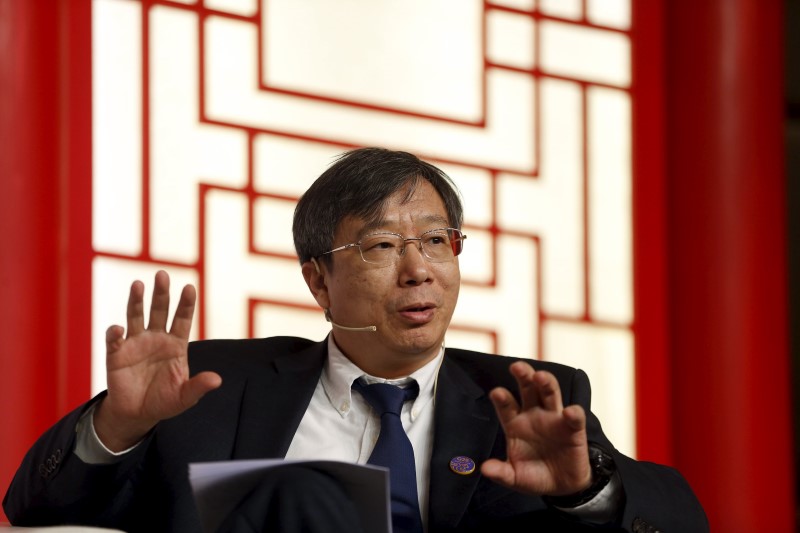

(Bloomberg) -- People’s Bank of China Governor Yi Gang said the result of the Group of Twenty meeting over the weekend was “a little bit better” than expected, but stressed that difficulties remain ahead in solving trade tensions with the U.S.

At an event Monday in Helsinki, Yi said he’ll remain cautious in the future because difficulties remain in structural and fundamental issues, though the road map for trade talks agreed by Presidents Donald Trump and Xi Jinping in Osaka is constructive.

“But as long as the two largest economies have more or less normal trade relationship, we can continue the negotiation, we can solve problems one by one, and we can address each side’s priority concerns better and keep the trade relationship more or less at the working level,” Yi said.

On the domestic economy and policy settings, Yi said the central bank’s interest rates are at a comfortable level, economic growth is close to its potential and the current policy stance is enough to deal with different situations. Yi’s comments signal that policy makers won’t necessarily adopt broader easing measures if the risks from the trade war remain constrained.

China’s economic growth will continue to moderate as labor supply shrinks, local officials place less stress on the growth of gross domestic product and environmental protections get tougher, Yi said during his remarks at an event organized by the Bank of Finland.

Gauges of activity in China’s manufacturing sector in June showed the economy remains fragile, underlining the need for the truce with the U.S. to be a lasting one. Yi pointed to the growing importance of consumption as a driver for growth, and added that he expects the current account surplus to be below 1% of GDP this year.

On debt-related risks, Yi said China’s total debt ratio as a percentage of GDP has stabilized, and it’ll continue to stay stable as long as the central bank can keep broad money supply basically in line with nominal GDP growth. Yi said the PBOC didn’t want to deleverage, but rather to reduce the risks of leverage and keep the growth low.

Yi said last month that there’s “tremendous room” for monetary policy to adjust if the trade war with the U.S. worsens.

(Updates to add comments on debt in the seventh paragraph.)