By Jonathan Schwarzberg

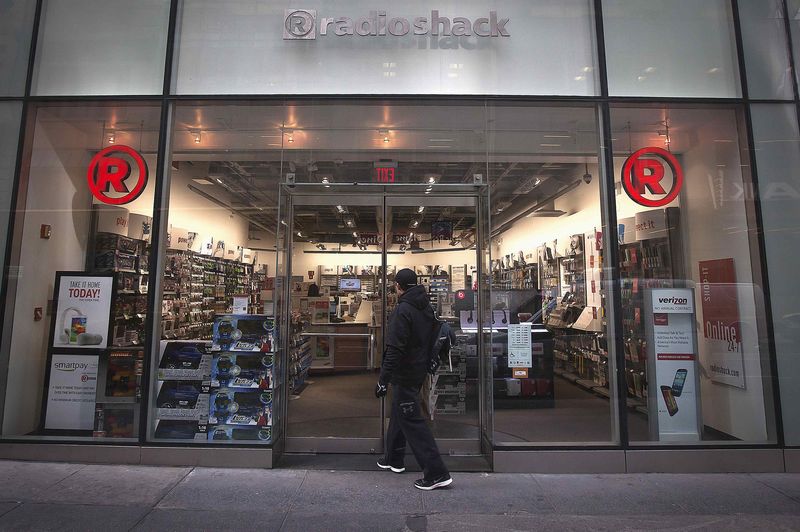

NEW YORK (Reuters) - RadioShack Corp

The troubled electronics retailer filed for Chapter 11 bankruptcy protection on Thursday saddled with $1.38 billion in debt, according to court documents.

RadioShack said it has $1.2 billion of assets, according to the same documents.

The DIP financing includes a $15 million subfacility for new letters of credit. It also rolls up the company's prepetition revolver and first-in, last-out facility. It has $20 million of incremental borrowing capacity.

RadioShack's prepetition debt includes a $535 million credit facility due in 2018 with approximately $250 million outstanding.

Radio Shack originally lined up the 2018 credit agreement with a $535 million asset-based revolver, also provided by DW Partners, and a $50 million asset-based term loan in December 2013 with a lenders group led by GE Capital. According to court documents, the lenders sold their interests to Standard General LP on October 3, 2014.

At that time, the credit agreement was amended, splitting the $535 million revolver into a $275 million term loan, a $120 million letter of credit facility and a $140 million revolving facility. Cantor Fitzgerald served as the administrative agent.

This credit agreement is secured by a first-priority lien on the current assets and second-priority lien on the fixed assets, intellectual property and equity interests of subsidiaries.

RadioShack also has a $250 million term loan dating back to December 2013. This agreement is with Salus Capital Partners LLC and Cerberus Capital Management. It is secured with a second-priority claim on current assets and a first-priority lien on fixed assets.

In addition to the loan debt, RadioShack has $330 million outstanding of 6.75 percent unsecured notes due May 15, 2019.

Hedge fund Standard General is acting as the stalking horse bidder for the purchase of up to 2,400 stores. RadioShack is proposing an expedited sale process that would be completed within 45 days.

Standard General has separately reached an agreement with Sprint to form a "store within a store" in up to 1,750 of the Radio Shack locations.

(Refiled to add missing word 'billion' in second paragraph)

(Editing By Michelle Sierra and Lynn Adler)