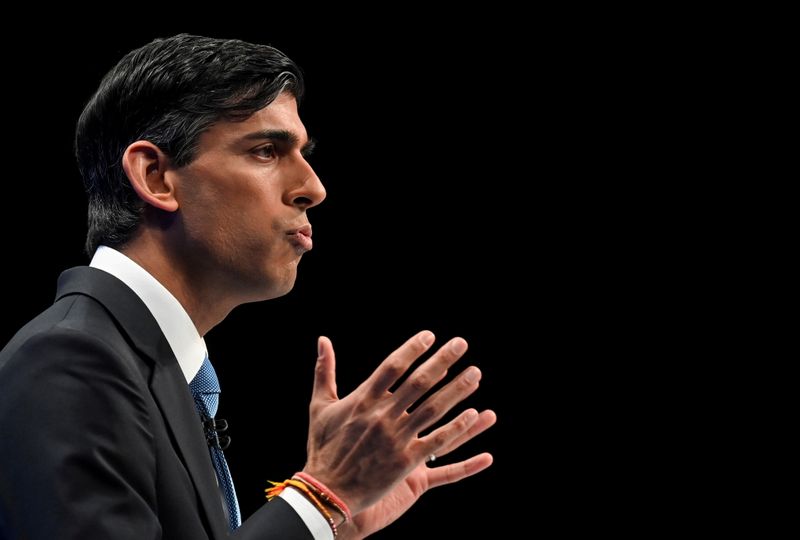

LONDON (Reuters) - Finance minister Rishi Sunak set out multi-billion-pound public investments alongside tight controls on day-to-day outlays in his budget speech and three-year spending plan on Wednesday.

Below are highlights of Sunak's speech in parliament:

ON INFLATION

The House will recognise the challenging backdrop of rising inflation. Inflation in September was 3.1% and is likely to rise further - the OBR expect CPI to average 4% over next year.

The pressures caused by supply chains and energy prices will take months to ease. It would be irresponsible for anyone to pretend that we can solve this overnight.

ON FISCAL POLICY

In terms of our fiscal policy, we are going to meet our commitments on public services and capital investment… …but we are going to do so, keeping in mind the need to control inflation.

ON OBR FORECASTS

They forecast the economy to return to its pre-COVID level at the turn of the year – earlier than they thought in March. Growth this year is revised up from 4% to 6.5%. The OBR then expect the economy to grow by 6% in 2022, and 2.1%, 1.3% and 1.6% over the next three years.

In July last year, at the height of the pandemic, unemployment was expected to peak at 12%... The OBR have today revised down their scarring assumption from 3% to 2%.

ON TWO NEW FISCAL RULES

First, underlying public sector net debt, excluding the impact of the Bank of England must, as a percentage of GDP, be falling. Second, in normal times the state should only borrow to invest in our future growth and prosperity. Everyday spending must be paid for through taxation.

ON DEBT AND BORROWING

Underlying debt is forecast to be 85.2% of GDP this year, then 85.4% in 2022-23, before peaking at 85.7% in 2023-24. It then falls in the final three years of the forecast from 85.1% to 83.3%.

Borrowing as a percentage of GDP is forecast to fall in every single year. From 7.9% this year to 3.3% next year, then 2.4%, 1.7%, 1.7% and 1.5% in the following years.

ON INTERNATIONAL AID

I told the House that when we met our fiscal tests, we would return to spending 0.7 percent of our national income on overseas aid... Based on the tests I set out, today’s forecasts show that we are, in fact scheduled to return to 0.7 in 2024-25 – before the end of the Parliament.

ON COVID, HEALTH AND HOUSING

Today’s Budget does not draw a line under COVID; we have challenging months ahead.

We’re investing more in housing, too. With a multi-year housing settlement totalling nearly £24bn.

At the start of this Parliament, resource spending on healthcare was 133 billion pounds ($183 billion). Today's Spending Review confirms that by the end of the Parliament, it will increase by 44 billion pounds to over 177 billion pounds.

FUTURE GROWTH PLANS

Over the long-term the only way to pay for higher spending is economic growth. And if we want to see higher growth, we’ve got to tackle the problem that’s been holding this country back for far too long: Our uneven economic geography.

As we come out of the worst economic shock we’ve ever seen, we've got a choice. To retrench - or to invest. This Government chooses to invest: To invest in our economic infrastructure. To invest in innovation. To invest in skills. To invest in a Plan for Growth that builds a stronger economy for the future.

($1 = 0.7272 pounds)