Benzinga - The Federal Reserve’s preferred measure of inflation, the personal consumption expenditure (PCE) price index for the month of May, will be released Friday.

Investors are on edge as they eagerly anticipate the unveiling of the PCE inflation figures following a sudden shift in sentiment caused by a surprisingly hawkish Fed Chair Jerome Powell and robust economic indicators this week.

As we approach this data release, investors have already upped their bets on a 25-basis-point hike by the Fed in July, placing an 87% probability, according to the latest CME Group FedWatch Tool. Speculators are also increasing their bets on a possible back-to-back hike in September, assigning a 24% probability to this outcome.

May PCE Inflation: What Is The Market Expecting?

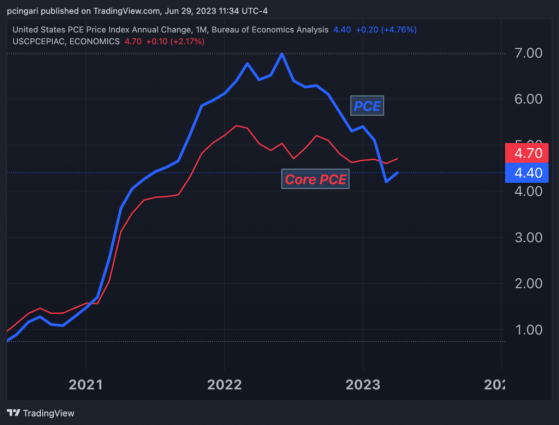

- The analyst consensus estimate calls for PCE inflation to sharply decline from 4.4% year-on-year in April to 3.8% in May. If expectations hold, PCE inflation will fall to its lowest level since April 2021, more than two years ago.

- On a monthly basis, the PCE price index is expected to have increased by 0.1% in May, a sharp deceleration from the 0.4% increase recorded in April.

- The underlying measure of the PCE, or core PCE, which excludes both energy and food items from the basket, is seen as stable at 4.7% year on year.

- Since the Fed has recently alluded to paying more attention to services ex-housing inflation in order to evaluate inflation stickiness, the core PCE inflation rate will be of particular importance for investors Friday.

- On a monthly basis, the core PCE inflation is expected to have surged 0.3% in May, somewhat lower than the 0.4% advance in April.

- The consumer price index (CPI) came in at 4%, down from 4.9%, while core CPI inflation was 5.3%, down from 5.5%.

Chart: PCE Inflation Vs. Core PCE Inflation

PCE Inflation: Potential Market Reactions

On the other hand, markets could immediately react to a lower-than-expected reading by lowering some pressure on a September hike. Yet as the Fed has signaled at least two rate hikes coing in 2023, possibly beginning at the next meeting, even a lower-than-expected PCE reading is unlikely to significantly alter expectations for July.

Even if PCE is in line with expectations, hawkish reactions to the release are still possible in case core PCE remains unchanged, or tilts higher.

That scenario would suggest overall PCE inflation has been lowered by the prices of volatile products like food and energy, while the core inflation rate has remained elevated due to the sticky, high cost of services.

How Did US Stocks React To The Prior Reading?

Despite PCE data that came in higher than expected, stocks rallied sharply on the back of artificial intelligence and rising hopes for a debt ceiling deal in the United States.

The Nasdaq 100 Index, as tracked by the Invesco QQQ Trust (NASDAQ:QQQ), rallied 2.6%. The best performer of the day was Marvell Technology Inc. (NASDAQ:MRVL) up 32%, followed by PDD Holdings (NASDAQ:PDD), up 19% and Broadcom Inc. (NASDAQ:AVGO), up 11.5%.

The S&P 500 Index, as tracked by the SPDR S&P 500 ETF Trust (NYSE:SPY), also rose 1.3%. The best performers among S&P 500 heavyweights were Tesla Inc. (NASDAQ:TSLA), up 4.7%, Amazon Inc. (NASDAQ: AMZN, up 4.4%, and American Express Company (NYSE: AXP), up 4.1%.

Read now: President’s ‘Bidenomics’ Agenda Takes Center Stage In Chicago Address Today: Jobs, Inflation And Investments In Focus

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.