By Dhara Ranasinghe

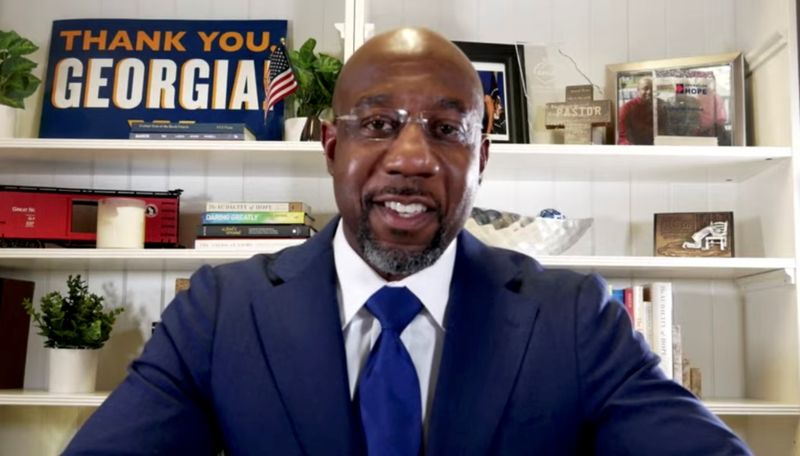

LONDON (Reuters) - Georgia... say no more about what is driving world markets. Democratic challenger Raphael Warnock has won a hotly contested U.S. Senate race in the state over Republican incumbent Kelly Loeffler, TV networks and Edison Research are projecting.

With a second contest still undecided, which party will control the chamber is up in the air. Yet markets appear to have to have made up their mind, bracing for a Democrat win that could pave the way for a big fiscal boost in the months ahead.

While stocks are down and Wall Street futures indicate a weaker opening, expectations of a fiscal boost -- and reflation -- are most pronounced in U.S. Treasury markets, where 10-year yields have pushed above 1% for the first time since March, and the yield curve us at its steepest since 2017. European bond yields are tracking higher too in their wake.

Bitcoin meanwhile traded above $35,000 for the first time, rising to $35,879 and extending a rally that has seen the digital currency rise more than 800% since mid-March.

A deluge of economic data will give markets more to chew on; French December inflation data and services PMI numbers for major European economies.

The US ADP (NASDAQ:ADP) employment report will be watched closely ahead of Friday's non-farm payrolls report.

Key developments that should provide more direction to markets on Wednesday:

- Georgia Senate races that will decide fate of Biden's agenda too close to call

-Andrew Bailey, the head of the Bank of England, speaks to the Treasury Select Committee at 1400 GMT.

- Oil hits 11-month high after Saudi Arabia pledges voluntary output cut

-Germany will issue 5 billion euros of 10 year Bunds; UK to sell 3 billion pounds in 10-year gilts

- British baker Greggs slowed the rate of sales decline caused by COVID-19 in Q4

-Trump places curbs on eight Chinese apps including Alipay. But the New York Stock Exchange may reconsider plans to allow three Chinese telecom firms to remain listed.