Proactive Investors -

- House prices stagnate

- Mining and oil stock drag on footsie

- Sunak to meet UK plcs

11.30am: UK house prices barely rise in April

Asking prices for homes put on sale in the UK have risen less than expected in April amid subdued momentum in the property market, according to Rightmove data.

Average asking prices increased by 0.2% over the past month, compared to around 1.2% seen at this time of year.

In comparison to the same period a year earlier, asking prices were up by 1.7%, compared to a 3% annual increase from a month prior.

"Agents are reporting that many sellers have transitioned out of the frenzied multi-bid market mindset of recent years and understand the new need to tempt spring buyers with a competitive price," said Rightmove director Tim Bannister.

The average asking price for a home advertised on Rightmove between March 12 and April 15 was £366,247.

However, first-time buyer property prices rose to record highs in April and have led the way in the recovering housing market.

Agreed sales of first-time properties sat 4% higher in April 2023 than in March 2019, though transactions for second-step and top-of-the-ladder homes remained 4% and 3% lower respectively.

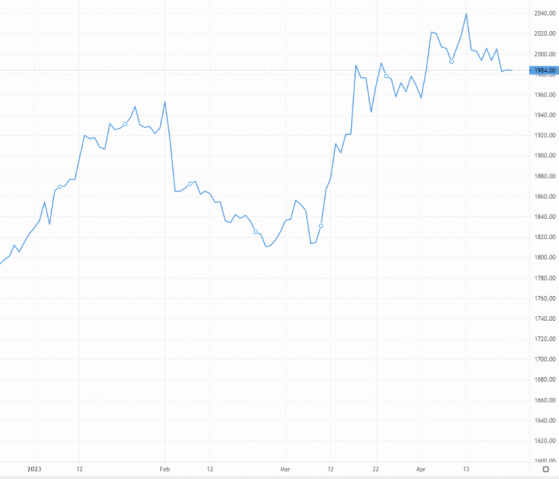

11.04am: Bitcoin seen lower, gold stagnates at US$1,980

Benchmark cryptocurrency Bitcoin racked up further losses this morning, dipping 0.9% against the US dollar after a bearish Sunday session, bringing week-on-week losses to around 8.5%.

Bitcoin has been one of, if not the most, successful asset classes in 2023, rallying over 80% to US$31,000 in mid-April after reaching above 30k for the first time in 10 months.

As the global benchmark cryptocurrency, bitcoin aka digital gold has shown close alignment with the physical variety in 2023, due to their alignment as a relative safe-haven status amid a volatile streak in the financial markets.

But with things cooling down and a full-scale meltdown avoided, investors may be redirecting their cash to income-yielding equities and the money markets.

Gold has also been in retreat mode following a strong 2023 rally, though has remained stagnant at US$1,980 this Monday.

TickMill Group’s market analyst James Harte said: Both gold and silver are under pressure across early European trading on Monday as focus remains on fresh Fed tightening expectations ahead of the upcoming May FOMC (Federal Open Market Committee).

However, Harte said near-term moves are “not yet enough to worry bulls”.

Gold shines bright in 2023 – Source: capital.com

Back to the UK markets, footsie has made some intraday gains, pulling itself up form 7,880 to 7,910 at the 11am bell.

A strong showing from the retail segment via JD Sports Fashion PLC (LSE:LON:JD.), Next plc (LON:NXT) and Burberry Group PLC (LSE:LON:BRBY) alongside gains on recent Melrose (LON:MRON) spin-out Dowlais Group Plc (LON:DWL) and insurance group Abrdn PLC (LON:ABDN) have offset a bearish performance from major oil and mining groups.