Benzinga - Shares of Advanced Micro Devices, Inc (NASDAQ: AMD) gained after the company released its fourth-quarter results and several analysts raised their price targets for the stock.

Credit Suisse on Advanced Micro Devices

Analyst Chris Caso reiterated an Outperform rating, while raising the price target from $90 to $96.

The company’s fourth-quarter print came as a “relief to investors” after Intel Corp’s (NASDAQ: INTC) “very cautious report a week ago,” Caso said in a note. While AMD guided to below consensus for Q1, "guidance was almost directly in line with our numbers as we lowered numbers ahead of the quarter," he added.

Bernstein on Advanced Micro Devices

Analyst Stacy Rasgon maintained a Market Perform rating and price target of $80.

“AMD's Q4 results were decent with a slight beat to consensus amid increasingly lowered expectations,” Rasgon wrote. “Data Center and Embedded revenues grew YoY and QoQ; Client revenues fell significantly QoQ and YoY given PC market weakness and continued channel inventory correction, and Gaming was up slightly QoQ and up YoY on stronger consoles,” he added.

Morgan Stanley on Advanced Micro Devices

Analyst Joseph Moore reiterated an Overweight rating, while raising the price target from $77 to $87.

“Results were disappointing vs. street models, but viewed in the context of Intel guiding for a 20% sequential/39% y/y revenue decline in 1q, and an operating loss amid excess inventory conditions, a modest gross margin shortfall and investor digestion at hyperscalers should be a relief,” Moore stated.

Advanced Micro Devices reported results that were better than feared, “given the very challenging environment,” he added.

Check out other analyst stock ratings.

Baird on Advanced Micro Devices

Analyst Tristan Gerra maintained an Outperform rating and price target of $100.

“Ongoing share gains in 2022, which we expect will continue or accelerate in data center this year driven by fourth-gen EPYC, despite broad-based inventory develeraging expected to continue in 1H23,” Gerra said in a note.

“2H23 should witness a reacceleration of YoY revenue comps along with gross margin expansion,” he added.

Rosenblatt Securities on Advanced Micro Devices

Analyst Hans Mosesmann reaffirmed a Buy rating and price target of $200.

“AMD slightly beat 4Q22 earnings (not expected), and guided below consensus for 1Q23 (expected) to a down mid-single digits sales growth outlook,” Mosesmann said. “AMD’s results place Intel’s outlook as mostly Intel-specific and dispels residual angst on Intel destroying the compute market to bring AMD down with them,” he added.

Goldman Sachs on Advanced Micro Devices

Analyst Toshiya Hari maintained a Buy rating and price target of $87.

“While we expect the competitive landscape in PC and the near-term correction in Data Center to potentially weigh on investor sentiment, we remain constructive on the stock given our expectation for significant market share expansion in server CPU and the potential for margin improvement in 2H23/2024 driven by higher volumes and better mix vs. 1H23 - both idiosyncratic in nature,” Hari mentioned in a note.

AMD Price Action: Shares of Advanced Micro Devices had risen by 7.24% to $80.59 at the time of publication Wednesday.

Now Read: Apple Won't Be Developing Wi-Fi Chip For Now, Says Analyst — Making This Chipmaker 'Biggest Winner

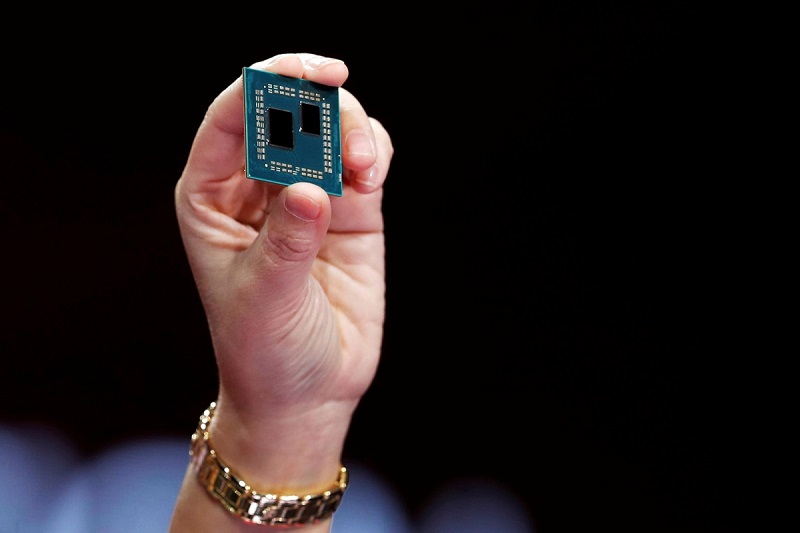

Photo: Shutterstock

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.