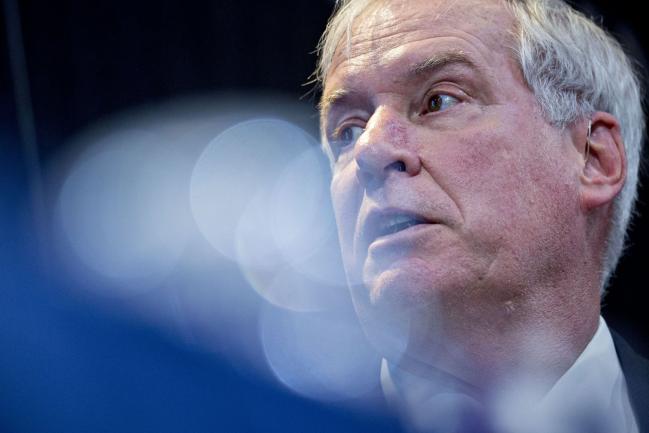

(Bloomberg) -- Federal Reserve Bank of Boston President Eric Rosengren expects a weak economic rebound from coronavirus-related shutdowns and said more than 200 lenders had begun registration for the Main Street Lending Program.

“More support is likely to be needed from both monetary and fiscal policy,” Rosengren said in the text of a speech he’s scheduled to deliver online Friday to the Greater Providence Chamber of Commerce. He sees unemployment remaining above 10% through the end of this year, with inflation persisting “well below” the Fed’s 2% target.

“Unemployment remains very high, and because of the continued community spread of the disease and the acceleration of new cases in many states, I expect the economic rebound in the second half of the year to be less than was hoped for at the outset of the pandemic,” he said.

Pessimistic Outlook

Rosengren’s outlook put him on the pessimistic side of projections released June 10 by the Federal Open Market Committee. The median forecast for unemployment at the end of 2020 among the 17 policy makers was 9.3%.

But Rosengren is not alone in warning that recent strong economic indicators -- like the May jobs report and retail sales data -- may be misleading. Fed Chair Jerome Powell, appearing before lawmakers this week, said he expects a significant bounceback in the labor market in the near term, but one that leaves the U.S. far short of employment levels seen before the pandemic.

Rosengren focused some of his remarks on re-opening efforts in some states, like South Carolina and Florida, where there is evidence that new cases are rising.

Risky Reopening

“Given the death toll of the virus even with the economic lockdown, I see a substantial risk in reopening too fast and relaxing social distancing too much,” he said.

He also made clear the threat is not just to public health, but also to the economy.

“So far, in the United States efforts to contain the virus have not been particularly successful,” he said. “This lack of containment could ultimately lead to a need for more prolonged shut-downs, which result in reduced consumption and investment, and higher unemployment.”

Main Street

Rosengren also commented on the Main Street Lending Program, an emergency credit facility created by the central bank and administered by the Boston Fed. It aims to provide loans to small and mid-size businesses and was opened for lender-registration on Monday.

He said more than 200 financial institutions of various size from across the country had begun registering to participate, and that interest from businesses was “tremendous.”

The program, in which banks will make loans of $250,000 to $300 million and then sell a 95% stake in each loan to the Fed, has been slow to start since its March announcement and has been modified several times. The Fed received thousands of comment letters in response to the initial announcement of the program, and some critics argue the terms and complexity of the program may still not be favorable to borrowers or lenders.

©2020 Bloomberg L.P.