in financial markets is adding to the stresses on UK commercial property.

The report noted credit dries up particularly quickly in the real estate sector. The side effect of bank collapses in the US and Switzerland comes when rising rates and shaky office occupancy are already causing problems.

Goldman analysts noted its banking team and economists expect further tightening of financial conditions, which could have a knock-on impact on the growth outlook, notwithstanding high inflation, and ultimately on the availability of credit for European real estate.

The FT highlighted that visits to the office have fallen 30% in the UK since January 2020, according to real estate analysts Green Street while demand for CRE space has dwindled just as interest rates have surged.

UK base rates have climbed to 4%, up from a 0.5%. Interest cover from rental yields has increased less. Prime office yields in London were some 4.5% in February, according to Savills (LON:SVS), compared with 3.75% a year earlier.

During January, a commercial property index from Investment Property Databank fell 17%, with warehousing down most at 22%.

Transaction volumes were only a third of figures a year ago. If banks and other lenders, including insurers such as Legal & General, require borrowers to hold LTV ratios below 60% that could trigger forced sales, the report warned.

Goldman highlighted that according to Bloomberg, PGIM Real Estate expects European banks to withdraw as much as €125bn from property lending, just as c.€200bn in debt matures this year and next.

L&G investment chief warns of more banking failures

Legal & General’s chief investment officer warned more banks will fail as interest rates continue to rise as the Bank of England is expected to announce another increase to fight rising inflation.

Referring to the banking turmoil, Sonja Laud from L&G told BBC Radio 4's Today programme: "Over 70 years and every hiking cycle we have seen in that period, we have never seen a hiking cycle that has not led either to a recession - which is 80% of the cases - or a financial crisis, or both.”

"The question always has been why should this time be different?”

"If you slam on the brakes, the chances are something will break and it is always the weakest links that are flushed to the surface first” she explained.

"These were unique business cases and challenged business models that we have seen first.

"We have to expect more will break simply because we are trying to slow down the economy in order to arrest inflationary pressures" she warned.

The Bank's Monetary Policy Committee is widely expected to increase interest rates by 25 basis points to 4.25% at midday.

It comes after inflation unexpectedly increased to 10.4% last month, driven by food prices rising at their highest rate in 45 years.

However, the Bank of England faces a difficult balancing act with the banking sector still in a delicate position following the collapse of Silicon Valley Bank and rescue of Credit Suisse (SIX:CSGN).

ARM set to increase prices ahead of IPO

Arm Holdings is seeking to raise prices for its chip designs as the SoftBank-owned group aims to boost revenues ahead of a hotly anticipated initial public offering in New York this year.

A report in the Financial Times, said the UK-based group, which designs blueprints for semiconductors found in more than 95% of all smartphones, has recently told a number of its biggest customers of a radical shift to its business model.

Citing several industry executives and former employees the FT said Arm planned to stop charging chipmakers royalties for using its designs based on a chip’s value and instead charge device makers based on the value of the device.

This should mean the company earns several times more for each design it sells, as the average smartphone is vastly more expensive than a chip.

The changes represent one of the biggest shake-ups to Arm’s business strategy in decades, at a time when SoftBank chief executive Masayoshi Son is seeking to drive up Arm’s profits and attract investors to its impending return to the public markets.