By Susan Taylor

TORONTO (Reuters) - De Beers Canada has suspended operations at its unprofitable Snap Lake diamond mine in the remote Northwest Territories due to poor market conditions, and said on Friday that it will evaluate the mine's potential over the next year.

De Beers, 85 percent owned by Anglo American (L:AAL) and 15 percent owned by the government of Botswana, said work has started to put the underground mine on care and maintenance and will last up to nine months.

The company is letting go 434 employees and will employ 120 for the suspension work. Ongoing care and maintenance operations will require about 70 staff, it said.

Another 41 employees have been transferred to Gahcho Kue mine, now being built in the Northwest Territories (NWT) with Mountain Province Diamonds (TO:MPV), a 49-percent partner in the project. Sixty more employees could be transferred in 2016.

Gahcho Kue is expected to start production in late 2016 and operate for 11 years.

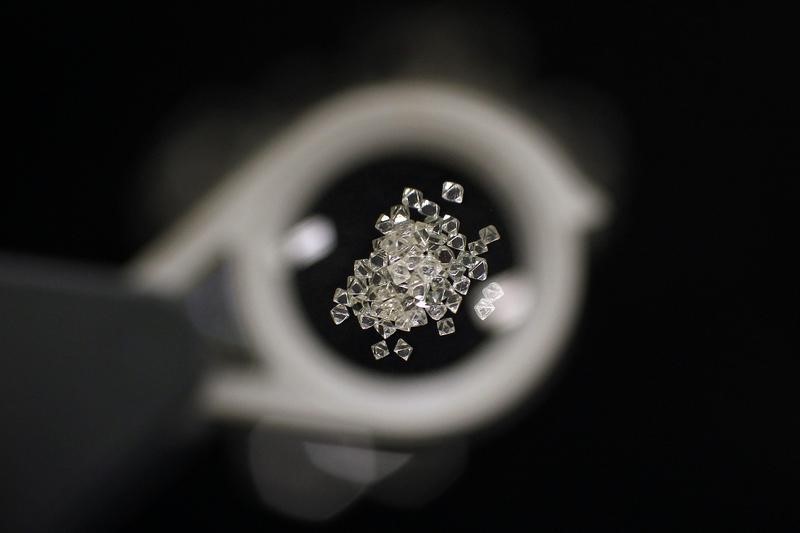

Snap Lake, which was planned to operate until 2028, has not turned a profit since it began production in 2008. Groundwater problems added to already high costs at the mine, which produced 1.2 million carats last year.

Mountain Province Chief Executive Patrick Evans said the suspension will further trim De Beers' output, already cut to 29 million carats from 32 million carats this year.

"Supply restraint on the part of the major producers is very prudent and it's certainly going to help relieve the pressure that exists in the mid-stream and balance the supply-demand equation," he said. "The sector's health is not good."

Slower demand growth in China for diamond jewelry along with a glut of supply held by stone cutters and polishers has contributed to an 18 percent drop in the price of rough stones this year.

"It's going to be a shock to our economy," said Tom Hoefer, executive director of the NWT and Nunavut Chamber of Mines.

Diamonds directly contributed 18 percent to the region's gross domestic product last year, but some put the contribution at closer to 40 percent when related spending for such things as construction is included, Hoefer said.

Rio Tinto (L:RIO) sees production at its majority-owned Diavik mine ending in 2023. Dominion Diamond (TO:DDC), which holds 40 percent of Diavik and 89 percent of Ekati mine, awaits expansion permits that could extend Ekati to 2031.