(Bloomberg) -- As the U.S. government kicks off its debt sales this year, here’s one potentially worrisome sign for traders to keep in mind: the steep decline in demand at its bond auctions.

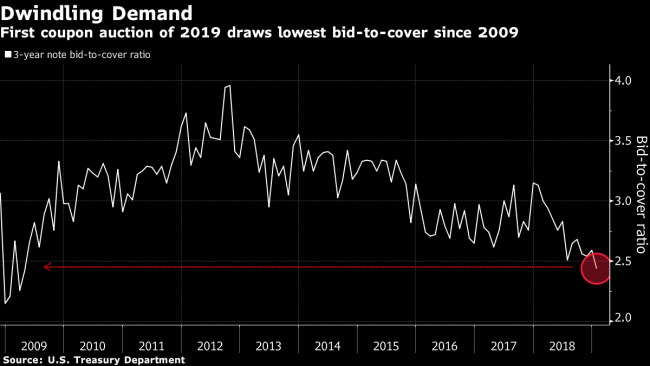

Of the $2.4 trillion of notes and bonds the Treasury Department offered last year, investors submitted bids for just 2.6 times that amount, data compiled by Bloomberg show. That’s less than any year since 2008. The bid-to-cover ratio, as it’s known, fell even as benchmark Treasury yields soared to multi-year highs in October, before falling back to their lows last month.

Granted, it’s not as if the U.S. will have trouble borrowing as much as it needs. And there’s little in the data to suggest weak auctions lead to bond losses. Yet the drop-off serves as an early warning that demand for Treasuries may not keep up as the U.S. goes deeper in the red. Debt supply jumped in 2018 largely because of the Trump administration’s tax cuts. Forecasts show the deficit could soon swell past a trillion dollars and stay that way for years to come.

The weakness “doesn’t matter until it suddenly does,” says Torsten Slok, Deutsche Bank’s chief international economist. “A declining bid-to-cover ratio increases the vulnerability and probability that investors suddenly will begin to think that a falling bid-to-cover ratio is important. Put differently, all fiscal crises begin with a declining bid-to-cover ratio.”

The first note auction of 2019 did little to ease those worries. The Treasury sold $38 billion of three-year notes Tuesday, matching the biggest sale since 2010. The bid-to-cover ratio was the lowest since 2009. It will follow up Wednesday with a $24 billion sale of 10-year notes, which yield 2.73 percent.

The Treasury has boosted its auctions for four straight quarters, surpassing levels last seen in 2009. What’s more, the U.S. has grown more reliant on the public to finance its deficit as the Federal Reserve scales back its purchases of Treasuries to shrink its $4 trillion of crisis-era bond holdings.

To some Wall Street observers, the drop in bid-to-cover ratios is merely a mathematical necessity rather than a cause for alarm.

“We’ve seen record high auction sizes, so decade-low bid-to-cover makes sense,” said Ian Lyngen, head of U.S. interest-rate strategy at BMO Capital Markets. “I would expect, mechanically, for bid-to-cover ratios to come down, just because there’s not endless, insatiable demand out there for Treasuries.”

Lyngen says he’s on the lookout for so-called tails for signs of stress at auctions. A tail occurs when the auction yield is higher than the prevailing market rate for the securities at the time bids close. And a larger tail indicates that bond investors are demanding a bigger concession for the offering.

Cracks Emerge

Yet there too, some cracks have started to emerge.

The three-year maturity has produced five tails in the last seven auctions of the security, including Tuesday’s, according to Jefferies. Auctions have tended to be “sloppier” since the Treasury increased its borrowing in February, says Tom Simons, the firm’s money-markets economist. Continued weakness in auction demand could lead to larger tails this year, he says.

“If auction sizes start rising later in the year and inflation picks back up,” he says, “then the second half of the year could get hairy.”