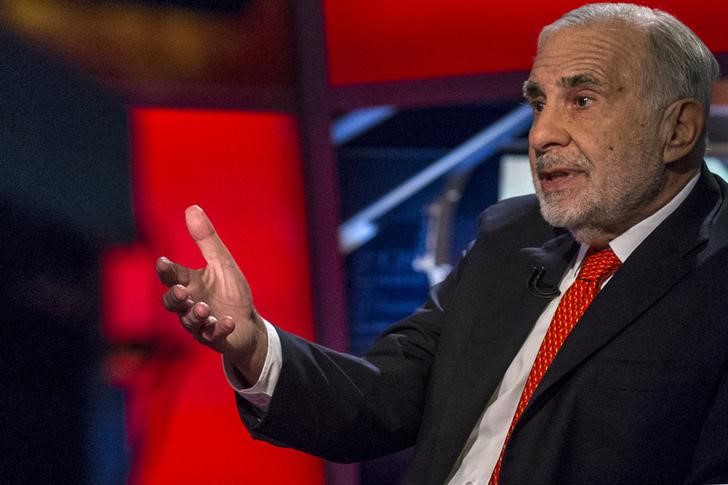

(Reuters) - Apple Inc (O:AAPL) remains undervalued and misunderstood, activist investor Carl Icahn tweeted, even as the company posted stellar quarterly results on Monday.

The billionaire investor said he expects to put out an "in-depth" report within two weeks.

Apple beat Wall Street's revenue and profit forecasts on Monday as it sold more iPhones in China than the United States for the first time.

The most valuable publicly traded U.S. company also raised its quarterly dividend by 11 percent to 52 cents per share and boosted its share buyback programme to $140 billion (91.36 billion pounds) from $90 billion.

Icahn, who has been vocal about his belief that Apple is undervalued, has urged the company's board to buy back more shares using its huge cash pile. He has also pledged to keep his own stock out of any repurchase.

The 79-year-old, one of Apple's top 10 investors, said in February that Apple stock should be trading at $216.

Apple's shares were marginally down at $132.62 by midday. The stock had fallen as much as 2.3 percent earlier in the day.