Proactive Investors - Cable brought the Tuesday session to a net positive close at 1.218 but has shed around 35 pips this morning, bringing the pair to 1.215.

It looks to be the fifth straight sideways trade for the par leading in to the Christmas break, though with both UK and US gross domestic product figures due for a final reading on Thursday, we could see a spurt of activity before the week is done.

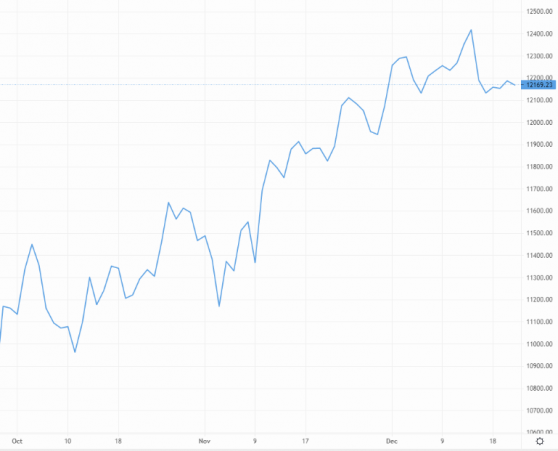

Any surprises left for GBP/USD this year? – Source: capital.com

Contractions are expected to appear on both sides of the Atlantic, but a hotter reading for the UK could boost sterling upside if traders begin pondering a more restricting Bank of England strategy in the new year.

EUR/GBP saw a reversal in yesterday’s closing hours, having failed at the intraday high of 87.70p to close at a softer 87.16p. The euro has since gained on the pound in today’s Asia trading window and is currently changing hands for 87.30p

Against the greenback, the euro has maintained the upper hand throughout the first half of the week. Another 0.12% was added to the EUR/USD pair in the Tuesday session to close at 1.062, where it has since remained.

Elsewhere on the economic calendar, the Bank of Canada will give its final inflation rate reading this afternoon. Forecasters expect an easing off of 0.2%, having remained unchanged at 6.9% last month.

GBP/CAD has been cutting a bearish figure this week- the pair opened Monday at 1.664 and has since dipped to 1.656.