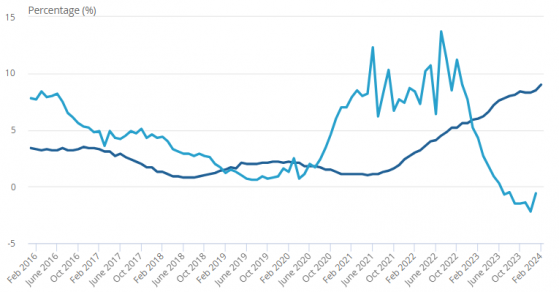

Proactive Investors - UK private rents surged by 9% in the 12 months to February 2024, marking the steepest increase since the Office of National Statistics' records began in 2015.

Rent hikes were most pronounced in London, where they rose by 10.6%. Average UK house prices, in contrast, dipped by 0.6% over the same period.

The London borough of Brent saw the highest annual rental growth of all local areas and Melton in Leicestershire saw the lowest.

Rental prices were highest in Kensington & Chelsea and lowest in Dumfries & Galloway.

“These new data show that UK rental prices continued to grow strongly in the year to February, at their highest annual rate since records began in 2015,” said ONS deputy director for prices Matt Corder.

“Average UK house prices continued to fall, albeit at a slower annual rate than seen recently. Indeed, Scotland’s average house prices rose at their fastest annual rate for more than a year.”