By Joseph White and David Shepardson

DETROIT (Reuters) - Negotiators for the United Auto Workers and Ford Motor (NYSE:F) have narrowed their differences on pay increases after a new offer from the automaker amid "really active" talks, people familiar with the bargaining among the Detroit Three automakers and the union said on Wednesday.

UAW President Shawn Fain plans to update the union's 150,000 members at Ford, General Motors (NYSE:GM) and Chrysler parent Stellantis on Friday, a person briefed on the union's plans said. It is not clear whether Fain will order a fresh round of walkouts, or declare sufficient progress has been made to delay strikes at additional plants.

In addition to Ford, talks with Chrysler parent Stellantis and other automakers and the UAW have been active in recent days, sources said. Stellantis declined to comment.

Ford said on Tuesday it had made a "comprehensive" new offer that included a "more than 20% general wage increase, not compounded" with a double-digit increase in the first year. Ford did not elaborate. That proposal, however, when combined with cost-of-living adjustments previously offered by the automaker, could bring the total wage increase offer close to 30% over the life of the contract, people familiar with the situation said.

However, the UAW and Ford have not announced agreements on other, significant issues including pay and union representation at future battery plants, and the union's push for a return to retirement plans that assure a defined level of benefits.

Ford Chief Financial Officer John Lawler said Friday the automaker's retirement offer would assure UAW workers could retire with $1 million in savings.

But in a sign the Detroit automakers are still bracing for a lengthy struggle, General Motors on Wednesday secured a new $6 billion line of credit and estimated the cost of the United Auto Workers strike was $200 million during the third quarter, a company spokesman said.

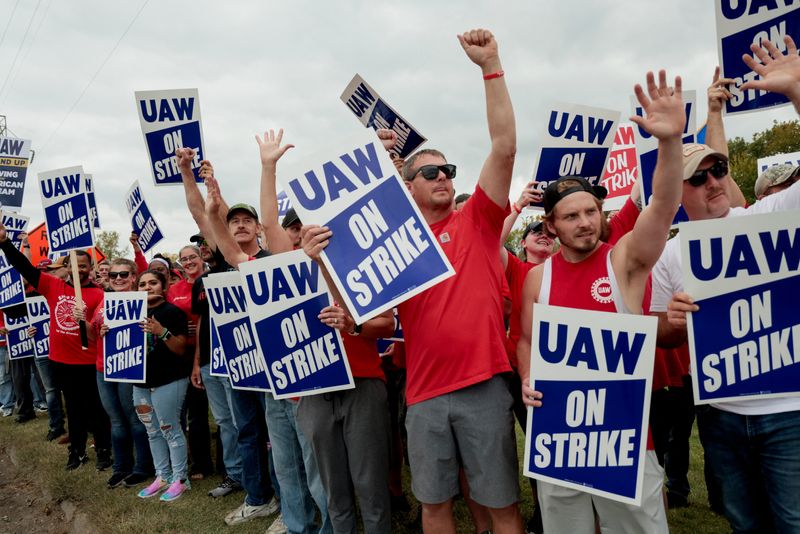

The targeted strike against the Detroit Three automakers began on Sept. 15 and is now in its 20th day.

GM Chief Financial Officer Paul Jacobson told CNBC the line of credit was "prudent" given statements from some UAW officials "that they intend to drag this on for months." He said GM has made a record contract offer and said it needs a deal that puts it "on par with our competitors."

The union has struck two GM assembly plants and 20 parts distribution centers.

The strike cost at GM reflects 16 days in which production was stopped at one assembly plant in Wentzville, Missouri, for midsized pickup trucks and vans. It also reflects the strike at GM parts facilities and knock-on impacts including a production halt at a GM car plant in Kansas due to a lack of parts.

The indicated average cost of $12.5 million a day for General Motors from its filing Wednesday could rise sharply if the UAW shuts down more vehicle production in the weeks ahead.

Against that backdrop, GM said in a securities filing it has locked in the new, $6 billion line of credit through October 2024. JP Morgan and Citibank are listed as joint lead arrangers for the deal.

Ford secured a $4 billion line of credit in August, ahead of the Sept. 14 UAW contract expiration.

GM's new line of credit will bolster its balance sheet against a protracted strike that could widen to cut off production of its most profitable vehicles: large Chevrolet and GMC pickup trucks and large SUVs such as the GMC Yukon and Cadillac Escalade. GM shares ended down about 1% on Wednesday afternoon.

The additional funds will require GM to maintain at least $4 billion in global liquidity and $2 billion in U.S. liquidity. The terms of the credit agreement also restrict GM from mergers or sales of assets and limits on other, new debt.

The UAW said on Monday it presented a new contract offer to GM. GM, in turn, said despite the offer, "significant gaps remain." The automaker has been forced to lay off 2,100 workers at five plants in four states.

Ford said Wednesday it was laying off another 400 workers in Michigan starting Thursday because of the strike after previously furloughing 930 workers, and Stellantis 370 workers in Ohio and Indiana because of the strike.

Meanwhile, nearly 30% of auto parts makers surveyed by an industry trade group said they have laid off some workers due to the UAW strikes. Another 60% expect more layoffs by mid-October if the walkouts continue, the Motor Equipment Manufacturers Association said.