LONDON (Reuters) - Libya's $67 billion (£51.6 billion) sovereign wealth fund has recovered $73 million from the bankrupt Lehman Brothers and $53.8 million from Cornhill Capital after lengthy legal battles, the fund said in a statement.

The Libyan Investment Authority (LIA) is involved in a number of disputes with Western firms, not least its $3.3 billion claims against investment banks Goldman Sachs (NYSE:GS) and Societe Generale (PA:SOGN), which are being pursued in London courts.

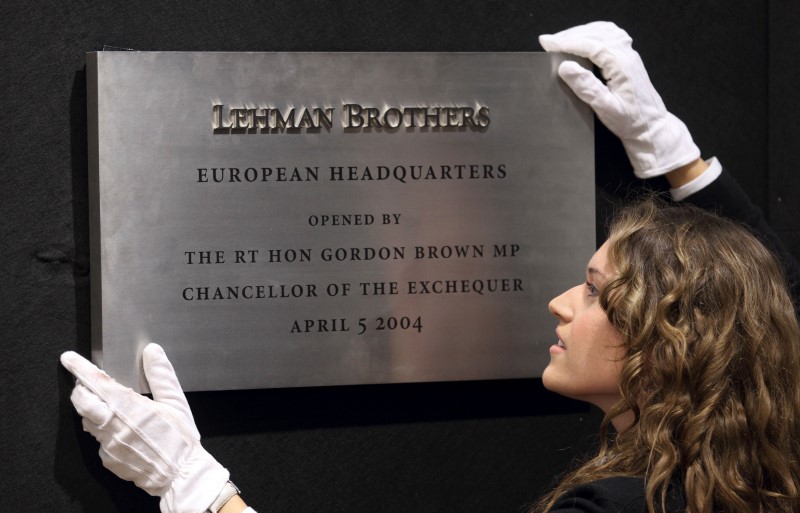

The dispute with Lehman stems from the collapse of the Wall Street giant in 2008. The LIA invested at least $200 million in a Lehman structured product at a time when the country was still ruled by Muammar Gaddafi. After Lehman filed for bankruptcy in September 2008, the LIA attempted to recover as much as possible of its investment.

As part of the process of receiving funds back from the administrators, some $73 million has now been recovered, paid in instalments to an LIA account. Lehman's administrators attempt to make payouts to different tranches of Lehman creditors via applications to the courts.

The LIA has also recovered $53.8 million after a three-year battle with UK-based Cornhill Capital over an investment in the latter's Bermuda-domiciled Cornhill Natural Resources Fund.

In October 2013, the LIA tried to withdraw what remained from an initial investment of $100 million, a person with knowledge of the situation said.

However, Cornhill Capital delayed making a redemption on the grounds that to do so would violate international sanctions, the LIA said in a statement. The United Nations Security Council had imposed an asset freeze on the LIA in 2011 to prevent the country's wealth being spirited away after the fall of Gaddafi.

A substantial portion of the LIA's assets remain frozen, but the redemption proceeds from Cornhill have now been paid into a sanctioned account, the LIA said in the statement.

Cornhill Capital declined to comment.

The leadership of the LIA is contested by multiple individuals. One of these, AbdulMagid Breish, who was appointed LIA chairman in June 2013, said the decision in the Cornhill case was "an encouraging result".

He added that the LIA would continue to press for greater recoveries from Lehman.

The LIA is awaiting a judgement in its case against Goldman Sachs, which ran for seven weeks in June and July.

The trial date for the lawsuit against Societe Generale was pushed back until April 2017 under a judge's ruling in July.