Proactive Investors - Spread-betters are expecting the FTSE 100 to fall at the open, around 17 points.

Looking around at other company news, Warhammer tabletop games maker Games Workshop Group PLC (LON:GAW) has given a year end-update, saying revenue grew 10% and profit before tax should be up 17% or more.

The maker of miniature figurines for tabletop battle games said core revenues came at above £490 million for the 53 weeks to 2 June, we up from £445 million last time, while profit is estimated to be "not less than £200 million", compared to £171 million the year before.

Included in the profit estimate is the allowance for £18 million of staff profit share.

Inflation not expected to change Bank of England decision tomorrow

The fall in CPI inflation from 2.3% in April to 2.0% in May "probably won’t be enough" to persuade the Bank of England's MPC to cut interest rates tomorrow, says Ruth Gregory at Capital Economics.

And with services inflation nudging down only slightly, Gregory says her forecast that the MPC will cut rates for the first time in August is "looking a little shakier".

"With core inflation (3.5%) and services inflation (5.7%) in May still above that in the euro-zone (2.9% and 4.1% respectively), we doubt the Bank will be ready to follow in the ECB’s footsteps and cut interest rates tomorrow. For now, we are sticking with our forecast that the Bank will first cut interest rates from 5.25% in August, although that relies on better news on services CPI inflation and wage growth in the coming months," she says.

Paula Bejarano Carbo, economist at NIESR, says that while it is positive news that annual CPI falling to the Bank of England’s 2% cent target for the first time since July 2021", the bad news is that "we expect to see inflation rebound somewhat from June onwards".

"Given that today’s data indicate that core inflation remains elevated, this rebound might be sharper than projected. As a result, we expect the MPC to exert caution at its upcoming meeting and hold interest rates, despite today’s encouraging fall in the headline rate," she added.

---------------------------------------------------------

- Are you interested in investing in shares and would you like to have a reliable forecasting tool? Try InvestingPro today and start reaping profits. Plus, we're on promotion! Check out our offer and add a 10% with the code UK10. It's never been easier to get it right and win!

Jonathan Bone, lead mortgage adviser at Better.co.uk, said: "It’s taken 35 long months for inflation to finally reach the 2% mark.

"This milestone should be cause for celebration for the 1.5 million homeowners who are set to remortgage this year. Typically, reaching this target would provide the Bank of England the confidence needed to cut interest rates, making mortgage borrowing more affordable. However, given the fact we’re in the middle of an election, Andrew Bailey will be hesitant to pull the trigger."

He advises that people needing to remortgage this year can consult with a mortgage broker up to six months before their current deal ends.

"Mortgage offers generally remain valid for three to six months, giving you the flexibility to secure a better rate when interest rates likely drop later this year."

Another Vodafone sale

There's about 100 comments about inflation in my inbox but some company news first: Vodafone Group PLC (LON:VOD) has sold down its stake in Indian mobile towers group Indus Towers Ltd.

The FTSE 100 telecoms group sold 484.7 million shares, almost exactly an 18% stake via a placing that raised it the equivalent of €1.7 billion gross proceeds.

Vodafone, which retains a 3.1% stake in Indus, says it will use the cash to repay its outstanding debt of €1.8 billion secured against Vodafone's Indian assets.

Good news on inflation

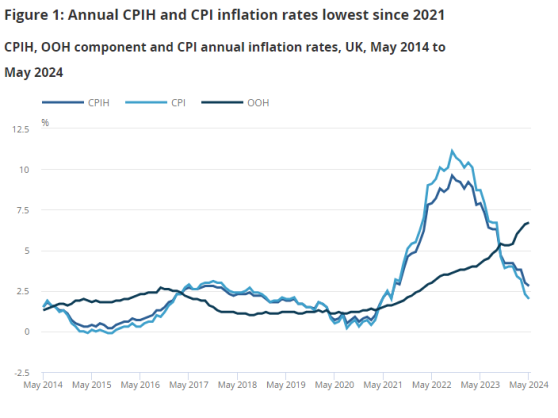

More on those UK inflation numbers, where the headline CPI rate returned to the BoE's 2.0% target for the first time since July 2021.

Core CPI, which excluded more volatile prices like food, fuel, alcohol and tobacco, was up 3.5%, softening from the 3.9% in the previous month.

A small possible blot on the copybook is that services CPI, which is closely followed by the BoE's monetary policy committee as a signifier for the persistence of inflation, eased less than expected in May to 5.7% from 5.9% a month earlier, when it had been forecast to drop to 5.5%.

CPI including owner occupiers’ housing costs (CPIH) rose by 2.8%, down from 3.0% in the 12 months to April, or 0.3% on a monthly basis.

The largest downward contribution to the monthly change in both CPI and CPIH annual rates came from food, with prices falling this year but rising a year ago.

The largest upward contribution came from motor fuels, with prices rising slightly this year but falling a year ago.

FTSE 100 set for hesitant start

The FTSE 100 is set for a meek start on Wednesday after a mixed UK inflation reading and despite some fresh record highs overnight on Wall Street.

London's blue-chip index has been called down one point on spread-betting platforms, after finishing up just over 49 points at 8,191.29 yesterday.

US stock indices all finished in the green, mostly helped by Nvidia (NASDAQ:NVDA) overtaking Microsoft (NASDAQ:MSFT) to be the world's most valuable company at a $3.33 trillion market cap, though the rest of the top five mega-caps all fell.

Asian stocks are mixed this morning.

Back home, the big news is from the Office for National Statistics, which posted its prices day data, showing the consumer price index was up 2.0% year-on-year in May, finally returning to match the Bank of England's target.

The headline CPI rate eased from 2.3% the month before, as expected, as CPI rose 0.3% on a monthly basis, which was lower than the 0.4% consensus forecast from economists.