By Lindsay Dunsmuir

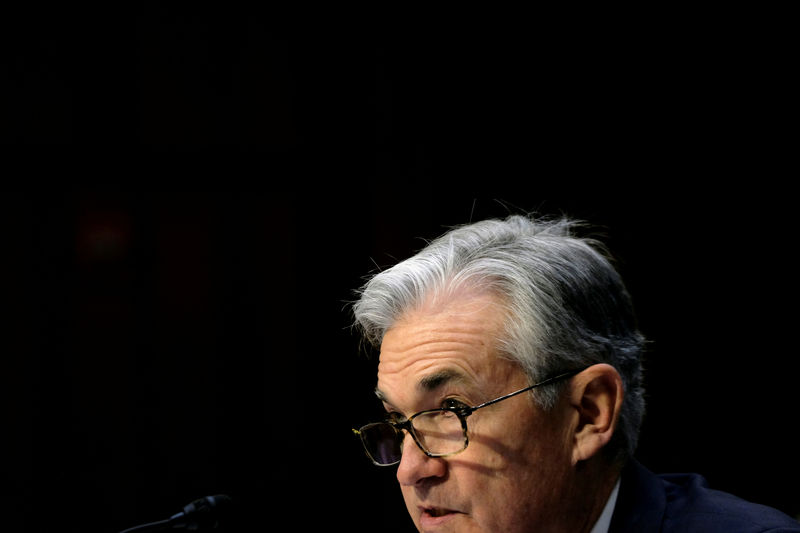

WASHINGTON (Reuters) - Federal Reserve Chair Jerome Powell on Thursday said the risk of the U.S. economy facing a dramatic bust is remote in part because the record-long expansion is notable for not having pockets of overheating activity.

Powell, appearing before U.S. lawmakers for a second day, reiterated his view that the current expansion appears on a sustainable footing, with few indications of an imminent downturn despite risks from the long-running U.S.-China trade war, a slowdown in business investment and weakness abroad.

"The U.S. economy is the star economy these days," Powell told the House Budget Committee. "We're growing at 2%, right in that range, more than any of the other advanced economies are growing. There's no reason that can't continue."

Asked if there were any excesses that threatened to torpedo the expansion, Powell said: "Look at today's economy. There's nothing that's really booming that would want to bust in other words."

"It's a pretty sustainable picture."

The U.S. economy is in its 11th year of expansion, although growth this year has slowed from 2018 when the Republican tax cuts fed an acceleration in activity. In the third quarter, the economy grew at a 1.9% annualised pace, down from 3.4% in the comparable period a year earlier.

U.S. manufacturing activity has slowed as tit-for-tat tariffs between Washington and Beijing and slack demand from overseas markets have fostered uncertainty. Business investment has been a net drag on gross domestic product for the last two quarters.

Asked about the possibility the slump in manufacturing could drag down the broader economy, Powell said central bank officials had seen no signs of that.

"That's a risk that we monitor very carefully - we don't see that yet," Powell said. "The 70% of the economy that is the consumer is healthy with high confidence, low unemployment, wages moving up."

"That is what is driving our economy now and seems to be continuing to do so."

To address concerns the expansion was at risk, in part from President Donald Trump's trade war with China, the Fed has cut interest rates three times this year. The Fed's targeted rate now stands in a range of 1.50-1.75%, down from 2.25-2.50% at midyear.

In prepared remarks that were nearly identical to those delivered on Wednesday to the Joint Economic Committee, Powell said the impact of the three rate cuts this year was still to be fully felt in supporting household and business spending and will let the central bank likely stop where it is unless there is a "material" change in the economic outlook.