Proactive Investors - High energy prices will likely stick into the 2030’s, meaning households will continue to pay more on bills than before the energy crisis for several years to come.

According to consultancy Cornwall Insight, prices will remain above pre-energy crisis levels well into the next decade, after last year’s hikes.

Russia’s invasion of Ukraine added to supply woes leftover from the pandemic, causing wholesale gas to drag up energy prices last year.

Though prices have new-fallen to pre-war levels, reflected in Ofgem’s lower household-bill determining price cap, analysts expect a return to normal figures is still a long way off.

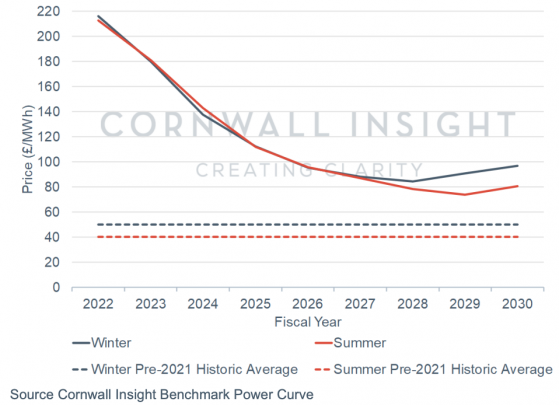

By 2030, UK power prices per megawatt hour will average close to £80 during the summer and almost £100 in winter, compared to £40 and £50 respectively before 2021.

Prices are indeed expected to fall slowly, analysts noted, but will likely plateau in 2028 as larger areas of the economy become electrified, causing demand to grow.

Power price forecasts - average price per fiscal year

“This demand growth is mostly met by low-carbon, low marginal cost generators and as a result power prices do not significantly increase, although they remain above pre-pandemic levels,” Cornwall Insight forecast.

The consultancy’s GB Power Market Outlook report comes after warnings from the likes of Centrica PLC (LSE:LON:CNA)’s boss Chris O’Shea and International Energy Agency head Fatih Birol that the world is not out of the energy crisis yet.