Benzinga - by Surbhi Jain, .

As markets continue to reach new all-time highs, investors are constantly seeking opportunities that offer both stability and growth potential. With the S&P 500 and Nasdaq recently hitting new all-time highs, investors are out bargain hunting.

Mega-cap stocks, known for their large market capitalizations and relatively stable performances, are often considered safe havens during uncertain times. However, even within this category, there are bargains to be found. Moreover, even in times when the capital markets appear super bullish, ‘fear’ often lingers on, defining investor sentiment.

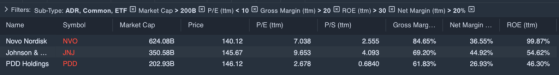

We ran a screener using Benzinga Pro to filter out three mega-cap stocks that are currently trading at attractive valuations, presenting an enticing opportunity for investors looking to capitalize on the market’s bullish momentum.

We filtered stocks that:

- Fall in the Mega cap category – those commanding over $200 billion in market capitalization.

- Trade at a P/E (TTM) of less than 10

- Sport Gross and Net Margins of over 20%

- Deliver an ROE of over 30%

Data Table: Benzinga Pro

Also Read: The ‘AI Big 10’: 10 AI Stocks Now Comprise 28% Of S&P 500, Up From 14% In 2023

Let’s look at these stocks, one by one.

Novo Nordisk

Denmark-based Novo Nordisk is the world’s leading provider of diabetes-care products. It holds about a third of the global branded diabetes treatment market.The company manufactures and markets a range of products, including human and modern insulins, injectable diabetes treatments like GLP-1 therapy, oral antidiabetic agents, and obesity treatments. Additionally, Novo has a biopharmaceutical segment focused on protein therapies for hemophilia and other disorders, accounting for approximately 10% of its revenue.

Here’s a quick look at NVO stock’s recent performance:

Source: Benzinga Report

Analysts are bullish on NVO stock with recent ratings predicting a 13.77% upside on average.

Source: Benzinga Report

Johnson & Johnson

Johnson & Johnson operates through its pharmaceutical and medical devices divisions. Following the 2023 divestment of its consumer business, Kenvue, these divisions now account for all of its sales.The pharmaceutical division targets therapeutic areas such as immunology, oncology, neurology, pulmonary, cardiology, and metabolic diseases. Over half of the company’s revenue comes from the United States.

Here’s a quick look at JNJ stock’s recent performance:

Source: Benzinga Report

Analysts are quite bullish on JNJ stock with recent ratings predicting a 26.45% upside on average.

Source: Benzinga Report

PDD Holdings

PDD Holdings is a multinational commerce group managing a portfolio of businesses focused on integrating more entities and individuals into the digital economy.This approach aims to boost productivity and create opportunities for local communities and small businesses.

PDD has developed a robust network of sourcing, logistics, and fulfillment capabilities to support its operations. Here’s a quick look at PDD stock’s recent performance:

Source: Benzinga Report

Analysts are very bullish on PDD stock with recent ratings predicting a 41.38% upside on average.

Source: Benzinga Report

Read Next: S&P 500, Nasdaq Close At Record Highs As Wall Street Turns Bullish Amid Improving Investor Sentiment

Image: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga